To no one’s surprise, the cruise line industry has been pummeled by the coronavirus pandemic. From the viral outbreak on the liner Diamond Princess, to ongoing headlines along the lines of ’40,000 Cruise Ship Workers Trapped at Sea,’ to the heavy share price declines among the industry stocks, the news has been unrelentingly bad.

But nothing lasts forever, not even bad news, and what goes down must eventually come back up. Even cruise line stocks. The industry is down about 60% year-to-date, drastically underperforming the travel segment generally, but in recent weeks cruise line shares have surged 75%.

At the macro level, JPMorgan analyst Brandt Montour makes a case for both near-term risk and longer-term recovering among the cruise lines. The risks are obvious: the potential for coronavirus outbreaks on the ships, mitigated by the companies reopening at partial capacity. On the positive side, Montour credits “…the pent-up demand for vacationing seen broadly, the surprisingly high risk-tolerance of the average American, recapitalizations across the cruise space…, the relative resiliency of demand from repeat-cruisers, and of course the broader macro recovery.”

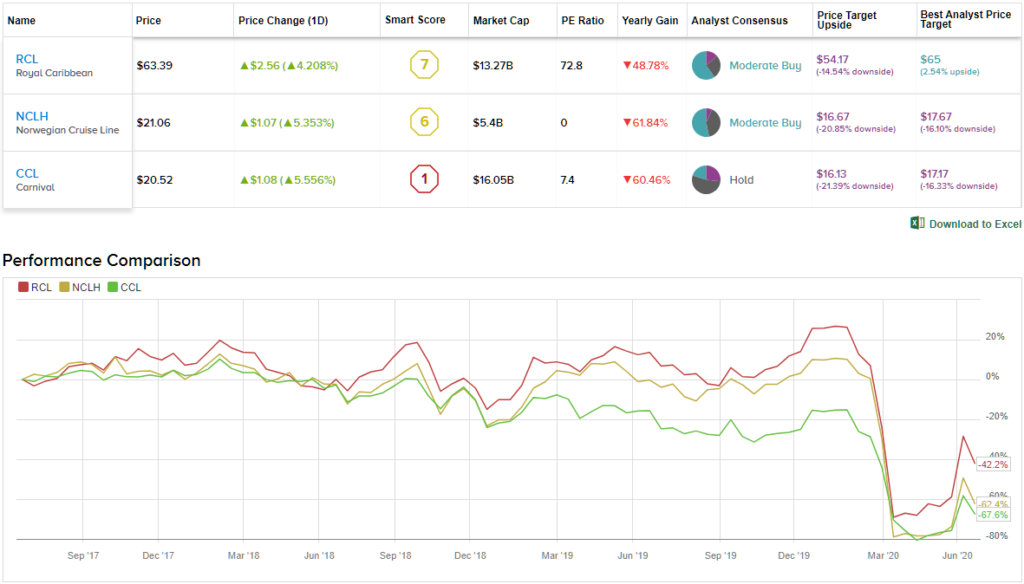

Getting into specifics, Montour has picked out two stocks that are worth the risk, and one that investors should avoid for now. Using TipRanks’ Stock Comparison tool, we lined up the three alongside each other to get the lowdown on what the near-term holds for these cruise line players.

Royal Caribbean (RCL)

We’ll start with Royal Caribbean, whose management Montour describes as “best in class.” The upshot is, that RCL shares are still available at a discount – and the company has several reasons for optimism going forward.

As Montour points out, RCL has a reputation for excellent physical infrastructure and operations – the company’s cruise ships and crews are generally considered industry leaders. With China opening up and loosening restrictions, RCL’s ticket prices have been holding up somewhat better than at peer companies. This is an important point; as the cruise lines are looking at reopening with limited capacity, maintaining ticket prices will be essential to maintaining margins.

All of this is not to say that the company is not feeling the pressure. Last month, RCL extended its suspension of sailings to the end of July, and the Q2 earnings forecast predicts a net loss of $4.43 per share – nearly triple the net loss reported in Q1. But these are likely balanced by the company’s strong liquidity position – it recently renegotiated more than $2.2 billion in debt – and its prospects for Q3 resumption of business in China.

