Everyone wants to get in on the ground floor of the next hyper-growth industry. Investors should definitely take a look at Joby Aviation (NYSE:JOBY), but also need to stay grounded. While I am bullish on JOBY stock for the long term, betting on Joby Aviation is speculative, and proper position sizing is essential. Based in California, Joby Aviation manufactures what might be informally called flying taxis. The more formal name of this aircraft type is electric vertical takeoff and landing (eVTOL) vehicles.

There’s no telling whether the skies will be crowded with Joby Aviation’s aircraft someday. If so, JOBY stock could literally be a multi-bagger. It’s not wise to make assumptions, though, so relax and take it steady, like an expert pilot, if you plan to buy shares of Joby Aviation.

Don’t Obsess Over Profitability

If you’re solely focused on whether Joby Aviation is profitable or not, you might miss out on the big picture and robust potential returns. As it turns out, Joby Aviation reported break-even EPS in 2023’s third quarter, and while that’s not a profit, it’s better than the analyst consensus estimate EPS of -$0.17.

What’s more important than whether Joby Aviation profited in Q3 is what the company accomplished. First of all, 84% of Joby’s Certification Plans are accepted by the Federal Aviation Administration (FAA). Furthermore, according to TheFly, Joby Aviation expanded its flight test program to include “flight with a pilot on board.”

You don’t have to worry about Joby Aviation running out of capital tomorrow or next week, as the company ended Q3 with $1.11 billion in cash and short-term investments. So, if you’ll forgive my terrible pun, Joby Aviation isn’t a fly-by-night operation.

Moreover, the company has a big-money contract with the U.S. government. Specifically, it has a $131 million contract with the Department of Defense, and the firm made history when it delivered the “first electric air taxi” to the U.S. Air Force.

By now, you should have the impression that Joby Aviation is the real deal. However, in case you’re not convinced that the company is legitimate, note that Joby is working with NASA. In fact, Joby Aviation reportedly “completed a series of air traffic simulations with NASA’s Ames Research Center.” The purpose of these simulations was to evaluate “how air taxi operations can be integrated into today’s airspace.”

Joby Aviation Makes Progress at Home and Abroad

If a company is going to test and produce air taxis, it can’t have any better partners than NASA and the Air Force. Truly, Joby Aviation is making value-added deals and forming powerful partnerships. You’ll be amazed to discover how Joby Aviation is getting major support in the U.S. as well as internationally.

In the company’s home state of California, the Governor’s Office of Business and Economic Development awarded Joby Aviation a $9.8 million California Competes grant. This grant is earmarked to “assist in financing a significant expansion of” Joby Aviation‘s “facilities in Marina, California.”

Next on our itinerary is a stopover in New York, where Joby Aviation successfully completed a test flight. This event, the firm claims, represents the “first ever electric air taxi flight in the city and the first time Joby has flown in an urban setting.” It’s a significant milestone, and Joby Aviation is definitely moving closer to full commercial operations as the company expects to start its commercial passenger service in 2025.

Finally, let’s take an international flight to Japan, where Joby Aviation is teaming up with ANA Holdings and Nomura Real Estate Development Co. to build vertiports. If you wanted evidence that Joby Aviation is getting ready to take the eVTOL industry to a global level, this is all the proof you should need.

A vertiport is basically a takeoff and landing structure for eVTOL aircraft. Joby Aviation’s management surely understands that the company can’t be an early mover in Japan unless there’s the necessary infrastructure. Thus, it makes perfect sense that Joby Aviation is working with established businesses to lay the foundation for Japan’s burgeoning flying taxi market.

Is JOBY Stock a Buy, According to Analysts?

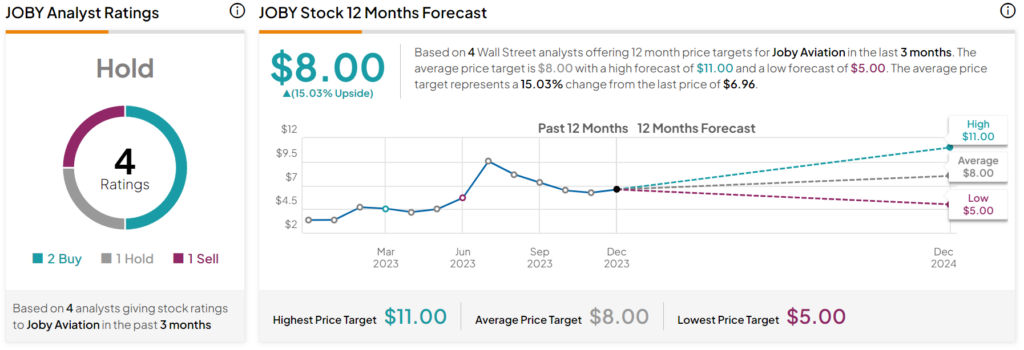

On TipRanks, JOBY comes in as a Hold based on two Buys, one Hold, and one Sell rating assigned by analysts in the past three months. The average Joby Aviation price target is $8, implying 15% upside potential.

If you’re wondering which analyst you should follow if you want to buy and sell JOBY stock, the most accurate analyst covering the stock (on a one-year timeframe) is Austin Moeller of Canaccord Genuity, with an average return of 4.67% per rating and a 67% success rate.

Takeaway: Should You Consider JOBY Stock?

Joby Aviation isn’t profitable and is involved in an industry that’s not yet fully established. Consequently, I don’t recommend taking a large position in its stock. On the other hand, Joby Aviation has U.S. government support and is laying the groundwork for future operations in Japan. Eventually, Joby Aviation could be a leader in a full-fledged global flying taxi market. Hence, investors might consider a tiny but hopeful stake in JOBY stock.