After decades of slow ramp in both advancements in technology and rising consumer interest, electric vehicles (EVs) and the companies that purvey them seem to have reached their zenith. After several new names have entered the foray, legacy car makers making 180 degree turns in their production directions toward EVs, and Tesla (TSLA) defying nearly every short-seller, investors still have not had enough. Rivian Automotive (RIVN) went public this past quarter, and has seen its valuation both soar and fall by staggering amounts.

The newly tradable firm reported its first quarterly print after market hours on December 16, to mixed results and reception. While the demand story for RIVN remains incredibly bullish, the automaker fell short of its production targets and is having difficulties meeting its output targets.

One of the more positive voices on Rivian is Daniel Ives of Wedbush Securities, who opined that despite the gap in ramping supply toward its massive reservation orders, this issue will remain but a speed bump. The firm has recently confirmed plans for a new factory in the state of Georgia, U.S., which will act as a “key production artery for the company over the coming years.”

The five-star analyst rated the stock a Buy, and reiterated his price target of $130. This optimistic target currently represents a possible 12-month upside of 33.06%.

Globally, many companies have been dealing with specialized component shortages, particularly those in the auto industry. Rivian has been no outlier, as its Illinois facility has felt the impacts and is making its best effort to ramp up production. Ives noted that the automaker has reservation orders projected to exceed 100,000 by the first half of next year. Speaking on behalf of his investment firm, the analyst noted that this metric remains the “linchpin to our bull thesis over the next 12 to 18 months.”

It appears Ives has not been alone in his hypothesis, as many investors have been speculating on Rivian’s high demand to drive future upside. However, upon reports of the underperformance, RIVN shares fell 10.26% on Friday, December 17. The high valuation had already priced in perfect results, which made it especially fragile.

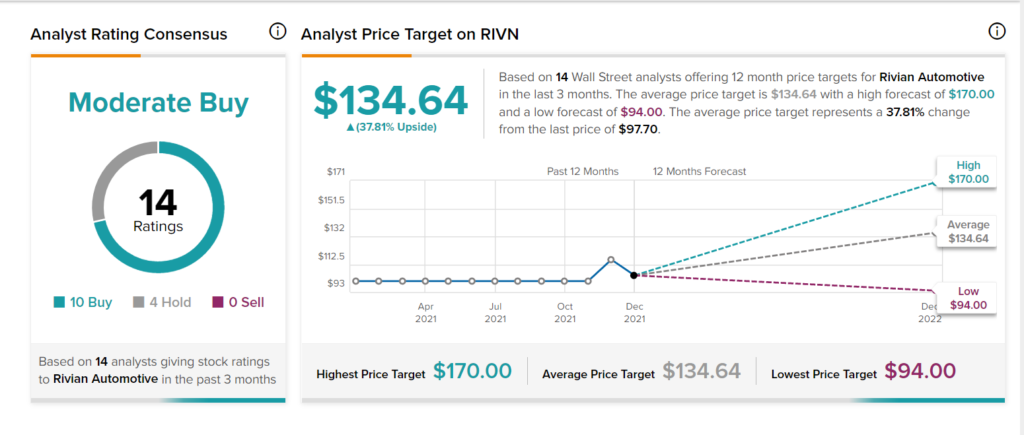

On TipRanks, RIVN has an analyst consensus of Moderate Buy, based on 10 Buy and 4 Hold ratings. The average Rivian Automotive price target is $134.64, suggesting a potential 12-month upside of 37.81%. RIVN closed trading Friday at a price of $97.70 per share.

Disclosure: At the time of publication, Brock Ladenheim did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >