It seems the tension between the U.S. and China is escalating, with Chinese government offices reportedly being told to ditch iPhones and other foreign electronics during their work hours. This new development, as reported by The Wall Street Journal, came to light through workplace chats and meetings, signaling a potential broadening of earlier restrictions on using such devices for official tasks. While the full extent of this directive remains unclear, it unmistakably indicates a firming stance on enforcing this restriction, which saw tech giant Apple’s shares (NASDAQ:AAPL) dip by almost 3% at the time of writing.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In the background of this developing scenario, it’s vital to note that Apple has a significant revenue stream flowing from Greater China, amassing a staggering $57.48 billion in the nine months ending on July 1. China’s move mirrors the U.S.’ own stance on restricting the use of some Chinese products and services, including popular entities like TikTok and Huawei, citing national security reasons. This tit-for-tat dynamic is further strained with the U.S. spearheading export curbs on semiconductor sales to China.

What is the Apple Stock Price Forecast?

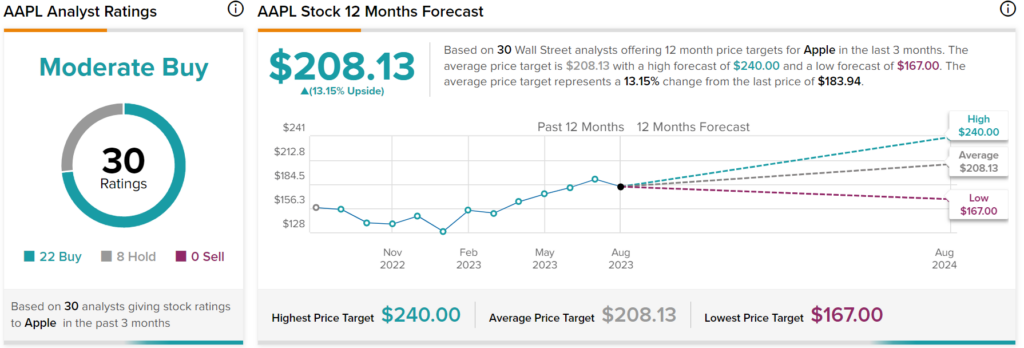

Turning to Wall Street, analysts have a Moderate Buy consensus rating on AAPL stock based on 22 Buys, eight Holds, and zero Sells assigned in the past three months, as indicated by the graphic above. Nevertheless, the average price target of $208.13 per share implies 13.15% upside potential.