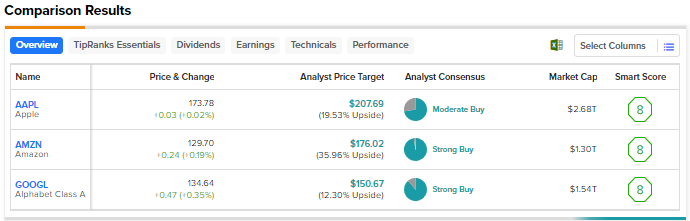

Tech stocks have been declining recently on fears that elevated interest rates for a prolonged period might push the economy into a recession. Nonetheless, several tech names remain attractive due to their strong fundamentals and attractive long-term growth potential. We used TipRanks’ Stock Comparison Tool to place Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN), and Alphabet (NASDAQ:GOOGL, GOOG) against each other to find the stock that could deliver the highest returns.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Apple (NASDAQ:AAPL)

Apple is known for its solid brand name and a compelling portfolio of hardware products, including iPhone, Mac, and iPad. The company also has a Services business, which is expanding at a rapid growth rate.

Apple exceeded analysts’ earnings expectations for the fiscal third quarter (ended July 1, 2023), even as the top line declined 1.4% year-over-year to $81.8 billion. Revenue was impacted by lower iPhone, Mac, and iPad sales due to macro pressures. That said, the 8.2% growth in Services revenue helped offset the weakness in major hardware lines to some extent.

While the long-term prospects for Apple seem attractive, recent news related to the overheating issue in iPhone 15 and persistent macro headwinds have weighed on investor sentiment. Shares have declined over 8% in the past one month but are still up 34% year-to-date.

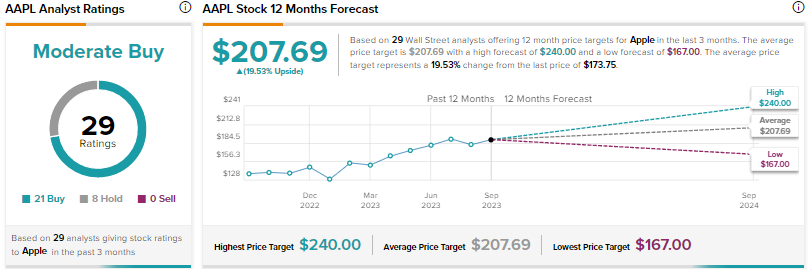

Is Apple a Buy or Sell Now?

On Tuesday, Bank of America analyst Wamsi Mohan reiterated a Hold rating on Apple stock with a price target of $208.

The analyst remains on the sidelines as positive catalysts of new product introductions like AR/VR headset and iPhone 15 are offset by a potentially weaker consumer spending environment in the second half of the year. Mohan also cited the growing threat from actions taken by China (like a ban on iPhone for government officials and changes in App store guidelines) as one of the reasons for his Hold rating.

Overall, Wall Street is cautiously optimistic on AAPL stock, with a Moderate Buy consensus rating based on 21 Buys and eight Holds. The average price target of $207.69 implies 19.5% upside potential.

Amazon (NASDAQ:AMZN)

E-commerce and cloud computing giant Amazon impressed investors by returning to double-digit sales growth in the second quarter. Further, the company’s cost-reduction and streamlining efforts drove an EPS of $0.65 in Q2 2023 compared to a loss of $0.20 per share in the year-ago quarter.

Looking ahead, Amazon expects to benefit from the significant interest of enterprises in generative artificial intelligence (AI). The company is confident that Amazon Web Service (AWS) is well positioned to be customers’ long-term partner in building generative AI applications. Amazon recently announced a $4 billion investment in OpenAI-rival AI firm Anthropic as part of its AI ambitions.

