General Motors (NYSE:GM) impressed investors with its market-beating third-quarter earnings even as revenue slightly lagged estimates. However, the company pushed back its production target of 400,000 electric vehicles in North America from 2023-end to mid-2024, citing “a slightly slower launch of cell and pack production.”

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

During the Q3 earnings call, GM’s CEO Mary Barra stated that it has taken longer than expected to employ and train the workforce for its Ohio battery plant that is being operated under a joint venture (Ultium Cells LLC) with Korea’s LG Energy Solution.

Strong Demand for General Motors’ EVs

General Motors assured investors about strong demand for its vehicles despite macro challenges. The company sold 14,700 Chevrolet Bolt EV and Bolt EUVs in the quarter. Overall, the company sold 15,200 EVs in Q3 and accounted for 8.3% of the U.S EV sales. It is now increasing production for the Chevrolet Bolt EV and Bolt EUV from 44,000 units this year to 70,000 units in 2023.

CEO Barra stated, “Our dealers and customers have embraced the Bolt because of its range, technology and value, helping it outsell Ford’s Mach-E by more than two to one in September.”

The company also expects its Chevrolet Equinox EV, GMC Sierra EV, Chevrolet Silverado EV, Blazer EV, and other innovations to drive rapid EV adoption.

General Motors feels that vertical integration is a key driver of its EV growth plans. In addition to the aforementioned Ohio battery plant, the company is also planning to open three more battery cell plants to bolster its EV expansion plan. It has secured all the required raw materials to ensure over 1 million units of annual EV capacity in North America by 2025.

What is the Prediction for GM Stock?

Following the Q3 results, Bank of America analyst John Murphy reiterated a Buy rating on General Motors stock. The analyst highlighted the company’s strong execution in its core as well as future businesses and called GM one of the best-positioned companies in his auto coverage over the long haul.

Murphy stated, “In addition to reiterating its strong guidance, the company continues to focus on its EV expansion from increasing its EV manufacturing footprint to vertically integrating battery cell manufacturing.”

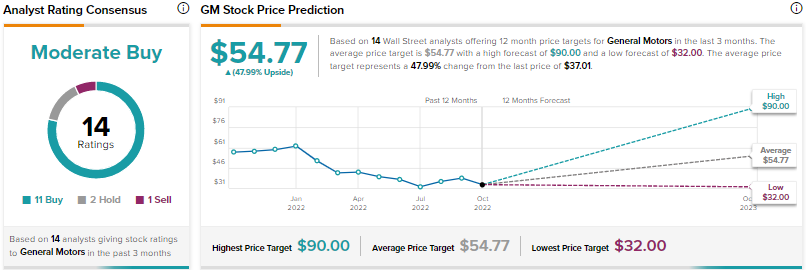

Meanwhile, the Street is cautiously optimistic about General Motors stock, with a Moderate Buy consensus rating based on 11 Buys, two Holds, and one Sell. The average GM stock price target of $54.77 suggests 48% upside potential. Shares have tumbled nearly 37% year-to-date.

Conclusion: GM’s EV Growth Story Remains Attractive

Despite the delay in General Motors’ North American EV production target timeline, the company’s growth plans and the demand for its EVs remain strong. The company has the expertise and the financial muscle to support its expansion plans in the EV space.