Shares of aerospace major Boeing (NYSE:BA) are ticking higher today after it bagged an order for six 737 Max-8 planes from Virgin Australia. Deliveries are anticipated in the second half of 2024.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

This order brings the total number of 737 Max-8s ordered by Virgin Australia to 14, with the company anticipating the delivery of one new plane for nearly every month of 2024. The Max-8 planes offer improved fuel efficiency, lower emissions, and are “40 percent quieter than existing 737s.”

Amid robust travel trends and airlines looking to boost their fleets, Boeing has been scoring major wins. Earlier this month, the company bagged an order worth $52 billion for 95 planes from Emirates at the Dubai Airshow.

While the Middle East remains a significant market for Boeing, China could also possibly warm up to the company after the recent meeting between the Presidents of the U.S. and China. Furthermore, the Royal Jordanian airline recently ordered four 787-9 Dreamliners.

Investors have been looking favorably at BA stock after the Federal Aviation Administration (FAA) gave the firm a “Type inspection authorization.” This means that FAA pilots can now join in on flight testing.

What is the Prediction for Boeing Stock?

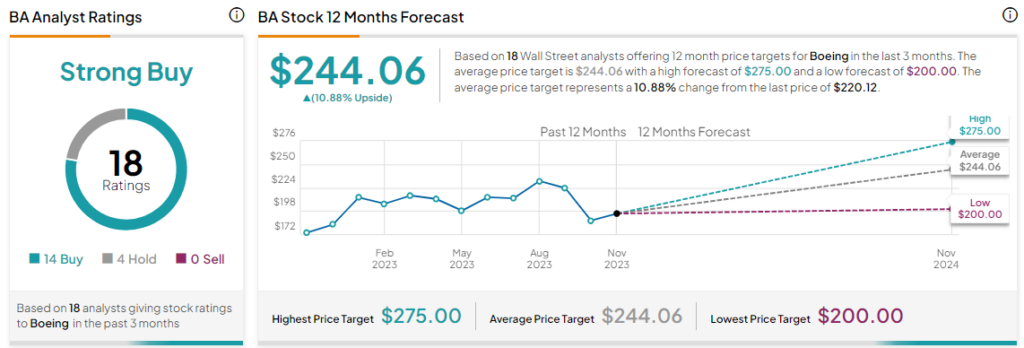

This slew of positives has pushed Boeing shares nearly 20% higher over the past month. Overall, the Street has a Strong Buy consensus rating on Boeing, and the average BA price target of $244.06 implies a 10.9% potential upside in the stock.

Read full Disclosure