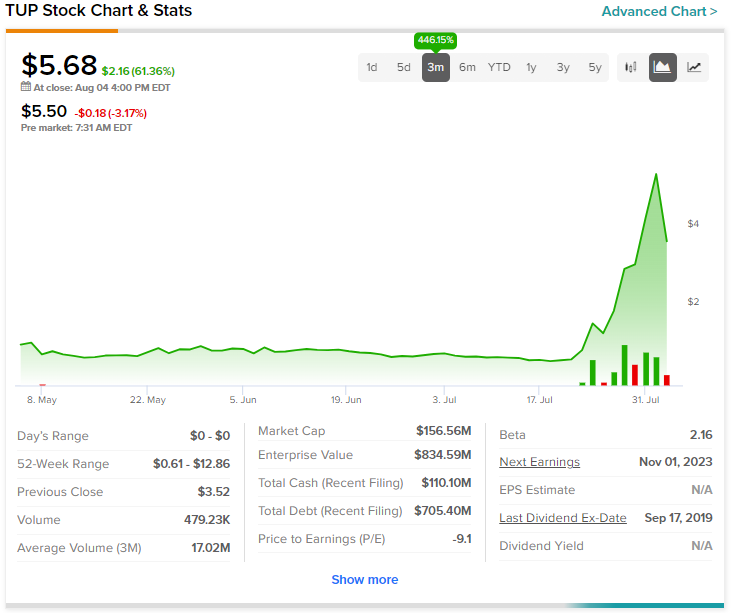

After soaring nearly 343% over the past month, shares of consumer products maker Tupperware Brands (NYSE:TUP) are up a further 61% in the pre-market session today after the company announced a major debt restructuring.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In its bid for a turnaround, Tupperware has entered into an agreement with its lenders for the restructuring of its existing debt obligations. The move means a reduction or reallocation of nearly $150 million of cash interest, an extension of the maturity of ~$348 million in principal, and reallocated interest as well as fees to fiscal 2027.

Furthermore, the agreement also lowers amortization payments to be made through fiscal 2025 by $55 million and importantly, provides the company with immediate access to $21 million in a revolving borrowing capacity.

As a result, the move promises to improve Tupperware’s overall financial health while also boosting its capital structure.

With rising investor interest, Tupperware shares have jumped 446% over the past three months now while the total debt with the company now stands at $705 million.

Read full Disclosure