Artificial intelligence, AI, has been a staple of science fiction for decades, but it has been making waves in the real world for quite some time. Numerous advanced technologies, from autonomous vehicles to CT and MRI scanning, depend on AI to function. Moreover, over the past year, generative AI has gained substantial popularity, particularly since the ChatGPT bot showcased how the technology can replicate human interaction in our online communication. It’s not quite Data from Star Trek, but AI is undoubtedly here to stay, and that presents opportunities for investors.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The potential of AI, both to revolutionize our world and to enhance our investment portfolios, captured the attention of Tim Horan, a 5-star analyst at Oppenheimer.

“We are upgrading our AI-focused holdings as we believe they are poised to outperform. There is accumulating evidence that AI can lead to significant new revenue streams and productivity improvements. Valuations are also currently reasonable, especially if our expectations of accelerating growth and productivity improvements for many of these companies are realized. Regardless, most of them are trading well below their peak valuations,” Horan opined.

Against this backdrop, Horan has picked out 2 AI stocks that he sees in a particularly strong position, and he has upgraded their rating to ‘Buy.’ Let’s delve deeper into these opportunities.

Don’t miss

- Goldman Sachs Says These 2 Healthcare Stocks Have up to 130% Upside Potential

- Tech Stocks Have More Room to Run, According to Bank of America — Here Are 2 Names to Watch

- ‘Riding the Clean Energy Wave’: This Analyst Suggests 2 Stocks to Play the Renewable Energy Transition

C3.ai (AI)

The first stock we’ll look at is C3ai, a software firm that integrates AI technology into its product lines. The company offers a wide range of AI software and tools, including its AI Applications, AI Application Platform, and AI Development Tools. The software has found use in a variety of sectors, including customer engagement, fraud detection, predictive maintenance, and supply chain optimization. C3ai can count numerous big names among its client base, including the oilfield services giant Baker Hughes, business titan Koch Industries, and even the US Air Force.

C3ai was founded in 2009 and went public in 2020, and has built itself into the leading enterprise AI provider. The company has found success promoting its software products as essential to the world’s ongoing digital transformation. C3ai boasts it can provide enterprise-scaled AI apps with solid efficiency and cost benefits, and that its products will support value and operations in any industry. Customers can realize benefits in a variety of ways, from engaging their own customers to preventing money laundering to optimizing supply chains. AI can change the way we work, and C3ai is at the center of it.

Shares in C3ai peaked in late summer and started sliding in early August but have found support in recent weeks on several new items. The first of these came in October when the company announced that its AI Reliability application will now incorporate asset monitoring and predictive maintenance software developed and made available by Shell Oil. This marks an expansion of an already successful collaboration between the two companies.

In a similar note, C3ai announced earlier this month that it will be expanding its ‘strategic collaboration agreement’ in existence with Amazon Web Services. This partnership has been in operation since 2016 and includes a generative AI suite running on AWS.

The announcements followed the release of C3ai’s fiscal 1Q24 results, for the quarter which ended this past July 31. The company beat the forecasts in the release, showing a top line of $72.4 million and a non-GAAP net loss of 9 cents per share. The revenue total, which was up 10% year-over-year and at the high end of the published guidance, came in a modest $760,000 above the estimates, while the EPS loss was 8 cents per share better than had been expected.

This makes a good background to understand Horan’s upgrade on C3ai, from Neutral to Outperform (i.e. Buy). Horan recaps his original stance on the stock, and explains how AI shares have borne out his optimistic view and brought plenty of potential to the table, writing, “Our 6/29/23 initiation [report] was positive on C3.ai’s long-term growth opportunity, but neutral on the stock. Since then, C3.ai has reset guidance, worked through a model transition to usage-based, and shown real-world customer benefits. AI stock has underperformed by 20% since mid-June, while revenue growth accelerates (0.1% in F4Q23 to 23%E in F2Q24, reporting 12/6). The ‘AI’ theme is real and durable, with C3.ai well-positioned as one of the few pure plays helping customers drive new revenue sources/major productivity improvements; should accelerate growth into ‘25E.”

