On the surface, the headline numbers seem to dissuade investments tied to expansionary sentiments, including the so-called sector of growth stocks. However, the economic ecosystem isn’t guaranteed to be at stasis indefinitely. Also, certain compelling tickers such as GOOG/GOOGL, ADBE, and META offer very attractive discounts that shouldn’t be ignored.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

First, it’s important to acknowledge the headwinds impacting the best growth stocks. Primarily, the Federal Reserve remains committed to attacking historically high inflation via interest rate hikes. As the cost of borrowing rises, fewer businesses are interested in absorbing the higher risks associated with expansion. Therefore, commercial activity fades, thus largely bolstering companies that have established track records (such as dividend stocks).

However, the Fed gave no guarantee that it would continue raising rates forever. Certainly, once inflation comes under control, the central bank will likely let off the gas. As well, if the economy appears to be slipping into a deep recession, the Fed may reduce rates. Theoretically, this should benefit the best growth stocks.

Also, the growth sector in the broader equities sphere tends to be associated with technology-based innovators. Given that developed societies move forward in terms of tech integration, over time, the best growth stocks should rise based on relevance and booming demand.

Finally, with all the turmoil that has sprouted so far this year, contrarian investors enjoy ample opportunities. Regarding the best growth stocks to buy, this arena is about as close as one can get to a time machine. If the top innovators were captivating at the beginning of the year, they’re more attractive now with their discounted prices.

Alphabet (GOOG) (GOOGL)

One of the stalwarts within the big tech machinery, Alphabet effectively owns the internet. Based on the latest data, the company’s Google ecosystem commands over 92% of the global search engine market share. Obviously, nothing else comes close, including the best that Russia and China have to offer. Just on this dominance alone, GOOG represents one of the best growth stocks to buy.

In addition, Alphabet may have dropped sharply in large part due to unrealistic expectations. With many investors getting spoiled by big tech firms constantly delivering the goods, they may have overreacted to some of the pessimism impacting the sector. On a year-to-date basis, GOOG stock gave up more than 40% of its equity value.

However, it’s the quantitative metrics that may appeal the most to contrarian investors. Currently, Alphabet features a price-earnings-growth (PEG) ratio of 0.64 times, favorably lower than the underlying industry median of 1.04X. As well, the company features revenue and profitability trends that rank above sector norms, making Alphabet one of the best growth stocks to buy.

Is GOOGL a Good Stock to Buy, According to Analysts?

Turning to Wall Street, GOOGL stock has a Strong Buy consensus rating based on 29 Buys, zero Holds, and zero Sell ratings. The average GOOGL price target is $129.71, implying 46.6% upside potential.

Adobe (NASDAQ:ADBE)

Another high-powered entity among the best growth stocks to buy, Adobe arguably generates the most popularity for its creatives-based software, particularly Photoshop. Fundamentally, this may play a significant role in the years ahead due to the anticipated expansion of the gig economy.

According to Statista, the projected gross volume of the gig economy is expected to reach $455.2 billion by 2023. However, the reluctance of corporate employees to return to the office could see this sector expand at a higher-than-expected rate. At scale, this dynamic should translate to significant demand for ADBE stock. After all, the gig economy doesn’t just include certain economic activities; it includes practically everything, such as dog-walking enterprises.

As with Alphabet above, Adobe features attractive quantitative metrics. Primarily, ADBE trades at 18.7x forward earnings. In contrast, the underlying industry features a forward price-to-earnings ratio of 22.6x.

Also, Adobe brings robust stats on the income statement, including revenue growth and profitability margins. Notably, its return on equity stands at 33.4%, ranking better than nearly 94% of the competition and reflecting a very high-quality business.

Is ADBE a Good Stock to Buy, According to Analysts?

Turning to Wall Street, ADBE stock has a Moderate Buy consensus rating based on 12 Buys, 14 Holds, and zero Sell ratings. The average ADBE price target is $367.22, implying 28.51% upside potential.

Meta Platforms (NASDAQ:META)

For those that wish to take contrarianism to the extreme, Meta Platforms could be enticing. To be fair, the risks are tremendous. Mainly, criticism centers on the company’s hard pivot to the metaverse, or the next generation of internet connectivity. Frankly, consumers, investors, and many of the firm’s employees just don’t get it. It’s a bad look for a once-proud tech powerhouse.

What’s worse, activist investors have demanded Meta address the sharp rise in costs associated with its metaverse initiatives. From outside observation, top management does not seem ready to acknowledge the challenges and reverse course. However, if it does do that in the future, the company could be extremely attractive because of its Facebook network.

While digital advertising concerns remain, the reality is that companies must market their products and services to survive, and what better platform to do it in than the world’s biggest social media network?

On the quantitative side, Meta will almost certainly appeal to risk-tolerant speculators. Mainly, the company is dirt cheap, priced at less than 11x forward earnings. In contrast, the industry median forward P/E ratio is 15.4x. Also, Meta enjoys strong income statement-related performance metrics along with a relatively stable balance sheet.

Is META a Good Stock to Buy, According to Analysts?

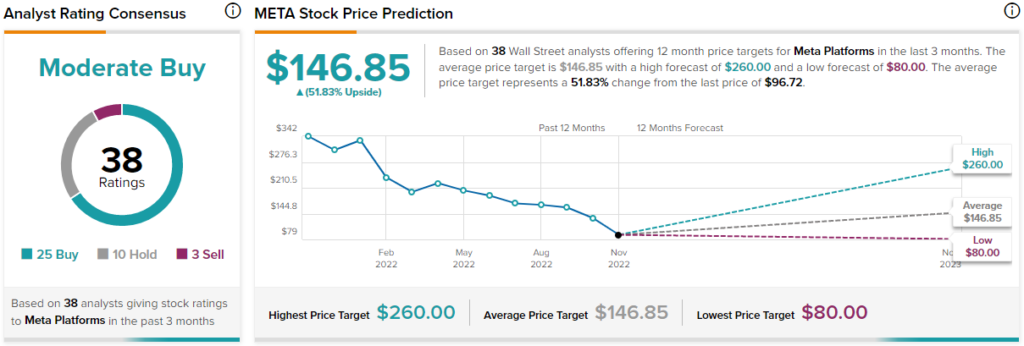

Turning to Wall Street, META stock has a Moderate Buy consensus rating based on 25 Buys, 10 Holds, and three Sell ratings. The average META price target is $146.85, implying 51.8% upside potential.

The Red Ink Incentivizes the Best Growth Stocks to Buy

Of course, with so many vagaries in the global economy, diving into the best growth stocks to buy presents heavy risks, no matter how fundamentally sound the underlying businesses are. Nevertheless, investors must trade on what might be, not what is. Thus, for the daring, the above growth-oriented names may deliver the goods, especially at such deflated prices.