Billionaire Elon Musk’s Twitter endeavor has not gone down well with Tesla (NASDAQ:TSLA) investors and analysts. Tesla shareholders have started questioning Musk’s leadership (or the lack of it) since he acquired the social media platform. The matter has become more intense due to concerns over the demand for electric vehicles (EVs) amid high inflation, growing interest rates, and the COVID-19 havoc in China. With Tesla stock down 65% year-to-date (33% in the past month), let’s take a look at other EV stocks with attractive growth potential.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

General Motors (NYSE:GM) Stock

Legacy automaker General Motors (NYSE:GM) is rapidly transforming its business with an increased focus on EVs. The company aims to manufacture 400,000 EVs in North America from 2022 through Q1 2024 and ramp up its capacity to 1 million units per year in the region in 2025. GM has assured investors that it has secured binding commitments for all the battery raw materials required to meet its 2025 capacity target.

GM is planning capital expenditure in the range of $11 billion to $13 billion per year through 2025 to support its growth plans. Overall, the company expects its revenue to grow at a 12% compound annual rate through 2025 to over $225 billion, fueled by robust growth in EV volumes. GM aims to generate over $50 billion in revenue from EVs in 2025.

What is the Target Price for GM Stock?

Following GM’s Investor Day event last month, Wedbush analyst Daniel Ives reiterated a Buy rating on GM stock and a price target of $42. Ives noted that despite ongoing supply and macro challenges, GM reiterated its long-term EV targets and its goal (initially announced in 2021) to double its revenue to $280 billion by 2030.

The analyst added that he is “incrementally confident that GM is on the right path towards accelerating its EV vision into the coming years with 2025 the major inflection point year.”

The Street’s Moderate Buy consensus rating for General Motors stock is based on seven Buys, five Holds, and two Sells. The average price target of $43.25 implies 27.8% upside potential. GM stock has tumbled over 42% so far this year.

Fisker (NYSE:FSR) Stock

California-based EV maker Fisker (NYSE:FSR) was co-founded by legendary car designer Henrik Fisker, who has been serving as the company’s Chairman and CEO since its inception in 2016. Last month, the company announced that it had commenced the production of its Fisker Ocean all-electric SUV on schedule. The Ocean is being built in Austria by a unit of Magna International.

The company expects production of over 300 units in Q1 2023, with a rapid rise to over 8,000 vehicles in Q2 and over 15,000 in Q3. Overall, Fisker aims to end 2023 with 42,400 units. The company had over 62,000 reservations and orders for Fisker Ocean as of October 31, 2022. The company is also working on a second model, a low-cost EV called Fisker Pear. Interestingly, Fisker Pear reservations were over 5,000 as of October-end.

Is Fisker a Good Buy Right Now?

Recently, Evercore ISI analyst Chris McNally initiated coverage of Fisker stock with a Buy rating and a price target of $15. McNally stated, “Fisker targets share gains in a currently neglected EV space – well-styled smaller SUVs with tech-forward features, with lower cost PEAR CUV on the way (’24).” The analyst estimates a 40% to 50% upside to the 2023 revenue consensus.

McNally highlighted that Fisker has an asset-light, differentiated business model compared to the likes of Rivian (RIVN) and Lucid (LCID), which should help the EV maker gain solid market share.

Wall Street has a Moderate Buy consensus rating on Fisker stock based on four Buys and three Holds. The average FSR stock price target of $13.17 implies 83.2% upside potential. FSR stock has declined 54.3% year-to-date.

Blink Charging (NASDAQ:BLNK) Stock

Blink Charging (NASDAQ:BLNK) is a leading provider of EV charging equipment and networked EV charging services. It has deployed more than 58,000 charging ports across 25 countries. The robust long-term growth prospects for EVs bode well for Blink Charging. The company is ramping up its capacity and intends to “aggressively compete” for a share of the $7.5 billion funding allocated under the Inflation Reduction Act to build a national network of 500,000 EV chargers by 2030.

Aside from organic expansion, Blink is also growing through strategic acquisitions. The company acquired Electric Blue in April 2022 to gain access to the U.K. and Ireland markets and Semi Connect in June 2022 to expand its charging footprint in the U.S. While macro challenges might impact Blink Charging over the short-term, the company is well positioned to capture growth in the EV charging space in the years ahead.

Is Blink Charging a Buy or Sell?

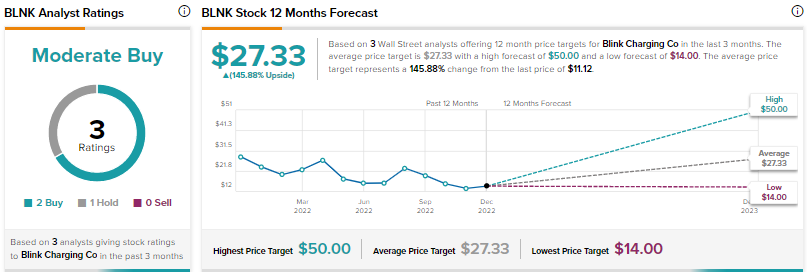

Blink Charging’s Moderate Buy consensus rating is based on two Buys and one Hold. At $27.33, the average BLNK stock price prediction suggests nearly 146% upside potential. Shares have plunged 58% so far this year.

Conclusion

Elon Musk’s Tesla has always attracted immense attention from Wall Street. That said, investors can consider other EV stocks also that are expected to gain from the rapid shift to EVs. While General Motors has strong cash flows to back its EV plans, Fisker and Blink Charging are growth stocks with high-risk, high-reward profiles.

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more