Alphabet- (NASDAQ:GOOGL)(NASDAQ:GOOG) owned Google is in legal soup. Per a Reuters report, the Danish Media Association, on behalf of Jobindex, an online job-search company, has sued Google, alleging that the internet giant unfairly favored its job search service offering, Google for Jobs. The move comes after a year when Jobindex complained about Google’s monopolistic behavior to the European Union regulators.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Jobindex alleged that Google copied job ads from Jobindex into its own offering without consent from the company, leading to copyright violations. Jobindex is seeking compensation and damages for the breach.

Google Faces Legal Risks

Lawsuits are not new for Google. The regulatory agencies in the U.S. and worldwide and other plaintiffs have filed several antitrust lawsuits against Google about various aspects of the company, including its advertising technologies and practices and the operation and distribution of Google Search. These legal proceedings could result in regulatory actions, fines, and penalties that harm the business.

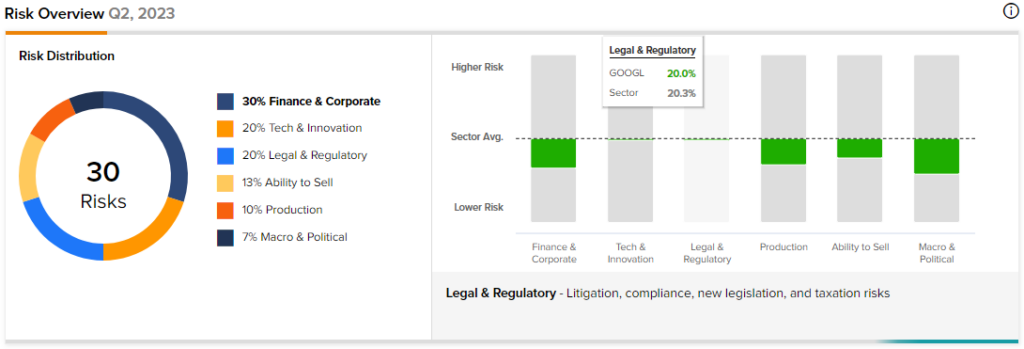

While the lawsuit’s outcome remains to be seen, TipRanks’ risk analysis tool shows that Alphabet’s legal and regulatory risks account for 20% of its total risks. At the same time, its legal and regulatory risk exposure is marginally lower than the industry average. Impressively, most of the company’s risks are well below the industry average. Note that TipRanks’ Risk Analysis tool helps you to stay up-to-date with the changing risk scenario. As Alphabet manages its risk well, let’s look at what the Street projects for GOOGL stock.

Is Alphabet Stock Expected to Rise?

Alphabet, which is part of the magnificent seven stocks, has gained 54.34% year-to-date. Given the recent gains, analysts’ average price target suggests limited upside potential for Alphabet stock in the short term.

Nonetheless, analysts are upbeat about GOOGL’s prospects and expect the company to benefit from its ongoing strength in the Search business. Also, the anticipated recovery in ad spending, momentum in the Cloud business, AI (Artificial Intelligence)-led innovation, and reduction of costs will support its revenue and earnings growth.

Alphabet stock has received 31 Buy and five Hold recommendations for a Strong Buy consensus rating. These analysts’ average 12-month price target of $150.67 implies 10.65% upside potential from current levels.