Following the disastrous imposition of the COVID-19 outbreak, few equity subsectors suffered as much as airline stocks. Seemingly overnight, major airports turned into veritable ghost towns as few passengers desired to sit in close quarters with complete strangers. Even with pandemic-related fears and restrictions fading, new headwinds associated with economic undercurrents weighed heavily on the travel industry. With the airliners, two tickers, JBLU and AAL, may encounter discrepant results, moving forward.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

To say that the pandemic represented a massive paradigm shift for airline stocks would be a gross understatement. Between February to April of 2020, the U.S. Bureau of Transportation Statistics reported that revenue passenger miles for U.S. carriers (for both domestic and international flights) fell a staggering 96.7%. At the time, little was known about COVID-19. Therefore, people kept their distance as a matter of caution.

Despite the obvious negative implications for airline stocks, a few bold contrarians bid up the market segment. Although many sector players reported poor bookings throughout 2020, the fundamental assumption was that eventually, circumstances would return to normal. Since biopharmaceutical companies were hard at work developing both therapeutics and vaccines, this narrative featured a logical trajectory.

Sure enough, government agencies gradually loosened COVID-related restrictions, initially boding very well for airline stocks. In addition, the phenomenon known as revenge travel or the pent-up demand among consumers to make up for lost time escalated dramatically.

However, the various catalysts for the airline stocks appear to have been short-lived. Earlier in the new normal, health-related concerns dominated wider consumer thought processes. Today, economic anxieties – particularly the possibility of a recession materializing from higher interest rates – pose headwinds for the airliners.

Nevertheless, if investors had to choose among various airline stocks, certain names could stand out over others.

JetBlue Airways (NASDAQ:JBLU)

One of the most popular discount airliners, JetBlue Airways fundamentally appears to have an edge against “premium” offerings. With consumers suffering from skyrocketing inflation throughout this year, JBLU seems a natural choice for airline stocks to buy. At some point, most folks find that they need to travel. So, why not do it at a lower price?

Unfortunately, this sentiment has not helped JetBlue financially. True, the company posted revenue of $2.45 billion in the second quarter of 2022, representing 63% growth against the year-ago period. However, the company posted a net loss of $188 million. In Q2 2021, JetBlue generated a net income of $64 million.

Currently, the discount airliner features retained earnings of $2.34 billion. At the end of 2019, this metric stood at $4.32 billion. Therefore, management needs to start bringing the business back to profitability.

However, economic circumstances might not allow for that. For instance, JetBlue theoretically could benefit from increased business travel. Sadly, though, major companies are starting to look into layoffs as they face recessionary pressures. Additionally, with the lower-income consumer segment likely to tighten its belt, JetBlue’s largely domestically-focused business incurs significant risks.

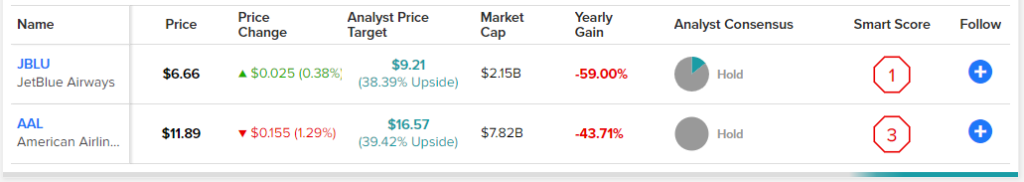

Is JBLU a Good Stock to Buy, According to Analysts?

Turning to Wall Street, JBLU stock has a Hold consensus rating based on one Buy, six Holds, and no Sell ratings. The average JBLU price target is $9.21, implying 38.4% upside potential.

American Airlines (NASDAQ:AAL)

While a larger entity than JetBlue, American Airlines suffers from similar pressures. Weighed down from a gradual erosion of consumer confidence, AAL stock has been feeling the heat. So far, though, a conspicuous difference is in financial performance.

In Q2 2022, American Airlines generated revenue of $13.42 billion, up 79.5% from the year-ago quarter. On the bottom line, the airliner posted a net income of $476 million in the most recent quarter. This compared very favorably to the net income of $19 million in Q2 2021.

That said, where JetBlue clearly has the advantage is in retained earnings. Right now, AAL features a loss of nearly $9.8 billion in this metric. In 2019, the company enjoyed retained earnings of $2.26 billion. From the perspective of stability, JBLU stock may seem like the better solution.

However, American Airlines features a partnership with Japan Airlines (OTC:JPNRF). Significantly, Japan will fully reopen to independent travelers on October 11. As one of the most popular tourist destinations, the Japanese government lagged other international agencies in reopening its country. Therefore, significant pent-up demand could exist, which may bolster AAL stock.

In addition, the Federal Reserve’s hawkish monetary policy means that the Dollar is substantially stronger than the Yen. That should help tourist dollars go much further, thereby appealing to consumers who have yet to exercise their revenge travel sentiments.

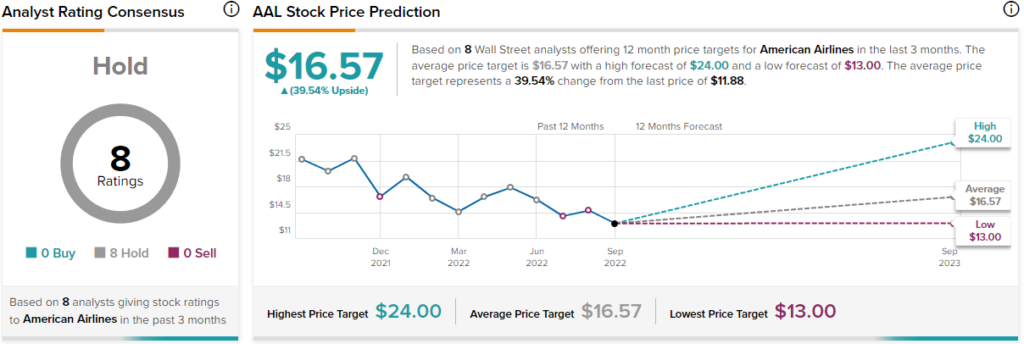

What is the Target Price for AAL Stock?

Turning to Wall Street, AAL stock has a Hold consensus rating based on zero Buys, eight Holds, and no Sell ratings. The average AAL price target is $16.57, implying 39.5% upside potential.

Conclusion: AAL Presents a Better Vision

On paper, JetBlue’s financial profile may be more appealing to conservative investors because of its positive retained earnings line item. However, when it comes to forward prospects, AAL is more attractive due to its international networks. Specifically, Japan’s reopening bodes well for American Airlines as outside factors such as U.S. Dollar strength versus the Yen help bolster the bullish narrative.