SoFi Technologies (NASDAQ:SOFI) released its Q1 report at the start of the month and despite posting beats on both the top-and bottom-line, worries about the outlook sent shares tumbling.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

At the time, due to concerns about the potential adverse effects on SoFi’s profit margins and valuation of its loan portfolio, Wedbush analyst David Chiaverini saw reason to downgrade his rating on SOFI from Outperform (i.e., Buy) to Neutral. Just two weeks later, Chiaverini thinks it’s time for another negative revision.

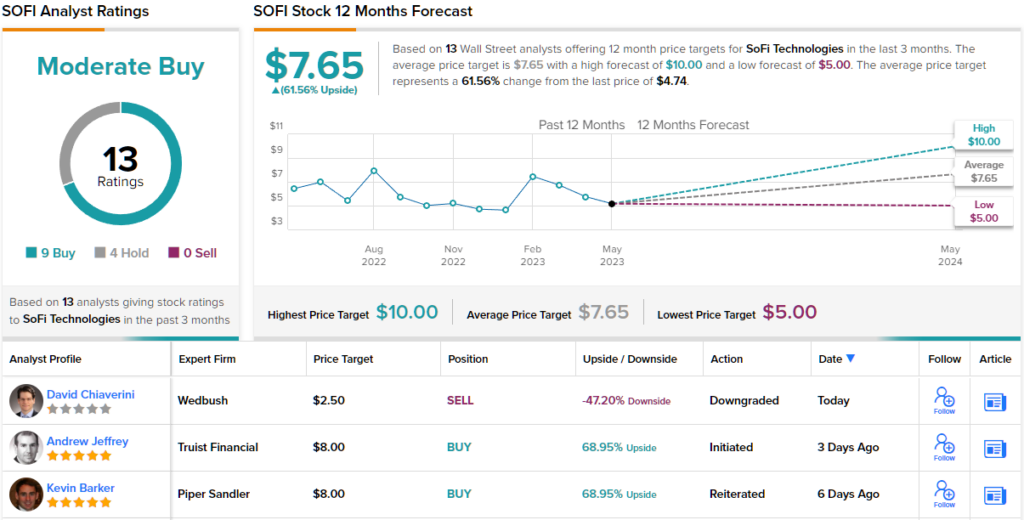

The analyst has just downgraded SOFI from Neutral to an Underperform (i.e., Sell) and lowered the price target from $5 to $2.5, suggesting the shares are set to shed ~47% from here. (To watch Chiaverini’s track record, click here)

So, what’s behind such a downbeat view? Chiaverini explained: “We believe 1) the company may be nearing a tipping point on the fee income it recognizes related to loan origination and sales, 2) capital levels may be overstated using fair value accounting and we believe the company may look to raise capital this year to support growth, and 3) in a hypothetical analysis in which we applied the held-for-investment / CECL (current expected credit loss) accounting methodology used by LendingClub to SOFI’s financials would result in SOFI’s tangible book value being reduced materially by nearly 60% on an apples-to-apples basis to $1.27/share from the current $3.05/ share.”

Chiaverini says he’s not calling for SOFI to alter its accounting practices, nor over the near term does he expect the company to revise its fair value mark assumptions in the immediate future.

However, he does think there is the possibility the regulators might want to take a look at SOFI’s accounting. And given SOFI is at ease holding loans to maturity instead of selling them, this could prompt a suggestion for the company to operate under a “more conservative capital requirement framework that contemplates a hypothetical switch to CECL accounting.”

Moreover, In the wake of the banking failures at failures at First Republic Bank and Silicon Valley Bank, Chiaverini expects the regulators to more closely scrutinize capital ratios and stress testing.

So, that’s the Wedbush view, what does the rest of the Street have in mind for SOFI? None are quite as bearish as Chiaverini. With an additional 9 Buys and 4 Holds, the stock claims a Moderate Buy consensus rating. Moreover, the average target is far more upbeat, too; at $7.65, the figure makes room for 12-month gains of ~62%. (See SoFi stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.