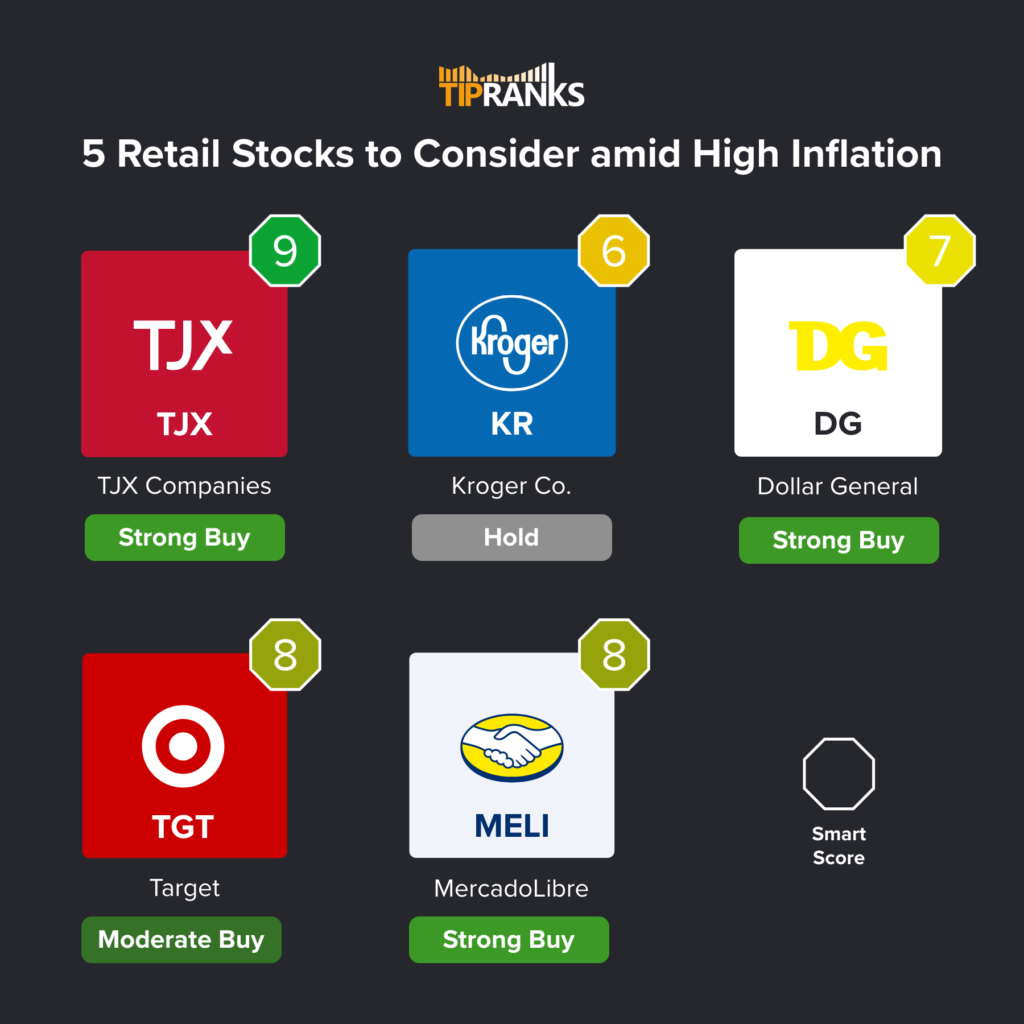

U.S. stocks have been presenting major headwinds for investors throughout much of the year, as inflation and skyrocketing interest rates push many traders to from their bullish sentiment. In this article, we’ll take a look at five retail stocks — TJX, KR, DG, TGT, and MELI — that may be able to power through tough times.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Federal Reserve Chair Jerome Powell announced another aggressive rate hike of 75 basis points. This marks the fifth consecutive rate hike this year alone, as the central bank looks to get a hold on rampant running inflation.

The recent hike in September has already caused investors to pull their cash from high-risk investments and park it in more secure equities.

In a survey conducted by Gallup in August this year, the majority of American adults responded by saying ongoing price increases are only adding to their financial hardships. Around 12% of respondents described their hardship as “severe,” and 44% currently face “moderate” hardships in terms of their standard of living.

