A few stock segments offer stronger opportunities than the healthcare stocks. It’s not an easy sector to play, but veteran investors know that these stocks, despite their famously high overhead and long product lead times, can turn on a dime and deliver a win.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It’s all tied into the nature of the biopharma industry. These companies spend fortunes researching new drugs and medical techniques – but their research can pan out in the form of multi-billion addressable markets. In the meantime, investors rely on a few key indicators – clinical study results and regulatory actions, mainly, but also new commercial entries – to determine the likelihood of sustainable revenues. Those clinical and regulatory catalysts can make biotech stocks boom – or bust.

And right now, two 5-star analysts at Goldman Sachs are pointing out healthcare stocks that look attractive. The reasons can vary, but for investors, the message is clear: according to Goldman, these are stocks to buy now.

We’ve opened up the database at TipRanks to pull up the latest details on these picks, to find out just what makes them attractive. Here they are, along with comments from the Goldman analysts.

Don’t miss

- ‘A Sector at a Crossroads’: Wells Fargo Predicts at Least 60% Upside for These 2 Beaten-Down Fintech Stocks

- Bank of America Says This ‘Buy’ Signal Could Trigger an 11% Upswing in S&P 500 Next Year — Here Are 2 Stocks the Banking Giant Likes Right Now

- ‘Putting the Fun Back in Fundamentals’: Deutsche Bank Says These 3 Homebuilding Stocks Look Attractive Right Now

Apellis Pharmaceuticals (APLS)

The first stock we’ll look at is Apellis, a biopharma firm that has caught the gold ring – it’s at the commercial stage, with an approved drug on the market and a large potential patient base. The company has developed the ‘first new class of complement medicines in 15 years,’ a set of new therapeutic agents that act through the C3 pathway. This is the complement system, a part of the immune system, and the C3 protein starts the complement cascade, natural process that clears out damaged cells, and pathogens, from the body. An overactive complement cascade can damage healthy cells and tissue, causing a variety of disease conditions.

Getting to specifics, Apellis focuses on conditions of the nervous system and the retina, working to meet the high unmet medical needs of conditions with few or nor available treatment options. Using the C3 pathway as its starting point, Apellis has created a project pipeline featuring drugs and drug candidates at all stages of development: from pre-clinical research, to human clinical trials, to post-approval commercialization.

On the commercial side, Apellis has two approved drugs, both new formulations of pegcetacoplan. This drug, the company’s leading product, has application to multiple conditions – as can be seen by the two approved formulations. The first of these, empaveli, received its FDA approval in May of 2021, as a treatment for adults suffering from paroxysmal nocturnal hemoglobinuria (PNH). The company realized $65.1 million in net US product revenues from the drug in its first full year on the market, 2022.

The bigger story is Apellis’ second commercial-stage drug, a pegcetacoplan injection formulation now known as syfovre. This formulation is used in the treatment of geographic atrophy (GA), a severe retinal condition that leads to blindness. Syfovre received its approval earlier this year, in February, and has been showing early commercial successes.

But – Apellis saw a serious drop in share value over the summer when reports came out concerning safety issues with syfovre, specifically, the occurrences of eye inflammation as a side effect. The company saw its share price fall by 71%, and it has not yet recovered. Industry experts have added context, noting that vasculitis is a common side effect in similar drugs, and also that the incidence has been less frequent and less severe with syfovre.

In its report for 3Q23, released this past Nov 1, Apellis reported $110.4 million in total revenue. This was $11.7 million better than the forecast, and the total included sales of $75.3 million from syfovre sales plus $23.9 million from empaveli.

For Goldman’s Salveen Richter, the story here revolves around Syfovre. She writes, “The debate has focused on the commercial opportunity of key driver Syfovre (GSe WW peak sales of $3.9bn)… In our view, the outlook now appears more favorable given 1) stabilization of the rate of retinal vasculitis at 0.01% per injection, which our KOL diligence suggests is acceptable, 2) two-year Ph3 Izervay data at the American Academy Of Ophthalmology (AAO) conference (which we attended), which underwhelmed KOLs and positions Syfovre as the more compelling treatment in GA.”

Richter comes down on a potentially upbeat note, saying, “In totality, while we anticipate additional retinal vasculitis events will occur, if the profile of the drug is intact over time, we would anticipate an inflection in Syfovre uptake (furthered by a permanent J-Code effective October 1). We model for a valuation floor of ~$10/share outside of GA (Empaveli and net cash).”

