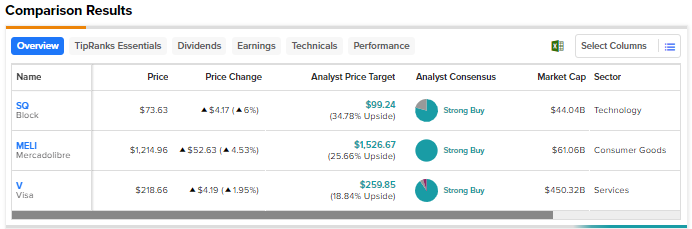

Macro uncertainties and the growing fears of an economic downturn are expected to impact consumer spending and in turn the performance of financial technology or fintech companies. Nonetheless, Wall Street continues to be optimistic about the long-term prospects of several fintech stocks due to the growing transition to digital payments. We used TipRanks’ Stock Comparison Tool to place Block (NYSE:SQ), MercadoLibre (NASDAQ:MELI), and Visa (NYSE:V) against each other to pick the fintech stock with the highest upside potential as per Wall Street analysts.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Block (NYSE:SQ)

Block ended 2022 with better-than-anticipated revenue and gross profit. However, the fintech’s adjusted earnings per share (EPS) fell short of estimates due to higher expenses. The company assured investors that it will focus on efficiency this year and “meaningfully” slow its pace of expense growth compared to prior years.

Block expects to deliver about $1.3 billion in adjusted EBITDA in 2023, reflecting a growth of over 30%. The company’s two ecosystems, Square for merchants and Cash App for individuals, are growing from strength to strength. Block is experiencing greater retention of its Square solutions from larger sellers and those who use more products. Last year, mid-market sellers who adopted four or more products had 15 times greater retention than those who only adopted one product.

Meanwhile, Cash App had 51 million monthly transacting active users in December 2022, up 16% year-over-year. Moreover, two out of three actives transacted each week on average.

Is Block a Buy Right Now?

UBS analyst Rayna Kumar reiterated a Buy rating on Block with a price target of $102 after meeting the company’s management.

“Block’s aggressive pace of innovation should continue to drive premium growth. Over the next 3 years, at minimum, we expect Block to generate a low 20’s gross profit CAGR,” said Kumar.

Overall, Wall Street’s Strong Buy consensus rating for Block stock is based on 19 Buys and five Holds. The average price target of $99.24 implies nearly 35% upside potential from current levels. Shares have advanced over 17% so far in 2023.

MercadoLibre (NASDAQ:MELI)

E-commerce and fintech company MercadoLibre is often called the “Amazon of Latin America.” Last month, the company posted upbeat fourth-quarter results, driven by solid momentum in its fintech business. Unique active fintech users increased 27% to nearly 44 million in Q4 2022, while total payment volume (TPV) through Mercado Pago, the company’s payments platform, grew 45% in U.S. dollars.

Over the past three years, the company has grown its TPV more than 4 times and its fintech revenues have increased nearly 5 times. Overall, MercadoLibre’s fintech business has emerged as a major contributor to its revenue and earnings. The company continues to broaden the scope of its financial services and enhance its revenues.

What is the Price Target for MELI Stock?

Following the results, BTIG analyst Marvin Fong boosted his price target for MercadoLibre to $1,400 from $1,245 and reaffirmed a Buy rating. Fong believes that the company’s adjusted EBITDA should triple in 2023 compared to 2021.

The analyst’s new price target is based on 27 times its 2024 EBITDA estimate. Fong contended that while this is a “relatively high multiple in this more sober market,” he feels that the company’s 25% to 30% revenue growth rate and its leading position in Latin America’s rapidly growing digital market justify a premium valuation.

Other Wall Street analysts are also bullish about MercadoLibre, with the stock earning a Strong Buy consensus rating based on nine unanimous Buys. At $1,526.67, the average MELI stock price target suggests 25.7% upside potential. Shares have rallied nearly 44% year-to-date.

Visa (NYSE:V)

Payments processing giant Visa started Fiscal 2023 with better-than-expected performance in the first quarter (ended December 31, 2022). Revenue increased 12% to $7.9 billion and adjusted EPS grew 21% to $2.18. Steady payments volume and processed transaction growth and continued recovery of cross-border travel drove the Q1 FY23 performance.

Visa continues to expand its presence across the world and collaborate with other fintechs to boost its prospects. For instance, a Mexican fintech Konfio that already has issued about 50,000 Visa small business cards, recently expanded its agreement with the company to issue Visa Business Infinite cards.

Visa also struck a deal with Latin America fintech platform Tigo Money and its parent Millicom to offer Tigo Money’s over 5 million wallet users the ability to digitize their cash and make purchases wherever Visa is accepted with the Visa-Tigo Money Access Card.

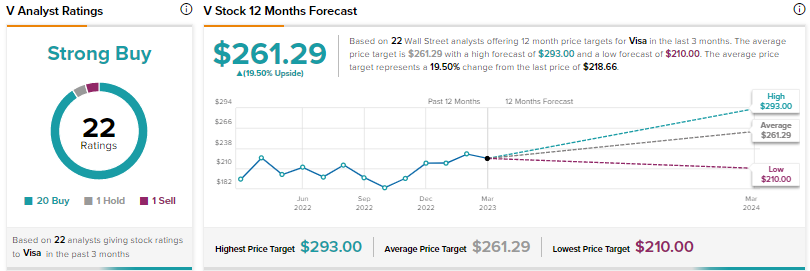

Is Visa Stock a Buy, Sell, or Hold?

Visa recently provided quarter-to-date estimates for the fiscal second quarter (through February 2023). The quarter-to-date U.S. payments volume increased 12%, cross-border volume grew 27%, and processed transactions increased 13% year-over-year.

Following the update, Baird analyst David Koning noted that Visa’s operating metrics through February were trending ahead of his estimates and implied that the company could beat his Q2 FY23 revenue estimates by over 1.5%.

Koning reiterated a Buy rating on Visa with a price target of $272, saying, “We like Visa a lot given resilient macro model, inflation helps, x-border improvement (especially in APAC), high quality earnings, and potential valuation re-rating.”

Wall Street’s Strong Buy consensus rating for Visa is based on 20 Buys, one Hold, and one Sell. The average Visa stock price target of $261.29 suggests 19.5% upside. Shares have risen over 5% so far this year.

Conclusion

Despite near-term headwinds, Wall Street is bullish about all the three fintech stocks discussed here. However, they see higher upside in Block compared to MercadoLibre and Visa. Block is expected to capture further business in the fintech space, driven by the strength of its Square and Cash App ecosystems.

Aside from Wall Street analysts, hedge funds have a Very Positive confidence signal for Block. As per TipRanks’s Hedge Funds Trading Activity Tool, hedge funds increased their holdings by 5.7 million SQ shares last quarter.