China has long placed a cultural premium on education, and it’s not unheard of for Chinese parents to spend small fortunes ensuring that their kids have every possible advantage in school, including tutoring, to accelerate their progress in class and provide the best exam preparation.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Given this cultural emphasis on education, it’s no surprise that analyst Eddy Wang of Morgan Stanley has chosen to focus on Chinese education stocks, particularly those specializing in high school tutoring.

“Strength in new business units and resilience in traditional units should help foster sustainable growth for education market leaders. Bolstered by strong net cash positions, China’s education industry should provide defensiveness in a turbulent ADR market,” Wang opined.

The analyst goes on to initiate coverage on Chinese education leaders that deserve a closer look. We ran them through the TipRanks database to see what makes them stand out.

Don’t miss

- Goldman Sachs Says These 2 Healthcare Stocks Look Attractive — Here’s What Makes Them Each a ‘Buy’ Right Now

- ‘A Sector at a Crossroads’: Wells Fargo Predicts at Least 60% Upside for These 2 Beaten-Down Fintech Stocks

- Bank of America Says This ‘Buy’ Signal Could Trigger an 11% Upswing in S&P 500 Next Year — Here Are 2 Stocks the Banking Giant Likes Right Now

New Oriental (EDU)

First up is New Oriental, a key player in China’s for-profit education and tutorial companies. New Oriental was founded in 1993 and today offers customers and students a wide range of programs to choose from, including language training, test prep courses for both overseas and domestic exams, and online education. Supporting products include educational content and software systems.

The company offers courses and educational materials both online and in person. Earlier this year, it boasted a network of 793 learning centers – including 83 schools – along with 9 bookstores. The company has a nationwide network of such bookstores, both online and offline, and its network includes 241 third-party distributors and more than 30,300 teachers in 76 cities across China.

The first thing an investor will notice when looking at New Oriental this year is the stock’s performance. Shares in EDU are seriously outperforming – the stock is up more than 95% year-to-date. The share gains have come hand-in-hand with solid improvements in revenue; the company has reported three consecutive quarters of sequential revenue growth.

In the last reported quarter, fiscal 1Q24, New Oriental reported $1.1 billion at the top line, a result that was up 47.7% year-over-year and more than $90 million ahead of the forecasts. The company’s bottom-line figure, a non-GAAP net income per ADR, came to $1.13, beating the forecast by 33 cents. New Oriental reported $335.8 million in operating cash flow for its fiscal Q1, against a quarterly capital expenditure of $132.5 million.

For Morgan Stanley’s Eddy Wang, the outlook on the stock is strong, based on its solid foundation. Wang says of EDU, “Demand for high school tutoring has been resilient given competition in China’s university entrance exams is still quite intense. We model EDU’s revenue from high school tutoring to grow 23% YoY in F2024, accounting for 26% of the total revenue. For overseas test prep/consulting, which was negatively impacted by Covid lockdowns and US-China tensions, we expect demand to gradually recover starting in F2024 (see the section Overseas Test Prep and Consulting (Traditional Business) ). We model EDU’s overseas business to grow 28% YoY in F2024, accounting for 24% of the total revenue.”

Looking forward, Wang believes there is still room for growth here, and he outlines the stock’s potential: “EDU’s share price has significantly outperformed YTD (+90%), yet we still believe EDU deserves an Overweight rating, given its larger scale post-Double Reduction allows it to enjoy market share gains and better margins, with high visibility on near-term revenue and earnings over the next 1-2 years.”

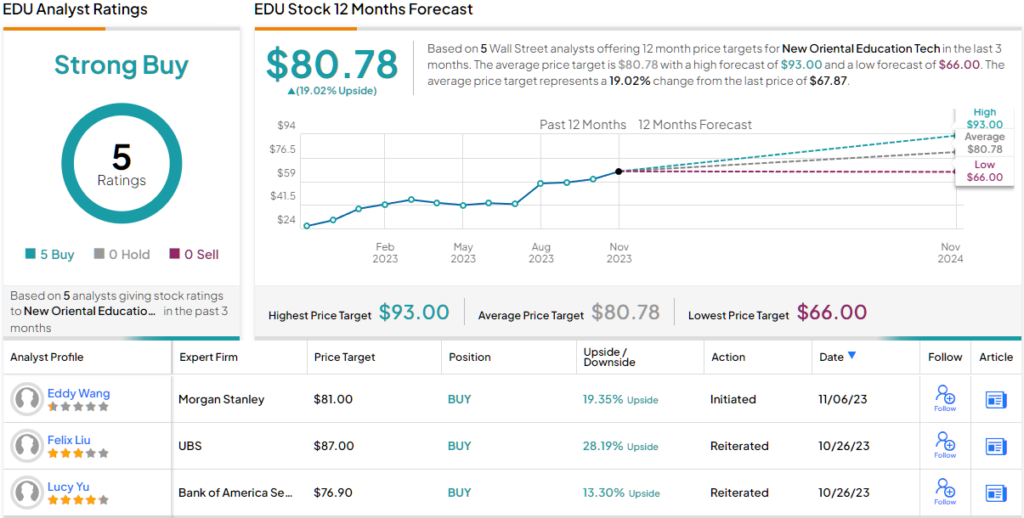

Wang’s Overweight (i.e. Buy) rating on EDU is complemented by his $81 price target, which suggests a 19% potential upside for the next 12 months. (To watch Wang’s track record, click here)

Are other analysts in agreement? They are. According to TipRanks, 5 Buys and no Holds or Sells have been issued in the last three months. So, the message is clear: EDU is a Strong Buy. The stock is selling for $67.87 per share on Wall Street, and the $80.78 average price target implies a one-year gain of 19%. (See EUD stock forecast)

TAL Education Group (TAL)

The second stock we’ll look at is TAL, another of China’s private for-profit education companies. TAL offers top learning opportunities using a combination of high-quality teaching and learning content. The company’s services are available for students of all ages, from preschool to grade 12, and are offered through three flexible class formats: online courses, small in-person classes, and personalized premium tutoring services. The company’s services cover enrichment programs and selected academic subjects, mostly in the Chinese educational system.

TAL’s mission is to provide the highest level of educational and educational support services available, based on quality, talent, and technology. The company promotes a customer-oriented approach based on innovation and cooperation.

In its October financial release, for fiscal 2Q24, TAL reported its best revenue result in the past 18 months, with a quarterly top line of $411.9 million. This was up 40% year-over-year and came in $14 million better than had been anticipated. TAL’s bottom line came in at 10 cents per ADS by non-GAAP measures, beating the estimates by 2 cents.

On the balance sheet, the company had cash and liquid assets of $2.96 billion as of August 31 this year, down 6.6% in the past six months.

The company caught the eye of Eddy Wang for its solid high school business. Wang writes of TAL, “We model TAL’s high school tutoring business to grow 6% YoY in F2024, driven by steady increase in enrollments. We also model TAL’s revenue from high school tutoring to account for 20% of the total revenue in F2024 (vs 25% in F2023), with increasing revenue contribution from other new businesses.”

“We forecast TAL’s revenue from enrichment learning services to grow 30%+ YoY in F2024, with double-digit operating margin; this could help to drive the company’s overall earnings growth,” Wang added.

To this end, the Morgan Stanley analyst rates TAL shares an Overweight (i.e. Buy), and his price target, $10.50, implies the shares will appreciate by 12% in the coming year.

Overall, this Chinese education stock holds a Strong Buy consensus rating from the Street’s stock watchers, based on 3 positive reviews set in recent weeks. The shares have an $11.17 average price target, suggesting ~19% one-year upside from the $9.40 current trading price. (See TAL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.