Montour touches on the points in his comments on the stock: “Its relative liquidity position is no longer a concern, while its relative share outperformance and valuation is worth the step up in quality, in our view.”

Overall, Montour sees RCL as a stock worth the risks. He rates it a Buy, expecting the shares to outperform peers in the near future. His $72 price target implies an upside potential of 18% for the coming 12 months. (To watch Montour’s track record, click here)

The Wall Street view of RCL is still cautious. The stock’s recent rebound, despite underperforming the broader markets, has still pushed the share price well above the average price target – but even so, 9 out of 15 analysts rate the stock a Buy. With 4 Holds and 2 Sells, this makes the analyst consensus view a Moderate Buy. RCL shares are selling for $62.66; if it continues to appreciate, expect the analysts to adjust their targets upward. (See RCL stock analysis on TipRanks)

Norwegian Cruise Line Holdings (NCLH)

Next up is Norwegian Cruise Line, the third largest player in the cruise line industry, with a market cap exceeding $5 billion. Norwegian’s greatest advantage right now is the size and capacity of its cruise fleet. With a smaller fleet of relatively newer ships, and no new vessels scheduled to launch for the next two years, Montour sees the company as well-positioned to weather the coronavirus storm.

Montour also takes care to point out Norwegian’s relative discount – and high potential upside. In fact, even though he rates RCL as his best pick, he still sees NCLH as having the greater return potential.

Like RCL, Norwegian has suspended sailings through the end of July. While this will badly impact the bottom line, the company has also improved its liquidity position. Subsidiary company NCL announced last month the closing of two investments tranches, one for $400 million and one for $675 million.

Norwegian’s sound cash position and relative share price discount are the main attractors for Montour. He supports his Buy rating for the stock with a $24 price target that implies a healthy 20% one-year upside potential.

“We like NCLH’s positioning with its relatively small, relatively newer fleet, with no new capacity coming on for the next ~2 years… NCLH’s relative discount and YTD share underperformance yield the most upside to our PT,” Montour concluded.

Again, Wall Street is more cautious here than JPM’s industry expert. The Moderate Buy analyst consensus rating is based on 15 reviews, including 8 Buys, 6 Holds, and 1 Sell. The average price target is only $16.67, while shares are selling for $19.99. (See NCLH stock analysis on TipRanks)

Carnival Corporation (CCL)

Last on the list is Carnival, the stock that Montour recommends avoiding – at least for now. It may strike you as unusual that the world’s largest cruise company (even after the coronavirus hit, Carnival boasts a $15.2 billion market cap.

But the company also has a heavy debt load. At the end of March, Carnival announced that it was making available $3 billion in senior secured notes to be due in 2023. In addition, the company also revealed plans to raise $1.75 billion through a sale of senior convertible notes, also due in 2023. In its simultaneous third debt announcement, Carnival also unveiled a public offering of $1.25 billion worth of common stock shares.

Along with the debt load, Carnival also suspended its 50-cent per share quarterly dividend, as a move to preserve liquidity. This is a serious blow to the stock, as the dividend, at current prices, would yield over 10%.

Montour comments on Carnival, saying, “CCL’s growth metrics were sluggish heading into the crisis, as older capacity and regional footprints were more impacted… During COVID-19, CCL likely sustained the most direct brand damage…” The analyst also points out that Carnival lacks any ‘unique growth drivers,’ and that the company’s size makes it less nimble in dealing with the current crisis conditions.

With that in mind, Montour hedges on Carnival, giving the stock a Hold rating. His $20 price target suggests a modest 2% downside. (To watch Montour’s track record, click here)

JPM’s expert analysis is in line with the Wall Street aggregate view on Carnival. The Hold analyst consensus rating is based 15 reviews, including just 3 Buys, along with 8 Holds and 4 Sells. Shares are selling for $19.44, and the average price of $16.13 implies over 20% downside. (See Carnival stock-price forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.