These comments back up the new Outperform rating, and Horan’s price target of $40 implies the shares will gain ~39% on the one-year time horizon. (To watch Horan’s track record, click here)

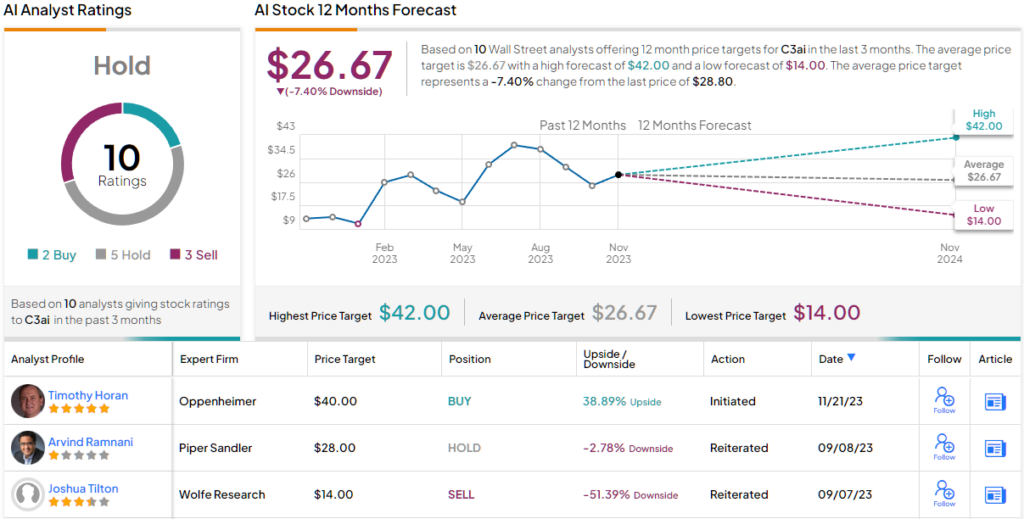

The Street’s view of C3ai is not as bullish as the Oppenheimer analyst allows. There are 10 recent analyst reviews here, and they break down to 2 Buys, 5 Holds, and 3 Sells, for a Hold consensus rating. The shares are trading for $28.80, and the average target price of $26.67 shows that the Street expects to see AI shares decline by 7% in the coming year. (See AI stock forecast)

DigitalOcean Holdings (DOCN)

Next up is DigitalOcean Holdings, a cloud computing company that works with startups, small- and mid-sized businesses, and developers to increase their productivity and agility, to deploy and scale their applications, and to accelerate their innovations. The company aims to make software development simpler and easier, so that its customers can spend more time driving business growth through creative applications and less time on infrastructure maintenance.

DigitalOcean does all of this by offering a broad range of cloud-based software tools – computing tools, cloud storage, network tools, and databases – that are simple and intuitive. The company’s product line won’t match the scale of a tech giant like Amazon or IBM, but its smaller size and simplicity have become the selling points of its cloud development program.

In a recently released industry report, DigitalOcean reviewed the current state of the cloud computing sector, and found some interesting statistics regarding the adoption of AI. The company found that 78% of organizations in its targeted customer base expect to increase their use of AI and machine learning technologies in the coming year. In addition, 35% of DigitalOcean’s target sector employs a multi-cloud approach, and 37% has plans to increase cybersecurity spending. This all suggests a rich field of opportunity for DigitalOcean in the near-term.

Some numbers will show the company already has achieved some solid successes. DigitalOcean has 154,000 customers that spend more than $50K per month, and saw 34% y/y revenue growth last year. And, in a metric that bodes well for ongoing success, DigitalOcean can boast of $713 million in annual recurring revenue.

