Manufacturer of airplanes Boeing (NYSE:BA) ticked higher in pre-market trading as top-rated RBC Capital analyst Kenneth Herbert upgraded the stock to a Buy from a Hold and raised its price target to $275 from the earlier $200.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The analyst believes that Boeing could fly high next year due to a favorable outlook and the possibility of improved execution on the company’s MAX and 787 airplanes. Herbert commented, “We believe buy-side expectations for 2024-2025 [free cash flow reflect conservatism, and as execution on the MAX and 787 continue to gradually improve, we believe the potential for positive revisions is growing.”

Is BA a Good Buy Right Now?

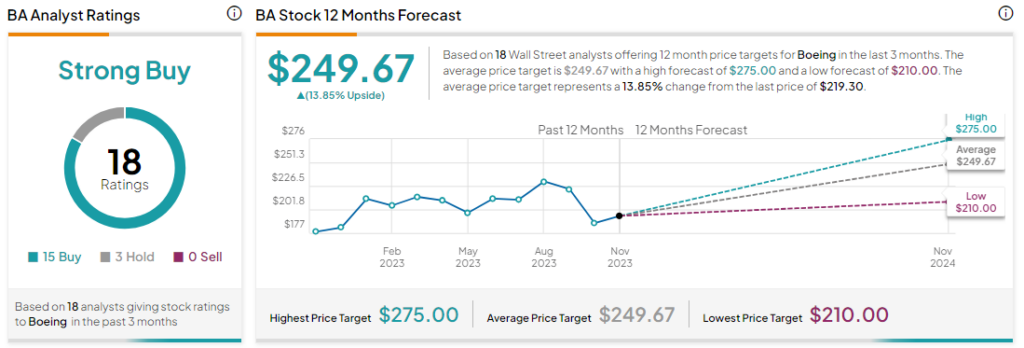

Analysts remain bullish about BA stock with a Strong Buy consensus rating based on 15 Buys and three Holds. Year-to-date, BA stock has surged by more than 10%, and the average BA price target of $249.67 implies an upside potential of 13.85% at current levels.