The mammoth growth in the shares of the struggling companies indicates that meme stocks are having a moment. Specifically, shares of Carvana (NYSE:CVNA), Tupperware Brands (NYSE:TUP), Yellow Corporation (NASDAQ:YELL), and Rite Aid (NYSE:RAD) are up significantly. In addition, shares of SoFi Technologies (NASDAQ:SOFI) and Rivian Automotive (NASDAQ:RIVN), branded as meme stocks, have gained over 95% in the past three months.

Furthermore, the most popular meme stocks, including AMC Entertainment Holdings (NYSE:AMC) and GameStop (NYSE:GME), continue to witness wild swings.

But before moving ahead, it’s essential to understand that meme stocks are shares of companies that have gained popularity among retail investors through the social media space. These stocks soar in price in a very short span due to the hype created around them on social media platforms and are highly volatile. The rally in these shares has nothing to do with fundamentals, as most of the meme stocks belong to companies with struggling businesses.

Against this backdrop, let’s delve deeper into meme stocks.

Is a Meme Stock a Good Investment?

Meme stocks often jump due to the hype around them instead of their financial and operating performances. Thus, they offer high potential returns in a short period. However, the chances of them sustaining the rally without the fundamental backing are low to null, making these meme stocks highly volatile and risky.

For instance, Carvana stock has rallied over 858% year-to-date despite its high debt, expensive valuation, and challenging market backdrop. Meanwhile, shares of Yellow Corporation, which is struggling due to high debt and union negotiations, have gained over 405% in the last five trading days. While retail investors’ enthusiasm was high, Yellow Corporation filed for Chapter 11 bankruptcy protection on August 6.

Besides for Carvana and YELL, Tupperware, which is grappling with higher interest rates and lower sales, witnessed about 430% growth in its stock in the last 10 trading days. The new debt restructuring deal gave a boost to its share price. During the same period, Rite Aid stock has grown by over 68% without any company-specific reason. Just when these shares have gained significantly, it is still unclear whether these companies will be able to turn around their businesses amidst dwindling sales and margins.

As it is hard to tell when to enter or exit a meme stock, investors with a high-risk appetite could allocate a small portion of their savings into meme stocks that have fundamental backing, like SoFi Technologies. In addition, investors can lower their risk and gain exposure to meme stocks through the Roundhill MEME ETF (MEME). The MEME ETF (exchange-traded fund) was launched in December 2021.

MEME ETF – the ETF Carries a Hold Consensus Rating

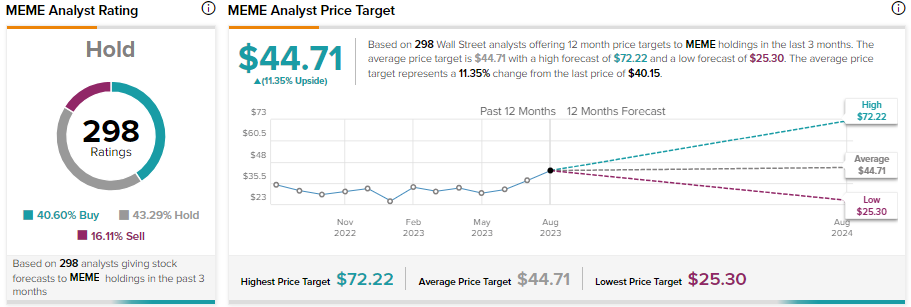

Though the MEME ETF can help you gain exposure to meme stocks and reduce your overall risk, it has a Hold consensus rating. Among the analysts providing ratings on its holdings, 40.60% have given a Buy rating, 43.29% have assigned a Hold rating, and 16.11% have given a Sell rating.

According to the recommendations of 298 analysts giving stock forecasts for MEME’s holdings, the 12-month average MEME price target of $44.71 implies 11.35% upside potential from current levels.