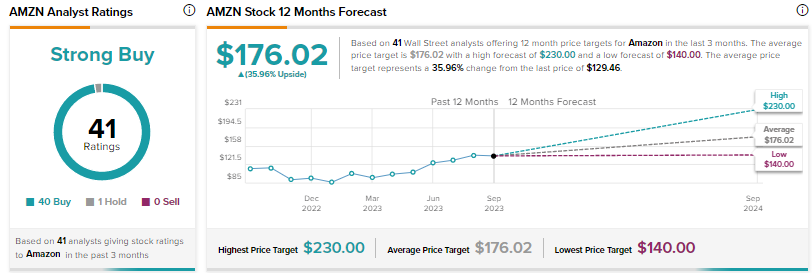

Is Amazon a Good Stock to Buy Now?

On Tuesday, Mizuho analyst James Lee reiterated a Buy rating on AMZN with a price target of $180, calling the stock his top pick. Lee said that checks with sales channels revealed that demand for AWS services remained stable after a notable improvement in Q2 2023. He said early budgeting for 2024 indicates accelerating AWS demand.

Like Lee, UBS analyst Lloyd Walmsley is also bullish on Amazon and raised his price target to $180 from $175 on Monday. Walmsley is optimistic that the launch of video ads within Prime Video content will generate substantial revenues and significantly enhance AMZN’s margins.

Amazon plans to include ads in Prime Video shows and movies from early 2024, initially in the U.S., U.K., Germany, and Canada, and later expand to additional countries. Walmsley expects Prime Video ads in the U.S. alone to generate $6.2 billion in incremental venue and boost EPS by $0.40 over time, adding nearly 1.2% to North America retail margins.

With 40 Buys vs. one Hold, Amazon stock earns a Strong Buy consensus rating. The average price target of $176.02 implies 36% upside potential. Shares have risen 54% since the start of this year.

Alphabet (NASDAQ:GOOGL, GOOG)

Google’s parent company Alphabet reported better-than-expected second-quarter results, even as macro pressures continue to impact ad spending. A 28% revenue growth in the company’s Google Cloud business fueled the upbeat performance in Q2 2023.

Alphabet is incorporating generative AI into several products, including Google Search, to expand its total addressable market and attract more customers. Moreover, its AI-optimized Google Cloud platform is preferred by several customers for developing and training generative AI models. Alphabet claims that over 70% of generative AI startups, including Cohere, Jasper, and Typeface, are Google Cloud clients.

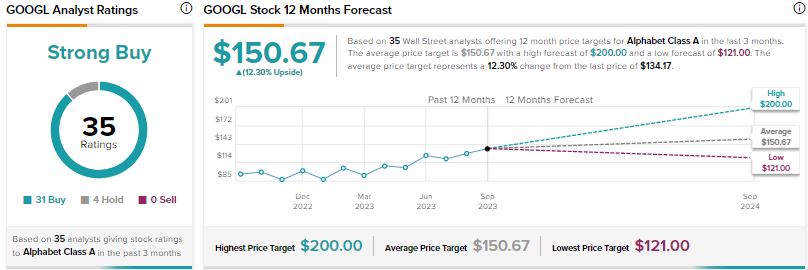

What is the Target Price for GOOGL Stock?

On Tuesday, Piper Sandler analyst Thomas Champion lowered his price target to $147 from $148 but reiterated a Buy rating on Alphabet stock, calling the tech giant an AI winner. The analyst noted that shares have outperformed the broader market despite the ongoing antitrust trial and thinks that GOOGL’s valuation remains “undemanding.”

Champion highlighted that the company’s filings reveal updated purchase commitments, suggesting additional AI and data center investments. Accordingly, the analyst increased his capital expenditure estimate.

“Looking ahead, we see an improving picture for core Search and new Cloud/AI revenue streams emerging,” concluded Champion.

Wall Street has a Strong Buy consensus rating on GOOGL stock, backed by 31 Buys and four Holds. At $150.67, the average price target implies 12.3% upside. Shares have advanced 52% year-to-date.

Conclusion

Wall Street is highly bullish on Amazon and Alphabet, but cautiously optimistic about Apple. Among these three tech giants, analysts see the highest upside potential in AMZN stock. Amazon’s dominance in e-commerce and cloud computing markets and lucrative AI prospects make it an attractive tech stock.