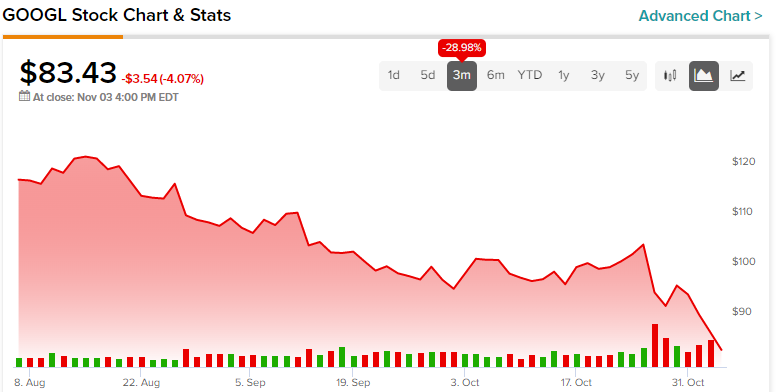

Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG) is a tech titan, but it’s in the doghouse right now. I am bullish on Alphabet stock, however, and so should any dyed-in-the-wool value hunter. Unfortunately, today’s investors are so anxiety-driven – and frankly, spoiled by years of robust corporate growth – that they refuse to see the terrific value that’s right in front of them.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Perhaps I shouldn’t say, “unfortunately,” though, as there’s a huge opportunity here. Alphabet is still an American search engine, tech gadget, and cloud computing pioneer. Nothing has fundamentally changed about the company, but a recent rout in so-called growth stocks has put short-term traders on edge.

They can stay on that edge if they’d like to, but chances are, the fearful skeptics will only end up buying Alphabet stock at higher prices. Instead of waiting for “confirmation” or an all-clear signal that everything’s going to be all right, I encourage you to check the data and decide for yourself whether Alphabet stock deserves an autopsy or a re-rating to the upside.

Investors Should be More Realistic in Their Expectations

There’s no denying it: Alphabet stock tanked after the company released its third-quarter 2022 earnings results. However, this also happened to shares of Amazon (NASDAQ: AMZN), Meta Platforms (NASDAQ: META), and to a lesser extent, Microsoft (NASDAQ: MSFT). It was a rough earnings season for Big Tech, and this suggests that perhaps investors have raised their expectations to unrealistic heights.

Bernstein analyst Mark Shmulik seems to raise this possibility, suggesting that Big Tech’s “disastrous” results may be a result of “investor expectations, demanding perfection across complicated conglomerates.” Bernstein cited other problematic factors, but Shmulik did observe a “betting parlay-like effect going on” with large-cap tech names, “where if even one metric misses, the stock sells off.”

As an individual investor, you can’t control the market’s overly-ambitious earnings expectations for companies like Alphabet and its Google business. However, you can control your own expectations and, just as importantly, let the data drive your decisions rather than your emotions.

Post-Earnings, GOOGL Stock is Compelling

Five years ago, did you imagine that Alphabet would carry a trailing 12-month P/E ratio of around 16.4x? Probably not, and many traders would have jumped at the chance to buy GOOGL stock at such a valuation. Yet, here we are, and people are afraid to accept this gift from Wall Street.

Again, the culprit is overblown expectations. During 2022’s third quarter, Alphabet’s revenue grew “only” 6% year-over-year. In the year-earlier quarter, the company’s revenue increased a whopping 41% year-over-year.

Financial traders shouldn’t have assumed that Alphabet’s revenue growth would maintain its pace from last year. No company in the real world can just keep growing like that. Meanwhile, Alphabet earned $1.06 per diluted share in Q3 2022, which is perfectly respectable even if it’s not as euphoria-inducing as the year-earlier quarter’s $1.40 per share.

Furthermore, Alphabet demonstrated year-over-year revenue increases from Google advertising and from total Google Services. The skeptics should also observe that Alphabet’s Google Cloud revenue improved significantly on a year-over-year basis.

Besides, Alphabet achieved all of this during a time when the economy is weak and inflation is high. Advertisers aren’t likely to spend as much as usual amid this challenging financial backdrop. Hence, Alphabet deserves credit for exhibiting growth in key areas, even if many investors will only focus on the negative and dismiss the positive.

Analysts All Like GOOGL Stock Now

Turning to Wall Street, GOOGL is a Strong Buy, based on 29 unanimous Buy ratings. Now, there’s something you probably don’t see every day: financial experts all agree on something! By the way, the average Alphabet price target is $129.90, implying 55.7% upside potential.

Conclusion: Should You Consider Alphabet Stock?

Clearly, Wall Street’s experts are bullish on Alphabet stock even while some investors are panic-selling their shares. For instance, Goldman Sachs (NYSE: GS) analyst Eric Sheridan assigned a Buy rating to Alphabet stock, and he reportedly sees $135 as the stock’s fair value. Even if the amateur commentators on social media won’t acknowledge it, Alphabet showed growth in multiple categories of revenue, including Google advertising and Google Cloud. It’s possible that some traders imagined that Alphabet would continue to grow this year as it did in 2021.

You don’t have to worry about other people’s too-high expectations, though. Instead, you’re invited to take advantage of the rare value-investing opportunity in GOOGL stock and consider a long position today.