Although every new year generally starts off auspiciously from a sentiment perspective, 2022 immediately imposed a rude awakening for Wall Street. With global inflation skyrocketing off the bat, central banks had little choice but to respond with higher interest rates. Unfortunately, this whipsawing effect imposed significant pressures on the broader economy. Against this backdrop, investors should really consider the fundamental value of dollar-store stocks, specifically the tickers DLTR and DG.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Let’s set up the background for why dollar-store stocks find themselves in the spotlight. 2020’s pandemic lockdowns resulted in severe economic penalties. To buttress a desperately spiraling situation, Washington then approved several rounds of fiscal and monetary stimulus programs. While these measures arguably saved the U.S. economy from destruction, they also contributed to an unprecedented expansion of the money supply.

Now, the Federal Reserve finds itself in the awkward situation of mitigating the mitigation. It’s also an unenviable circumstance, as the Fed committed to a hawkish monetary policy to reverse prior excesses. In short, the central bank will undo prior easy money policies in an attempt to stop inflation.

The tricky part for the Fed is that deflating the money supply could also end up deflating the economy. After all, higher interest rates correspond directly with higher borrowing costs. That hurts risk-on names which center on growth, not value derived from earnings.

However, the narrative could work out for dollar-store stocks. While a component of the broader retail sector, these entities provide critical goods at ultra-low prices. Such a business model will appeal to hard-hit consumers across the income spectrum, thus benefiting DLTR and DG.

Dollar Tree (NASDAQ:DLTR)

An American multi-price-point chain of discount variety stores, Dollar Tree enjoys a wide addressable market. As of October 2022, Dollar Tree features 7,882 locations in the U.S., spanning 49 states and territories. Currently, Texas has the greatest number of stores, at 666, followed by California, with 642. Florida rounds out the top three with 587.

Fundamentally, DLTR represents one of the dollar-store stocks to consider for your portfolio because of its intense relevance. As earnings reports from popular discretionary retail powerhouses demonstrated, consumers are keeping their wallets shut. In turn, this dynamic resulted in sharp increases in inventory that impacted retailers must reduce through margin-killing discounts. However, not many alternatives exist for the essentials, like food and water. Therefore, DLTR appears enticing.

To be fair, Dollar Tree rates as a modestly overvalued investment at the present juncture, with investors paying more for earnings compared to other companies in the defensive retail space. However, faced with either two realities – evermore rising inflation or crippling deflation – DLTR should remain resilient. Again, people need the essentials.

Further, its latest financial trajectory provides encouraging context. In its company’s quarter ended July 2022, Dollar Tree posted net income of $360 million. This tally represented a year-over-year lift of nearly 28%. Moreover, the company’s diluted earnings per share on a trailing-12-months (TTM) basis stands at $6.97. This figure significantly exceeds the EPS of $5.83 posted in the Fiscal Year ended January 2022.

Is DLTR Stock a Buy, According to Analysts?

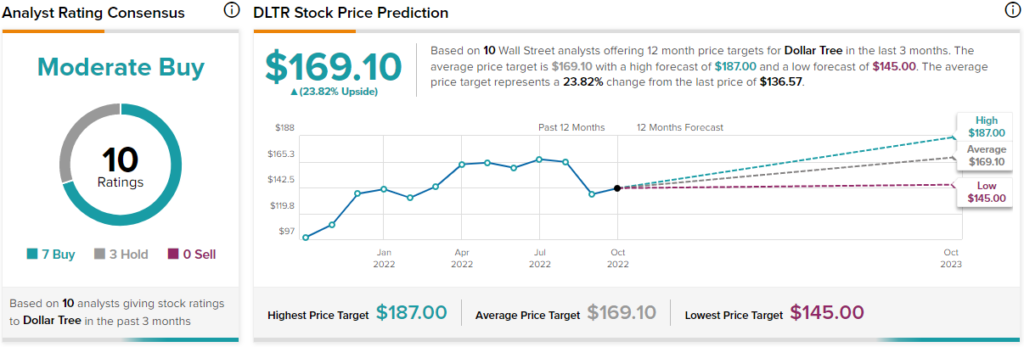

Turning to Wall Street, DLTR stock has a Moderate Buy consensus rating based on seven Buys, three Holds, and zero Sell ratings. The average DLTR price target is $169.10, implying 23.8% upside potential.

Dollar General (NYSE: DG)

Another popular name among discount dollar-store stocks, Dollar General features over 18,000 stores across 47 states. As with Dollar Tree, Texas commands the greatest number of Dollar General stores at 1,742. However, Georgia comes in second place at 1,021 stores, with Florida again rounding out the top three with 1,006.

Fundamentally, Dollar General should benefit from millennial migration trends. Even before the post-pandemic new normal, many young people left overpriced coastal metropolitan areas for more rural areas. Naturally, the wild price surges of the COVID-19 cycle helped accelerate this trend. Thus, Dollar General may be situated where the people will be, not necessarily where they are right now.

Financially, DG offers a fairly-valued investment relative to other dollar-store stocks. That should be expected, considering that demand for DG will likely rise as economic conditions become more challenging.

Further, Dollar General features excellent performance metrics in its income statement. For instance, its three-year revenue growth rate stands at 14.6%, ranked better than 87% of its peers. Additionally, the company’s return on equity hit nearly 38%, far higher than the 8.9% median of the defensive retail industry. This stat indicates that Dollar General enjoys a high-quality business profile.

Is DG Stock a Buy, According to Analysts?

Turning to Wall Street, DG stock has a Strong Buy consensus rating based on 11 Buys, three Holds, and zero Sell ratings. The average DG price target is $277.36, implying 17% upside potential.

Conclusion: A Relatively Easy Choice to Make

While it’s vital to steer away from absolute predictions on Wall Street, the reality is that on a relative scale, acquiring some shares of discount dollar-store stocks represents an easy choice. Most likely, the U.S. economy will face a “flation” problem, either inflation or deflation. Either way, consumers must purchase the essentials, and that’s really what makes both DLTR and DG viable.