In this piece, I evaluated two consumer financial services stocks — Synchrony Financial (NYSE:SYF) and Ally Financial (NYSE:ALLY) — using TipRanks’ comparison tool to determine which is better. Both offer credit cards, with Synchrony issuing more than 100 cards, including Amazon’s credit cards, and Ally offering several cards of its own. However, upon closer analysis, it looks like ALLY stock is better, although both stocks appear undervalued.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

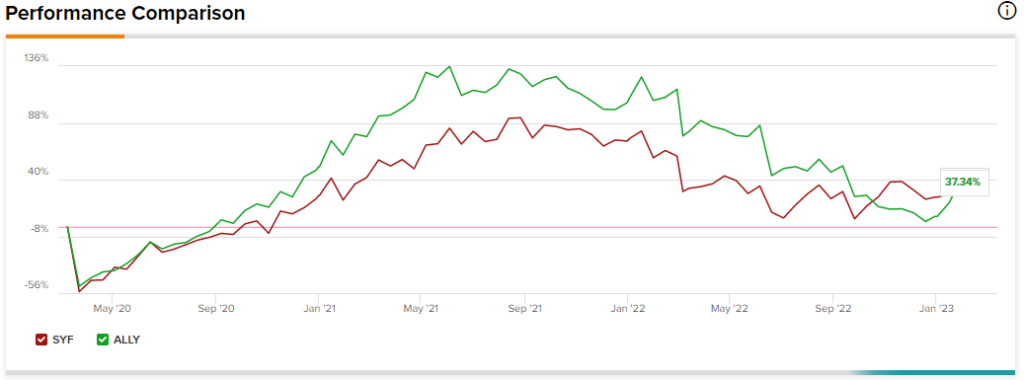

Ally is up more than 24% year-to-date but remains down 23.6% for the last 12 months. Looking at the stock’s price action reveals a steady decline throughout 2022 until it hit bottom toward the end of December, so all the gains over the last 12 months have come since then. Meanwhile, Synchrony has gained 10.6% year-to-date and 5.6% over the last 12 months despite a bumpy ride in 2022.

So, is there any upside left for Ally or Synchrony in the near term? A closer look at their valuations suggests this could be a buy-the-dip opportunity, although ALLY is more enticing. This could also be why Warren Buffett‘s Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) owns one but not the other.

Synchrony Financial (NYSE:SYF)

A quick review of Synchrony’s valuation and fundamentals reveals that the company looks undervalued relative to its sector and history. However, Synchrony still hasn’t recovered its revenue to pre-pandemic levels, so its recovery is coming much more slowly than Ally’s. Still, due to its valuation and solid dividend yield, a bullish view looks appropriate for Synchrony, at least for now.

Synchrony is currently trading at a price-to-earnings (P/E) ratio of 6.0 times and a price-to-earnings (P/S) ratio of 1.9 times. Meanwhile, the consumer finance industry is trading at a P/E of 9.7 times and a P/S ratio of 1.8 times, compared to the three-year averages of 11.5 times and 2.2 times, respectively.

Based on its P/E, Synchrony looks undervalued relative to its industry and its industry’s history. Looking at the company’s P/E over the last four years or so, its P/E is back to where it stood just before the pandemic-related plunge in early 2020. Thus, it appears more upside is likely, although the bull thesis could take a while to play out.

With $8.3 billion in revenue for 2022 and record purchase volume in the fourth quarter, Synchrony is well on its way to reaching the $9.1 billion of revenue seen in 2019. Finally, Synchrony’s dividend yield of 2.54% may not be the best of its industry, but it’s a solid reason to include the company in a dividend portfolio.

What is the Price Target for SYF Stock?

Synchrony Financial has a Moderate Buy consensus rating based on eight Buys, four Holds, and one Sell rating assigned over the last three months. At $40.62, the average Synchrony Financial stock price target implies upside potential of 14.1%.

Ally Financial (NYSE:ALLY)

Like Synchrony, Ally looks undervalued relative to its industry and history, although its undervaluation appears more pronounced, especially considering that it has surpassed its pre-pandemic revenue levels. Ally’s attractive dividend yield, combined with its low valuation, suggests a bullish view may be appropriate.

With a P/E of 6.2 times and a P/S of 1.1 times, Ally is also undervalued relative to its industry despite the recent rally, and its P/S ratio is considerably lower than SYF’s. Further, the company’s P/E and P/S have yet to recover to pre-pandemic levels.

Ally’s dividend yield of 3.9% only increases the attraction, especially considering that the company has increased its dividend annually for the last seven years. In fact, Ally is one of Buffett’s newer positions, as Berkshire started buying the shares in early 2022.

What is the Price Target for ALLY Stock?

Ally Financial has a Hold consensus rating based on six Buys, five Holds, and three Sell ratings assigned over the last three months. At $34.07, the average Ally Financial stock price target implies upside potential of 13.3%.

Conclusion: Bullish on SYF and ALLY

Although Ally’s revenue dipped between 2021 and 2022, it is benefiting from rising interest rates. Ally’s interest income on loans rose to $8.1 billion in 2022, surpassing each of the previous two years and the $7.3 billion recorded in 2019 before the pandemic.

However, Synchrony’s interest income has yet to recover to pre-pandemic levels despite the significantly higher interest rates. One concern for both firms is the soaring provisions for loan losses amid recession fears. Synchrony’s more than tripled between 2021 and 2022, while Ally’s rose nearly sixfold.

Nonetheless, ultimately, while Synchrony and Ally both look undervalued, calling for a bullish view, Ally is the clear winner.