Joby Aviation (NYSE:JOBY), a company developing electric air taxis for commercial passenger transport, successfully conducted a demonstration flight in New York City. This marked the city’s first electric air taxi flight and represents Joby’s maiden venture into flying within an urban environment. Additionally, Joby anticipates the commencement of its commercial passenger service in 2025.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Joby has officially disclosed that it anticipates New York to be among its initial launch markets after it receives the Federal Aviation Administration (FAA) certification. The company entered into a multi-year commercial and operational partnership with Delta Airlines (NYSE:DAL) in October to offer all-electric home-to-airport transportation service to Delta customers. The service is planned to kick off in New York and Los Angeles.

Per the deal, Delta will incorporate Joby’s operational service into its customer interface. This will enable customers to reserve seats for short-range journeys to and from city airports.

Joby Advancing Towards Commercial Service Launch

Joby is gearing up to introduce its commercial passenger service in 2025. Furthermore, the company has attained significant milestones, suggesting it could soon receive FAA certification for commercial use.

Joby said it is approaching the conclusion of the third out of five stages required to certify its aircraft for commercial use. The FAA has approved 84% of the certification plans. Furthermore, Joby delivered the first electric air taxi to the U.S. Air Force well before the agreed schedule under its contract with the Department of Defense. Additionally, the company has extended its flight test program to incorporate manned flights with a pilot on board and stated that its full-scale prototype aircraft has flown over 30,000 miles since 2017.

In summary, the company is flying in the right direction and maintains a strong balance sheet to support its future growth initiatives. With this backdrop, let’s look at the analysts’ recommendation for JOBY stock.

Is JOBY a Good Stock to Buy?

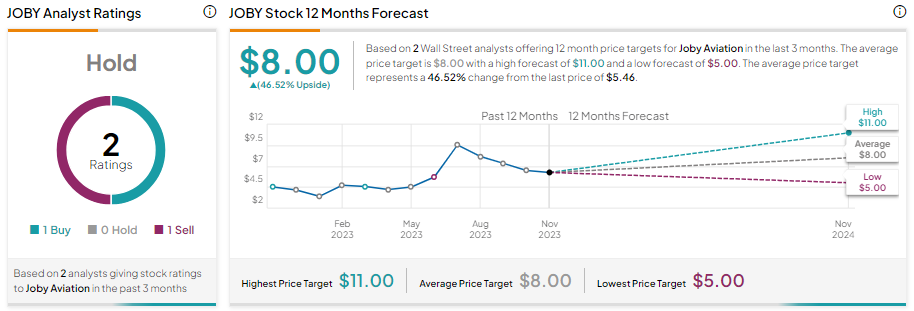

Joby stock has received one Buy and one Sell recommendation. Meanwhile, the average price target of these analysts stands at $8, implying 46.52% upside potential from current levels.