In the face of economic uncertainty, investors are actively seeking ways to leverage market volatility to their advantage. Fintech stocks have emerged as an intriguing choice, as they continue to trade at historic lows, despite their solid underlying financials and consistent growth trajectory. At least that’s the opinion of Wells Fargo’s Andrew Bauch.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In a recent research report, the analyst takes a close look at the fintech sector, describing it as facing a crossroads situation, buffeted by a series of headwinds, including high inflation, contracting liquidity, and an increasingly difficult geopolitical situation. However, uncertain market situations can also present opportunities, and Bauch predicts solid upside potential for certain companies.

“Historically, the primary drivers for most FinTech stocks were upside surprises to revenue and gross profit growth… many names in FinTech have highly idiosyncratic business models, and are less reliant on favorable macro conditions to drive profitability and growth. For example, many software & payment hybrid names can drive robust revenue growth through further payment penetration of GMV, even with hypothetically sluggish GMV trends,” Bauch opined.

Against this backdrop, let’s delve into Bauch’s bullish picks and explore the reasons behind the analyst’s prediction of a potential surge of at least 60%. We’ve drawn the details on two of them from the TipRanks database, to take a closer look. Let’s dive in.

Don’t miss

- Bank of America Says This ‘Buy’ Signal Could Trigger an 11% Upswing in S&P 500 Next Year — Here Are 2 Stocks the Banking Giant Likes Right Now

- ‘Putting the Fun Back in Fundamentals’: Deutsche Bank Says These 3 Homebuilding Stocks Look Attractive Right Now

- Goldman Sachs Says Utilities and Consumer Staples Stocks Are Set to Outperform as the Presidential Election Approaches — Here Are 2 Names the Banking Giant Likes

Flywire Corporation (FLYW)

The first Wells Fargo fintech pick we’ll look at is Flywire, a company in the online payment processing niche. Flywire, which was founded in 2009, got its start as a specialist firm focusing on payment processing for the education sector. Since then, the company has broadened its customer base to include healthcare and travel companies and also offers a range of B2B payment solutions.

Flywire does more than just smooth out payment processing. The company also works with customers to meet their needs in user verification and security compliance. Its success over the years has built up the foundation for a $2.5 billion company and a solid reputation.

By the numbers, Flywire can boast a client base of more than 3,500, using diverse payment methods to process transactions in over 140 currencies and 240 countries. This gives Flywire a truly global footprint – not bad for a mid-cap company out of Boston, Mass.

A look into the last quarterly report, for 3Q23, will give us an idea of where Flywire stands. The company reported total revenues of $116.8 million for the quarter, up 32% year-over-year but missing the estimates by over $3 million. The bottom line figure, an EPS of 8 cents per share, was 3 cents below the forecast – although it was a strong turnaround from the 4-cent EPS loss of the year-ago quarter. During Q3, Flywire saw a significant year-over-year increase in total payment volume, from $7 billion to $8.9 billion, and the company signed 185 new clients.

Investors didn’t like what they saw, to say the least, and the stock dropped by 25% post-earnings.

So, is it time to bail out or to buy the dip? According to Wells Fargo’s Andrew Bauch, it’s the latter choice.

“In our opinion, FLYW is one of the very few names in FinTech with the ability to build a robust backlog of non-cyclical and counter-cyclical revenue opportunities that can drive years of highly visible +30% growth (as suggested by the company’s MT guide). While the buy-side is likely pricing in revenue growth near 30% in 2025, we believe the magnitude of upside in ’24 and ’25 continues to be underappreciated.” Bauch opined.

Looking forward to the company’s prospects, the analyst added, “Our Overweight rating on FLYW is primarily driven by (1) a clear pathway of new client adds and expanding existing client relationships, (2) counter-cyclical industries that provide a level of sustainable growth in a wide range of economic scenarios, (3) large TAM’s that remain underpenetrated across each of FLYW’s industries, and (4) a high-value proposition that creates strong recurring revenues and new opportunities for growth.”

Taken all together, these comments supported Bauch’s Overweight (i.e. Buy) rating on the stock, and his $33 price target implies a solid 68% one-year upside potential for the shares. (To watch Bauch’s track record, click here)

Overall, FLYW boasts a Strong Buy consensus rating based on 10 recent analyst reviews, which include 9 Buys against a single Hold. The stock’s $33.80 average price target and $19.59 trading price together suggest a 72% upside potential. (See Flywire stock forecast)

Bill.com Holdings (BILL)

The second stock we’ll look at here is Bill.com, a software provider in the cloud niche, offering small businesses solutions for their multitudinous accounting and paperwork requirements. Bill.com’s cloud-based software platform provides tools for the automation, digitization, and simplification of common, and not-so-common, back-office financial functions and processes. The solutions offer users greater efficiency in their day-to-day back-office operations, and can be used for billing, payment processing, invoicing, and other bookkeeping entries.