At the time of the survey, the Consumer Price Index (CPI) for August stood at 8.3%, down from its 40-year high of 9.1% seen in June 2022.

Among the eye-watering inflation and increasing cost of borrowing, consumers could look to start cutting back on excessive spending to shrug off price increases.

It’s almost self-explanatory at this point that if consumers start cutting back, retail investors and traders will feel the knock-on effect filtering down towards companies’ bottom-line performances.

Without further ado, here’s a roundup of the top five retail stocks to purchase amid higher consumer inflation.

TJX Companies (NYSE: TJX)

TJX Companies, better known for its TJ Maxx stores, has held relatively strong against financial challenges experienced throughout 2022.

TJX Companies, which also owns the Marshalls, HomeGoods, and Sierra brands, had a relatively strong Q2, reporting $11.8 billion in net sales, which was only down 1.9% compared to the same period from the year before. The outcome was better than expected, seeing that the company has been dealing with higher prices and increased operating costs. Currently, their store count is sitting at around 4,700.

Analysts have predicted that the company’s increasing store count and improving cost management structure will help grow earnings per share (EPS) by 10.9% annually over the next five years.

There have also been talks about possible share repurchases, which could help TJX’s performance in the near term and help the stock rally against inflationary conditions.

What is the Price Target for TJX Stock?

Analysts have a Strong Buy rating on TJX stock based on 10 Buys and three Holds assigned in the past three months. The average TJX stock price target of $75.69 implies 23.4% upside potential.

Kroger Co. (NYSE: KR)

On the back of current conditions, grocery chains might see a slight uptick in annual sales and profits compared to the years before, as many more people will be looking to stock up on consumables rather than dining out.

The nearly 140-year-old supermarket chain stock has shown its resilience, and it has a dividend yield of 2.3%. KR is up over 10% in the past year, with investors hoping its stock price will reach its high of $62.78 per share.

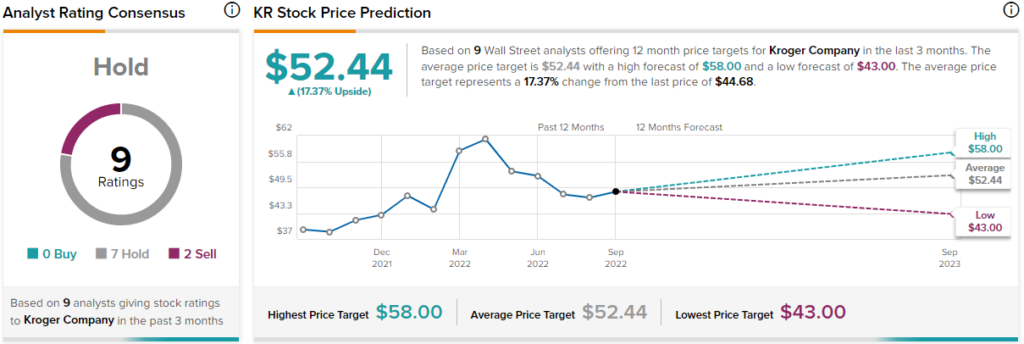

What is the Price Target for KR Stock?

Analysts currently predict that KR stock can increase by roughly 17.4% in the next year, but this could largely be offset by higher operational costs and interest payments, which would affect the company’s bottom line. Analysts have a Hold consensus rating on Kroger, with an average price target of $52.44 based on seven Holds and two Sells.

Dollar General (NYSE: DG)

Another popular discount retailer is Dollar General, which has seen its stock performance appreciate by more than 200% in the past five years. The company also increased its guidance recently, as it expects its full-year sales to increase by 11% compared to about 10.25% before.

Dollar General outperformed Wall Street estimates regarding Q2 earnings, and for Fiscal 2023, analysts have similar expectations, expecting sales to increase by 10.8% year-over-year, potentially reaching $37.91 billion.

The discount retailer has been looking to keep its pricing structure in line with other major competitors as consumers start shifting their spending habits from discretionary to necessary items. Also, investors enjoyed the company’s higher EPS which took effect in August, with earnings increasing from $2.69 per share to $2.98 per share.

