Shares of electric vertical take-off and landing (eVTOL) aircraft developer Joby Aviation (NYSE:JOBY) are trending higher today after the company teamed up with ANA Holdings and Nomura Real Estate Development Co. (NRE) to build vertiports in Japan. NRE is one of the biggest names in real estate development in the country.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The vertiports will consist of take-off and landing infrastructure for Joby’s aircraft and are expected to bolster the commercialization of Joby’s air taxi service in Japan. Joby had initially partnered with ANA, the largest airline group in Japan, for air taxi services in 2022.

Now, the three companies will initially focus on metropolitan areas, with plans for expanding their presence across urban locations in Greater Japan. Importantly, Joby is also a technical advisor for the Tokyo Bay eSG project. The project is aimed at multi-modal mobility solutions, including a floating landing port in Tokyo Bay.

The company’s air taxi can ferry passengers at speeds of up to 200 miles per hour without any in-flight emissions. Last month, Joby conducted the first electric air taxi flight in New York. It aims to begin its commercial passenger service in 2025.

Is JOBY a Good Stock to Buy?

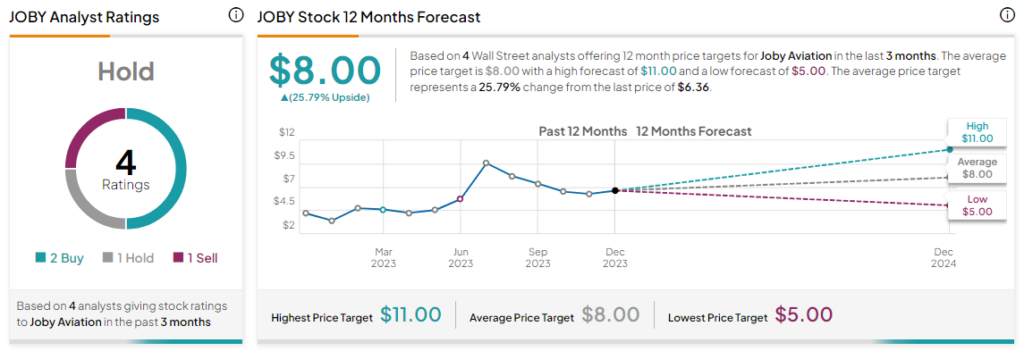

Despite recent price weakness, shares of the company still remain nearly 82% higher over the past year. Overall, the Street has a Hold consensus rating on Joby Aviation, and the average JOBY price target of $8 implies a further 25.8% potential upside in the stock.

Read full Disclosure