Alphabet- (NASDAQ:GOOGL)(NASDAQ:GOOG) owned Google is set to face one of its biggest legal battles ever, as the U.S. Justice Department (DOJ) and a coalition of states will start a civil trial against the company on Tuesday for violating antitrust laws.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Justice Department alleges that Google used restrictive agreements to maintain its dominance and suppress competitors in the search business. Three years ago, the DOJ and a group of state attorneys filed a lawsuit against Google for anticompetitive conduct.

They alleged that Google pays billions of dollars to phone manufacturers like Apple (NASDAQ:AAPL) and Samsung Electronics (GB:SMSN), wireless carriers such as AT&T (NYSE:T) and Verizon’s (NYSE:VZ), and browser developers like Mozilla and Opera to secure default status for its general search engine, thus impacting its competitors.

In its defense, Google argues that its agreements with device makers and others do not restrict them from promoting rivals. Further, the company added that its counterparties use Google as the default search engine because of its quality. The outcome of the trial remains to be seen. Meanwhile, let’s look at Google’s legal risks.

Google’s Risk Analysis

Antitrust lawsuits are not new for Google. The company faces several antitrust cases by various regulatory agencies in the U.S. and globally on numerous aspects like the operation and distribution of Google Search and advertising technologies and practices. Earlier this month, the Danish Media Association sued Google over monopolistic behavior.

Nonetheless, TipRanks’ Risk Analysis tool shows that Alphabet manages its risks well. The image below shows that most of the company’s risks are below the sector average. Moreover, its legal and regulatory risk exposure, which accounts for 20% of its total risks, is marginally lower than the industry average.

Is Alphabet a Buy or Sell Stock?

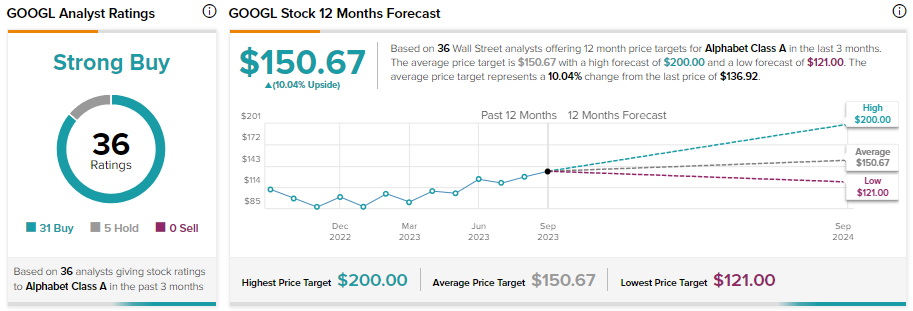

Alphabet is one of the magnificent seven stocks and has gained over 55% year-to-date. Despite the recent price appreciation, Wall Street remains bullish on Alphabet stock. With 31 Buy and five Hold recommendations, GOOGL stock has a Strong Buy consensus rating. Analysts’ average price target of $150.67 implies an upside potential of 10.04% from current levels.