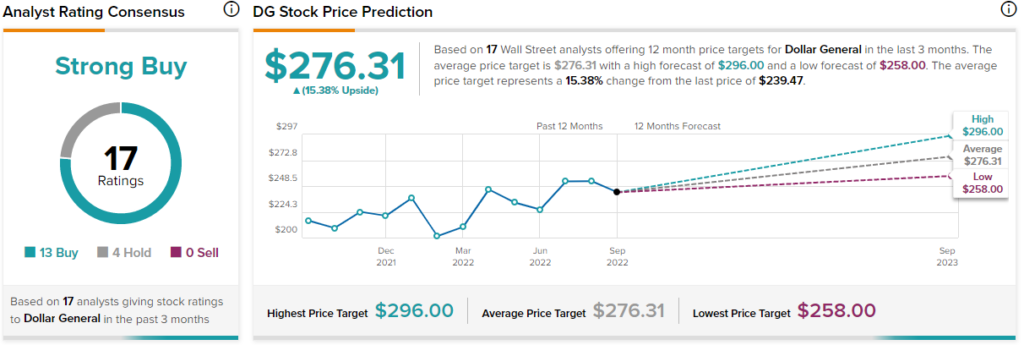

What is the Price Target for DG Stock?

Analysts are currently very bullish on DG stock, giving it a Strong Buy rating based on 13 Buys and four Holds assigned in the past three months. The average DG stock price target of $276.31 implies 15.4% upside potential.

Target (NYSE: TGT)

Although Target has been seen as one of America’s most favored top-tier corporate retailers, the company experienced an increasingly tough financial year as inflation and lowered consumer spending hurt its bottom line.

This did ultimately reflect on TGT’s performance, as its price fell about 25% during its second-most recent earnings call, but some investors are positive that the worst has come and gone and that TGT will be able to rebound in the coming months.

A major drawback perhaps at this point for Target is the company’s “earnings recession,” which led to an overall earnings decline back in May.

What’s keeping many investors interested at this point is that Target offers consumers a mix of both staple and discretionary items. This could mean that even though individuals are spending less, Target will continue to offer them a range of staple items at fair prices.

TGT has also recently joined the highly acclaimed and exclusive rank of Dividend Kings. Compared to other stronger performing and more established Dividend Kings, TGT currently has a ~2.8% dividend yield and pays $4.32 per share on an annualized basis.

What is the Price Target for TGT Stock?

On Wall Street, TGT stock has a Moderate Buy rating based on 12 Buys and eight Hold ratings assigned in the past three months. The average TGT stock price target of $191.75 implies 26.3% upside potential.

MercadoLibre (NASDAQ: MELI)

A growing favorite among retail investors, MercadoLibre is an Argentine e-commerce firm headquartered in Uruguay, which has rapidly expanded its operations in the U.S. Throughout 2021, the mid-tier online giant sold more than $28 billion in merchandise compared to the $21 billion sold in 2020.

Other than having significant influence in the e-commerce sector, the online retailer has seen its annual revenue grow by 53% in the past five years. At the same time, Amazon’s revenue increased by 27% annually. The steady performance has led many to estimate that the company could surpass Amazon in the next decade or so.

The company has a competitive pricing structure and ongoing development to improve its payments and logistics. There’s still a lot of room to grow, not just in the American consumer market but also in Canada and the greater part of Latin America.

Investors should still approach with caution, but ongoing support from consumers could help the company readily expand in the next few years.

What is the Price Target for MELI Stock?

Turning to Wall Street, MELI stock has a Strong Buy rating based on 10 Buys and one Hold rating assigned in the past three months. The average MELI stock price target of $1240.45 implies 49.5% upside potential.

Final Thoughts – The Next Few Months Will Test Investors

As investors continuously look for ways in which they can shield themselves against a possible recession, as the economic cycle moves ever so slightly, the upcoming months will put many of their investment strategies up to the test. Changes in consumer behavior, against the backdrop of a turbulent market, will leave investors looking toward retail stock picks that can offer both value and delivery, even as market volatility continues.

For investors, it’s important to consider how their overarching strategy will help play out regarding long-term results while also ensuring their portfolios are diverse enough to ride out treacherous waters.