The last quarterly release, for 3Q23, gives a snapshot of where Digital Ocean stands today. The company reported $177 million in top line revenue, up 16% y/y and $3.7 million ahead of the forecast. Earnings, reported as a non-GAAP diluted EPS of 44 cents, came in 9 cents ahead of the estimates.

Some numbers will show the company already has achieved some solid successes. DigitalOcean has 154,000 customers that spend more than $50K per month, and saw 34% y/y revenue growth last year. And, in a metric that bodes well for ongoing success, DigitalOcean can boast of $713 million in annual recurring revenue.

The last quarterly release, for 3Q23, gives a snapshot of where Digital Ocean stands today. The company reported $177 million in top line revenue, up 16% y/y and $3.7 million ahead of the forecast. Earnings, reported as a non-GAAP diluted EPS of 44 cents, came in 9 cents ahead of the estimates.

For Oppenheimer’s 5-star analyst Horan, the key point for investors here is DigitalOcean’s exposure to, and work with, AI technology. The analyst sees AI as the driver of DigitalOcean’s success, and writes of the company and its prospects, “We think growth is set to accelerate and are increasing outer-year estimates driven by several factors. AI demand is clearly strong and enterprise adoption is set to surge as we move past the network grooming phase of cloud services. We see interest rates starting to come down next year, making it easier for high-growth names and customers to raise capital. AI is also helping DOCN sell its legacy suite of products to new customers, and its Paperspace acquisition is creating synergistic opportunities though remains very early stage. Last, revenue growth should bottom in 4Q, and NRR has bottomed and looks primed to rebound to pre-COVID levels by year-end 2024.”

Looking ahead, Horan gives this stock an upgrade from Neutral to Outperform (i.e. Buy), along with a price target of $37 that suggests the shares will appreciate by 28% in the next 12 months. (To watch Horan’s track record, click here)

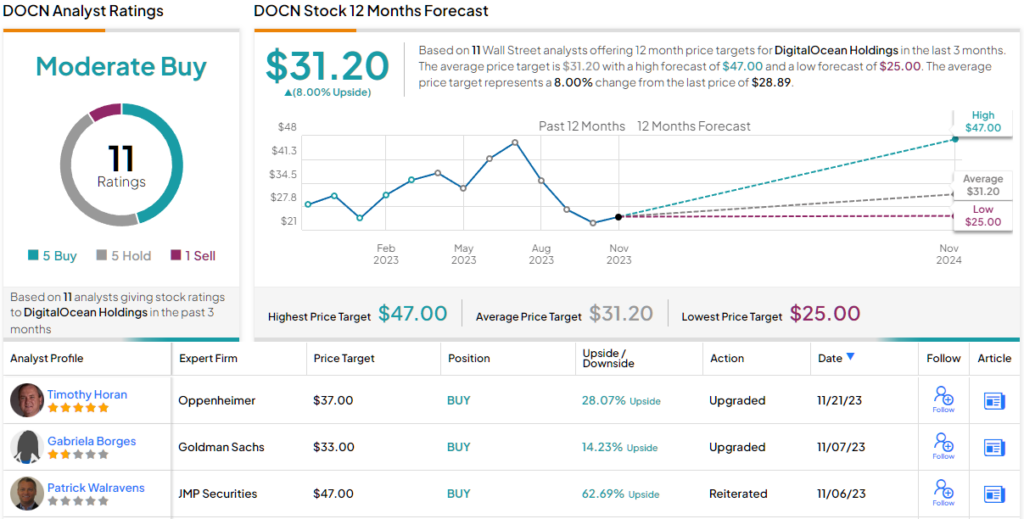

There’s a nearly even split among the analysts on this stock; the 11 recent share reviews include 5 Buys, 5 Holds, and 1 Sell for a Moderate Buy consensus rating. DOCN stock is trading for $28.89 and its $31.20 average target price implies a one-year upside potential of 8%. (See DOCN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.