Has Boeing (NYSE:BA) stock switched from a toxic asset to a terrific investment? We might be witnessing Boeing’s long-term turnaround in 2023’s final months, and I am bullish on BA stock in light of a Wall Street expert’s upgrade.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Boeing is an American aerospace and defense giant, and BA stock was once considered a safe defensive investment. For much of this year, however, the market focused on the “Magnificent Seven” technology stocks and left Boeing behind.

Yet, as we’ll see, analysts are mostly bullish on Boeing stock, and at least one of them expects the share price to make a sizable move over the next 12 months. There are no guarantees, of course, but I believe taking a moderately-sized share position in Boeing looks like a smart move now.

The Good News Keeps on Coming for Boeing

Even if Boeing isn’t a member of the “Magnificent Seven,” there’s been a slew of magnificent news items about Boeing in the past few weeks. If one of them doesn’t convince you to consider BA stock, maybe some of the other positive developments will change your mind.

First of all, the Federal Aviation Administration (FAA) granted Boeing “type inspection authorization,” allowing the company to commence flight testing its 737 Max 10 jet. This step could be instrumental as Boeing seeks to achieve certification for this potential addition to the company’s popular Max jet lineup.

Second, according to TheFly, Air Lease (NYSE:AL) announced that Boeing has delivered the first of a 25-unit order of 737-8 aircraft to Malaysia Airlines Berhad. Furthermore, Thai Airways is considering a “potential order for as many as 90 mostly widebody aircraft” from Airbus (OTC:EADSY) and Boeing. This would be “part of a long-term fleet renewal,” sources indicate.

On top of all that, Boeing scored an order for six 737 Max-8 planes from Virgin Australia. Deliveries are anticipated in the second half of 2024. With that, Virgin Australia has ordered a total of 14,737 Max-8 units.

That’s a lot for prospective investors to think about. With all of this good news coming in, don’t be too surprised if Boeing delivers a positive surprise or two in its next earnings report, which is slated for January 2024.

An Analyst Eyes $275 for Boeing Stock

Boeing stock tanked from August through October, but it appears that there’s a comeback in progress. However, with the share price hovering above $220, could an extended run to $275 be in the cards?

At least one prominent analyst seems to believe so. Not only did RBC Capital analyst Kenneth Herbert upgrade BA stock from a Hold to a Buy, but he also raised his price target on the shares from $200 all the way up to $275.

Evidently, Herbert envisions brighter days ahead in the wake of a challenging year for Boeing. “After another year of supply-chain disruptions and lowered expectations, we believe the set-up into 2024 is favorable,” the RBC Capital analyst opined.

I already mentioned some of Boeing’s current and potential orders, which indicate consistent demand for the company’s aircraft. On that topic, Herbert commented that he expects “the strong demand to sustain for both the commercial and defense business.”

If Herbert is correct, this strong demand should translate to improved free cash flow for Boeing in the long term. Thus, the analyst anticipates that Boeing will deliver free cash flow of $3.5 billion in 2023, $5.5 billion in 2024, and $8.5 billion and 2025.

Is Boeing Stock a Buy, According to Analysts?

On TipRanks, BA comes in as a Strong Buy based on 15 Buys and three Hold ratings assigned by analysts in the past three months. The average Boeing stock price target is $249.67, implying 12.3% upside potential.

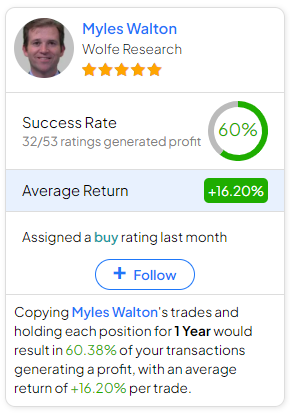

If you’re wondering which analyst you should follow if you want to buy and sell BA stock, the most profitable analyst covering the stock (on a one-year timeframe) is Myles Walton of Wolfe Research, with an average return of 16.2% per rating and a 60% success rate. Click on the image below to learn more.

Conclusion: Should You Consider Boeing Stock?

It’s fine to hold some “Magnificent Seven” stocks in your portfolio, but don’t ignore recovery stories like Boeing. Herbert’s remarks suggest that Boeing could deliver magnificent returns to its shareholders during the next 12 months.

Besides, there’s enough good news to persuade sensible investors that Boeing is on the right track. Therefore, I would definitely consider BA stock for a buy-and-hold position.