Going into the closing minutes of Wednesday’s trading session, Boeing (NYSE:BA) is up fractionally, thanks in large part to some good news from the Federal Aviation Administration. The good news is that Boeing can get back to some test flights and start recovering some lost goodwill with said flights.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

With the FAA’s latest nod, Boeing can now start flight testing its 737 Max 10 jet, which is the biggest version yet of its highly popular Max line. The flight tests are with certification in mind and, hopefully, will ultimately give Boeing one more model to offer up to airlines interested in a single-aisle jet aircraft. The FAA gave Boeing “type inspection authorization,” which allows FAA pilots to join in on flight testing that should certify the plane for everyday operations.

This is the latest step forward, reports note, but there will be several steps yet to go, and the process will take quite some time to reach fruition. In fact, Boeing has already run several flight tests on the 737 Max 10, but those tests didn’t count until now, thanks to the involvement of FAA pilots.

Boeing is Building on Earlier Successes

While Boeing’s comeback trail hasn’t always been straight or level, it has seemed to take off in recent days. The big winner was clearly the Dubai Airshow, where Boeing brought in over three times the business of its only major competitor, Airbus (OTHEROTC:EADSF). That was good by itself, but then Boeing brought in business from NATO as well, and the hits kept on coming. The most recent was an upgrade at Deutsche Bank, as it got stepped up from Hold to Buy.

Is Boeing Stock a Buy, Sell, or Hold?

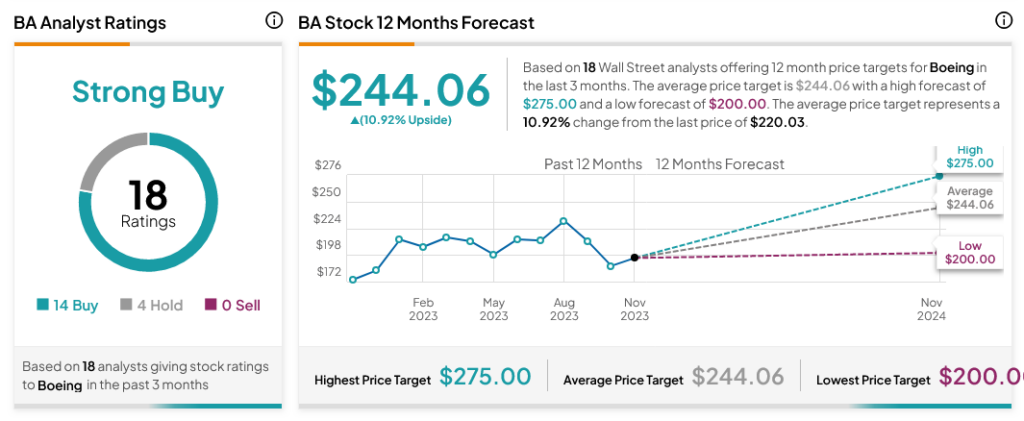

Turning to Wall Street, analysts have a Strong Buy consensus rating on BA stock based on 14 Buys and four Holds assigned in the past three months, as indicated by the graphic below. After a 25.59% loss in its share price over the past year, the average BA price target of $244.06 per share implies 10.92% upside potential.