Tesla (NASDAQ:TSLA), Carvana (NYSE:CVNA), and Rocket Lab (NASDAQ:RKLB) are among the buzzing stocks on the social media platform Reddit. While these stocks are hotly discussed on Reddit and have gained mentions, top Wall Street analysts predict a downside in TSLA and CVNA. However, they see solid upside potential for RKLB.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

But before digging into details, note that TipRanks identifies the top Wall Street analysts per sector, per timeframe, and against different benchmarks. The ranking reflects an analyst’s ability to deliver high returns through recommendations. Following the ratings, TipRanks’ algorithms calculate the statistical significance of each rating, the analysts’ overall success rate, and the average return.

Is Tesla Stock Expected to Drop?

Tesla stock has more than doubled this year. The EV (electric vehicle) giant’s strong delivery volumes have driven its stock price higher. However, top Wall Street analysts recently downgraded TSLA stock. Further, top analysts, including Ryan Brinkman of J.P. Morgan and Ronald Jewsikow of Guggenheim, predict steep downside potential in TSLA stock from current levels.

Both analysts reiterated a Sell rating on TSLA stock on July 3. While Brinkman raised the price target on Tesla stock to $120 from $115, he maintained a cautious outlook. The analyst’s price target indicates 55.52% downside potential from current levels. Meanwhile, Jewsikow’s price target of $112 suggests 58.49% downside potential.

Overall, TSLA stock has received eight Buy, eight Hold, and one Sell recommendations from top Wall Street analysts. Further, these analysts’ average price target of $239.19 implies a downside potential of 11.34%.

Is Carvana Stock Expected to Go Up?

Carvana stock has rallied significantly, growing more than 660% on a year-to-date basis in 2023. While its GPU (Gross Profit per Unit) has shown improvement, its fundamentals do not explain such massive gains.

Piper Sandler analyst Alexander Potter is bullish about CVNA stock. The analysts raised the price target on CVNA to $29 from $21 on July 5. However, his price target implies a downside potential of 18.47% from current levels.

While CVNA’s financial performance has shown improvement, its high debt (total debt of $6.75 billion at the end of Q1) is driving enterprise value, noted Needham analyst Chris Pierce. Last month, Pierce termed CVNA’s valuation generous amid a challenging industry backdrop and maintained a Hold rating.

CVNA stock has received two Buy, 12 Hold, and one Sell recommendations from top Wall Street analysts for a Hold consensus rating. At the same time, their average 12-month price target of $14.60 indicates 58.95% downside potential.

Is RKLB a Good Stock to Buy?

Shares of aerospace company Rocket Lab have gained more than 63% so far this year. The growth reflects successful launches, increased launch bookings, higher pricing, the ability to increase sales, and lower costs.

Despite the recent gains, Bank of America Securities analyst Ronald Epstein sees further upside in RKLB stock. The analyst reiterated a Buy on Rocket Lab stock on July 11. Meanwhile, his price target of $14 indicates a solid upside potential of 126.54% from current levels.

Cai von Rumohr of TD Cowen is also bullish about RKLB stock. On May 15, the analyst increased the price target on RKLB to $9.5 from $8, implying an upside potential of 53.72%. He expects Rocket Lab to benefit from “improving pricing power” due to the “shrinking group of credible small launch peers” and “its unique success rate.”

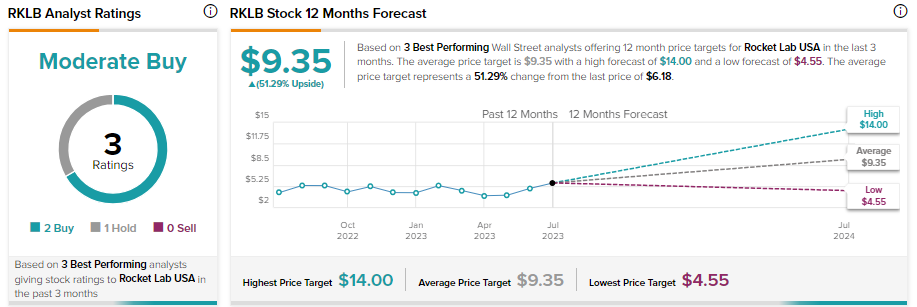

Overall, RKLB stock has two Buy and one Hold recommendations from top analysts, translating into a Moderate Buy consensus rating. Analysts’ average price target of $9.35 implies 51.29% upside potential.