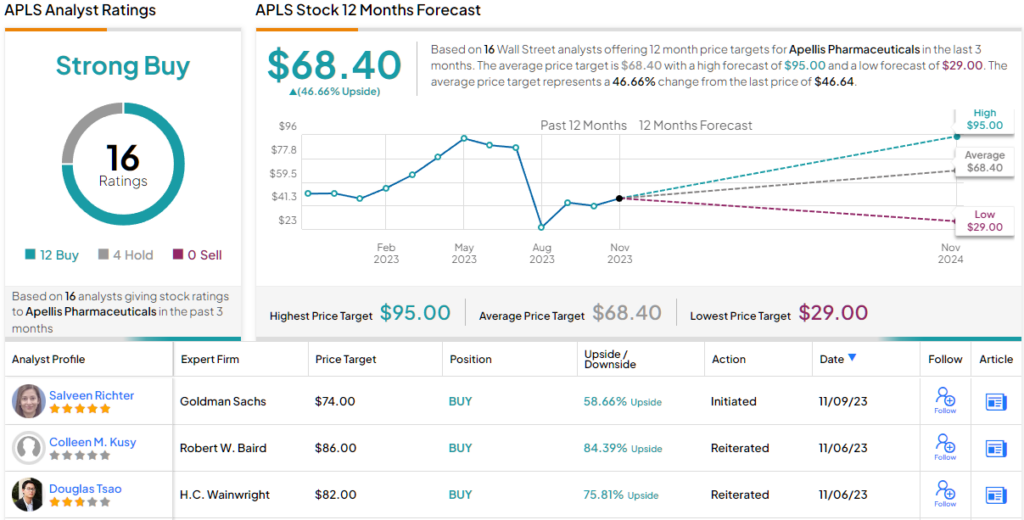

Quantifying her stance, this 5-star analyst gives APLS a Buy rating, with a $74 price target pointing towards ~59% upside potential for the coming year. (To watch Richter’s track record, click here)

Overall, APLS boasts a Strong Buy consensus rating based on 16 recent analyst reviews, including 12 Buys and 4 Holds. The shares are trading for $46.67, and their $68.40 average target price implies ~47% one-year upside. (See APLS stock forecast)

Cytokinetics (CYTK)

Next up is Cytokinetics, a biopharma with an active research pipeline and several clinical-stage study tracks. Cytokinetics is focused on the discovery, development, and commercialization of new muscle activator and muscle inhibitor drugs with potential application in the treatment of diseases that compromise the function and performance of muscle function. The company’s pipeline consists of drug candidates with high promise as potentially first-in-class therapeutic agents.

The leading drug candidates in Cytokinetics’ pipeline are small molecule compounds, designed to specifically target cardiac myosin contractility. The leading drug candidate is omecamtiv mecarbil, a cardiac myosin activator, has been tested in the treatment of heart failure with reduced ejection fraction, and based on results of the clinical study series has entered the regulatory approval process. The company is talking to both the FDA and the EMA in response to regulatory feedback, with the goal of advancing the approval process.

In a bigger development, the company has initiated the Phase 3 ACACIA-HCM study of aficamten, its other advanced late-stage drug candidate. This candidate is a cardiac myosin inhibitor, under study in the treatment of hypertrophic cardiomyopathy. There are several upcoming catalysts regarding aficamten, including topline results from the SEQUOIA-HCM pivotal phase 3 study, and the long-term data from the FOREST-HCM open-label extension study.

This company’s combination of upcoming catalysts has caught the attention of Paul Choi, another of Goldman’s 5-star analysts. Choi writes of Cytokinetics, “We recognize that SEQUOIA-HCM is likely to be positive given the prior aficamten and Camzyos (mavacamten) data; however, our proprietary analyses and KOL checks reveal optimism about aficamten’s potential to be best-in-class on safety with comparable efficacy leading to a high likelihood of adoption in naive oHCM patients. Overall, against the current biotech market backdrop we see an attractive profile given CYTK’s largely derisked late-stage asset and upside potential from expansion opportunities.”

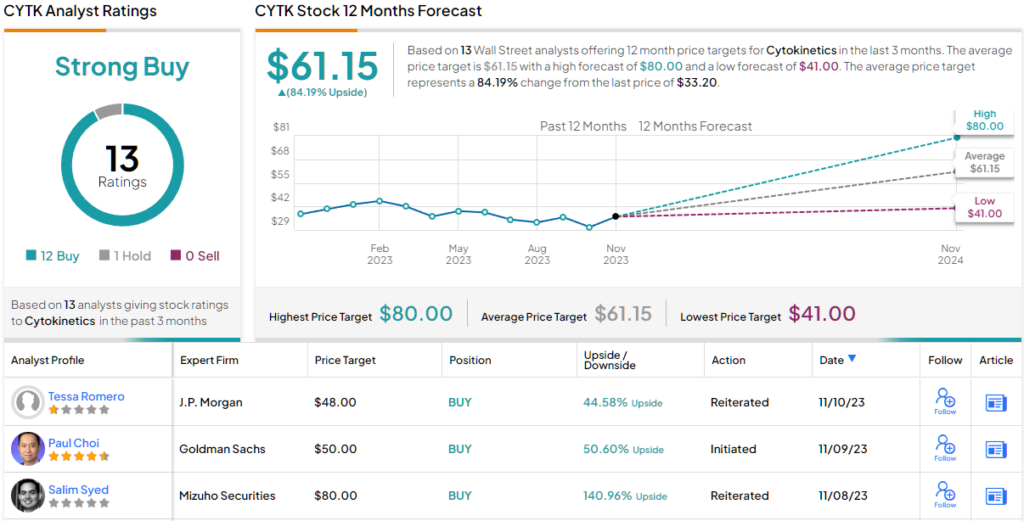

Looking ahead, Choi rates CYTK shares a Buy and sets a $50 price target to suggest a 50% gain over the next 12 months. (To watch Choi’s track record, click here)

This is another stock with a Strong Buy consensus from the Street’s analysts. The 13 recent reviews break down 12 to 1 favoring Buys over Holds, and the average price target, $61.15, implies an 84% increase from the current trading price of $33.20. (See CYTK stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.