Bill.com’s platform is popular with small businesses and midsized companies, and it allows them to put all of their financial activities into one place. The software streamlines the user experience by splitting functions between accounts payable & receivable and send & expense. Users can create and pay their bills, send out invoices, manage their expenses and budgets, and even access credit – it’s a one-stop shop for the small- to mid-size entrepreneur.

It’s been successful, too. Bill.com’s revenues and earnings have been on an upward trajectory in recent quarters. Yet, the shares lost 38% this month.

What happened occurred in response to the fiscal 1Q24 earnings report. The big-picture results were good. Revenue, at $305 million, was up more than 32% year-over-year and came in almost $6.2 million ahead of expectations. The company’s 54-cent non-GAAP EPS figure was 4 cents better than the forecast. And total payment volume, at $70 million, was up 8% year-over-year.

However, Bill.com lowered its forward guidance, significantly. The company is now predicting revenue for the 2024 fiscal year in the range of $1.21 billion to $1.25 billion, well below the previous range of $1.29 billion to $1.31 billion. The pare-down overshadowed the solid quarterly results, and investors pulled back from the stock.

Writing on the stock at Wells Fargo, analyst Bauch still sees it as a sound choice for investors. He writes, “BILL’s volume growth is fueled by two primary vectors, (a) net new customer growth (and more specifically, core net new customer adds), and (b) TPV per customer trends, both of which have faced their respective ebbs and flows over the last year. While the current FY24 guidance is calling for muted trends across both KPI’s in the coming fiscal year (approximately 4k core customer adds per quarter and ‘LSD decrease Y/Y’ in TPV/customer ex-F.I. channel), and even with the days of BILL consistently delivering HSD/LDD beats becoming increasingly rare, we believe these guide points could prove conservative given managements historical tendency to do so.”

Bauch goes on to write of Bill’s prospects for the near- to mid-term, saying, “Based on admirable trends demonstrated through a challenged macro, we have a high degree of confidence in management’s ability to navigate macro-swings better than many other names in our coverage.”

Getting to the brass tacks, Bauch gives the stock an Overweight (i.e. Buy) rating, and his $115 price target points toward a robust 105% increase in the coming year.

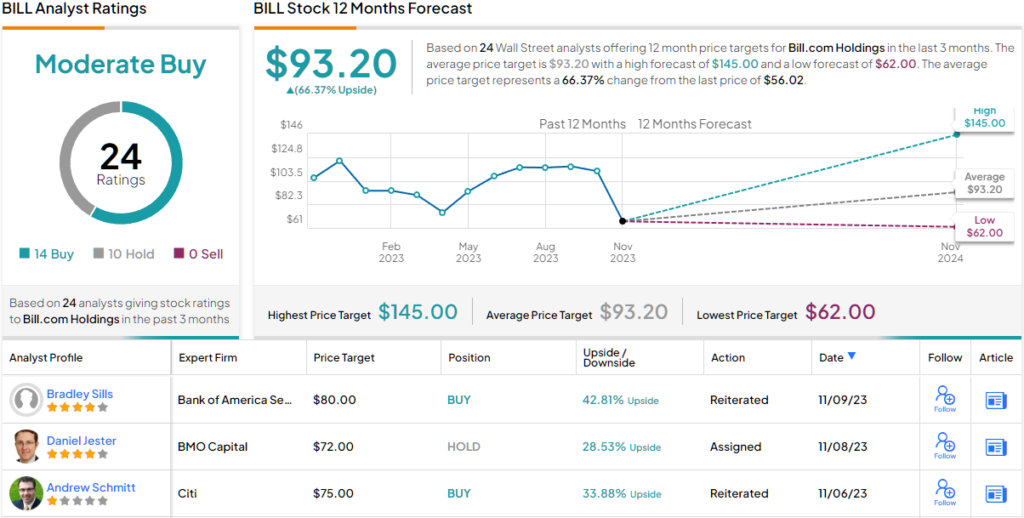

Overall, there are 24 recent analyst reviews of this fintech, and they break down to 14 Buys and 10 Holds, for a Moderate Buy consensus rating. The shares are selling for $56.02 with a $93.20 average target price, indicating potential for a 66% 12-month gain. (See Bill stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.