SoFi Technologies (NASDAQ:SOFI) stock isn’t everyone’s cup of tea, but I’m prepared to call it a fantastic fintech pick for 2023, in my humble opinion. I am emphatically bullish on SOFI stock because SoFi Technologies is demonstrating growth in key areas while also distancing itself from less reputable banks.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

SoFi Technologies started out as just a personal-savings app, but today it’s much more than that. Really, SoFi Technologies seeks to be a one-stop shop for all of its users’ financial needs, even including investment and advisory services. Plus, SoFi is a legally chartered bank, so it’s not fair to just call it an app.

As we’ll see, the experts on Wall Street generally have favorable views on SoFi Technologies. One of them even called SoFi the “future of banking for the next generation.” That might sound like an exaggeration, but there are reasons to maintain great expectations for a disruptor like SoFi Technologies.

SoFi Technologies Can Successfully Court Younger Bankers

In case you’re wondering who called SoFi Technologies the “future of banking for the next generation,” it’s Constellation Research principal analyst Ray Wang. I fully concur with Wang’s claim, as SoFi Technologies is a digital-first bank that appeals to younger users in the millennial and zoomer generations. Plus, SoFi gladly helps college students refinance their student loans, thereby helping to address the terrible student-loan debt crisis in the U.S.

Truly, SoFi Technologies represents modern banking and is a threat to stodgy old banks that refuse to change with the times. By the way, Truist Securities analyst Andrew Jeffrey made a similar statement to what Wang said, calling SoFi Technologies “the future of U.S. banking: digital, nimble and always on.” With that, Jeffrey assigned SOFI stock a Buy rating and a price target of $8, which implies a fair amount of upside compared to the current share price of under $6.

While SoFi Technologies is thoroughly modern, it’s also a responsible bank. As you may recall, less-reputable banks like Silicon Valley Bank and Silvergate Capital (OTC:SI) had difficulty convincing their depositors that their funds were safe. In contrast, SoFi Technologies offers “access to up to $2 million of FDIC insurance” for qualifying depositors versus the “industry standard $250,000 per account.” That’s a great way for SoFi to separate itself from failed banks and attract reluctant, nervous customers.

SoFi Technologies Shows Improvements in Key Areas

Not every analyst agrees with the positive assessments of SoFi Technologies issued by Wang and Jeffrey. Indeed, there’s at least one analyst anticipating a sharp decline in SOFI stock. Yet, I tend to view the upside potential as greater than the downside risk because SoFi Technologies is making strides in important areas.

As the old saying goes, you can’t argue with the numbers. During 2023’s first quarter, SoFi Technologies’ non-GAAP adjusted net revenue increased 43% year-over-year to $460.16 million, beating the consensus estimate of $441.02 million. Meanwhile, SoFi’s adjusted EBITDA grew by an eyeball-popping 772% to $75.69 million.

Turning to the bottom line, Wall Street expected SoFi Technologies to report Q1-2023 EPS of -$0.08, but the company did better than that with quarterly EPS of -$0.05. Indeed, SoFi Technologies has beaten the Street’s EPS forecasts for several consecutive quarters.

Here’s where the rubber really meets the road, though. SoFi Technologies’ total deposits increased by 37% during Q1 2023 to $10.1 billion. This shows that even during a time of crisis among less trustworthy banks, customers were willing to trust SoFi Technologies with their capital.

Is SOFI Stock a Buy, According to Analysts?

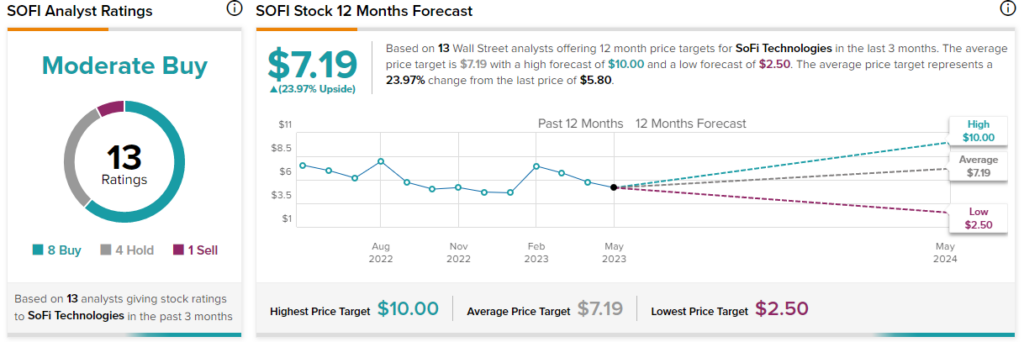

Not everyone likes SoFi Technologies, but the company seems to be generally well-accepted on Wall Street. SOFI stock comes in as a Moderate Buy based on eight Buys, four Holds, and one Sell rating assigned in the past three months. The average SoFi Technologies stock price target is $7.19, implying 24% upside potential.

Conclusion: Should You Consider SOFI Stock?

As I said in the beginning, SoFi Technologies stock isn’t everyone’s cup of tea. If you’re fearful of change and disruption, feel free to stick to traditional banks. On the other hand, if you’re ready to face the future of personal finance, I invite you to take a closer look at SoFi Technologies.

Given SoFi Technologies’ revenue growth and other areas of improvement, it’s surprising that the company isn’t universally liked by investors. Hence, there seems to be a window of opportunity here.