The streaming war does not have a clear winner yet. However, one thing that came out of the streaming war was that in July, for the first time ever, streaming content viewership surpassed that of cable TV in America. Here are two stocks that we think can weather the streaming war and benefit from the rise in cord-cutting.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Cable TV is Losing to Streaming

Research firm Nielsen revealed that 34.8% of total U.S. TV viewing time was spent on streaming, whereas 34.4% was spent on cable TV.

While this may seem like a narrow difference, it looks meaningful when each is compared to their respective year-ago viewership details. Cord-cutting continued to weigh on cable TV viewership last month, with viewers spending 9% less time watching cable TV year-over-year.

On the other hand, 23% more time was spent over the past year watching streaming content on Netflix (NFLX), YouTube (owned by Alphabet (GOOGL)), and Discovery, owned by Warner Bros. Discovery (WBD).

The streaming war has been going on among entertainment media giants for almost three years now to compete with the concept that was pioneered by Netflix. However, more than being a war, it has become chaos now. Numerous services are cropping up or closing down all at once, and there does not seem to be any clear winner.

Nonetheless, streaming is the future of the film world; hence, the streaming service is not going anywhere. The question is, who will benefit? Given the overcrowded industry, maybe many, but Netflix and Disney (DIS) have a long growth runway, in particular.

1. Netflix

Yes, Netflix has seen better days and has lost its first-mover advantage to an overcrowded industry. Neck-and-neck competition and inflation have increased subscriber churn rates. However, it is its efforts to regain its lost glory that is keeping investors hooked.

Netflix is looking to enhance its content portfolio and tighten its password-sharing options in an attempt to bring more subscribers to its platform. Also, the company’s choice to stick to original content, which is also its key differentiator, is expected to ensure consistent free cash flow for Netflix.

Earlier this month, Oppenheimer analyst Jed Kelly saw the password-sharing crackdown and ad-supported tier as the main top-line growth accelerators.

Last month, upgrading his rating on Netflix to a Buy, Stifel analyst Scott Devitt believes that the prolonged period of declining subscribers is slowly easing.

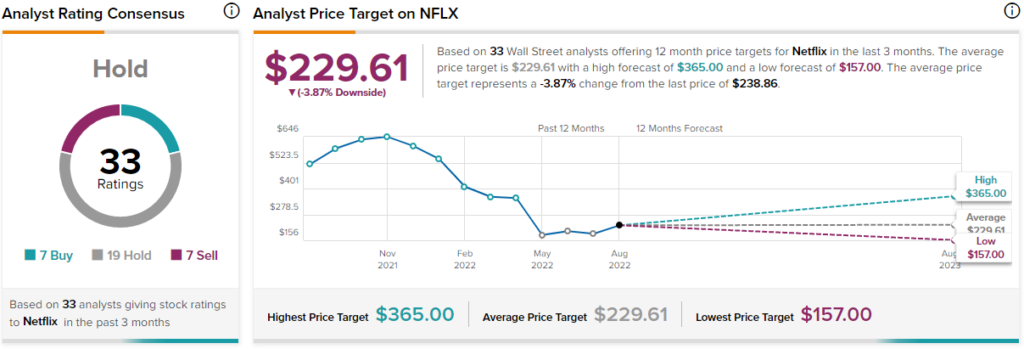

Wall Street is not entirely bearish on the stock, suggesting investors wait for a better time to accumulate more shares. NFLX stock has a Hold consensus rating, with seven Buys, 19 Holds, and seven Sells assigned in the past three months. On average, Netflix’s stock price forecast stands at $229.61, implying 3.9% downside potential.

2. Disney

Disney, a chief competitor of Netflix, recently hit a major milestone — it outpaced the latter’s subscriber volume last quarter.

For a long time, Disney had been reluctant to leave the comfort of its thriving cable TV and enter the world of streaming. However, the cord-cutting has accelerated over the past couple of years, giving the company a solid reason to finally jump in.

Disney also believes that its strong roster of franchises, including Star Wars, Marvel, and Pixar, has the potential to pull numerous users onto its platform.

Moreover, its theme parks are also proving to be a significant source of revenue. Rosenblatt Securities analyst Barton Crockett, who reiterated a Buy rating on Disney and raised the price target to $140 from $124, is upbeat about the company’s domestic park business.

Also, Morgan Stanley analyst Benjamin Swinburne believes that Disney’s content is undervalued. Learning from the struggles of Netflix, Swinburne believes that Disney is aware of the difficulties in monetizing a streaming platform and sustaining it, which is why it is approaching it one step at a time.

Right now, it is focusing on growing its subscriber base and is succeeding in that. The analyst believes that this will eventually lead to revenue growth and, consequently, profit growth.

Wall Street is bullish on the stock, with a Strong Buy consensus rating based on 17 Buys and three Holds. Disney’s stock price projection indicates an average price target of $139.58, which reflects an upside of 16% from current levels.

Conclusion: Both Companies Have Their Own Advantages

Both Netflix and Disney have their own advantages over each other. For instance, Disney is fast growing and has overtaken Netflix in subscriber volume despite coming into the game much later. On the other hand, in the previous quarter, Netflix’s streaming service pulled in $3 billion more in revenues than Disney’s did in Q2, and it has a far better operating income situation than Disney’s.

Nonetheless, given that streaming is here to stay, there is immense upside potential for the pioneer of streaming, i.e., Netflix, as well as the rapidly and strategically growing Disney. Most importantly, both have the means to overcome the hurdles of changing customer preferences and take their businesses to new heights.