If you are a sneaker fan, you probably know that Nike (NYSE:NKE) dominates the resale market, with resellers charging high premiums for limited releases. However, Nike updated its policy related to reselling and automated ordering of its products, which will make reselling tough.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

As per the updated terms, Nike can now charge a restocking fee, may decline refunds, impose purchase quantity limits, and even suspend accounts of people who intend to resell them. Further, under the new policy, Nike could cancel orders placed using automated software.

The move comes as the company is struggling with inventory issues. Nike’s inventory stood at $9.7 billion at the end of Q1 of Fiscal 2023, representing year-over-year growth of 44%. To clear excess inventory, Nike announced markdowns that took a toll on its margins.

Its gross margin fell 220 basis points in Q1, reflecting higher freight and logistics costs and lower margins in the NIKE Direct business owing to the markdowns.

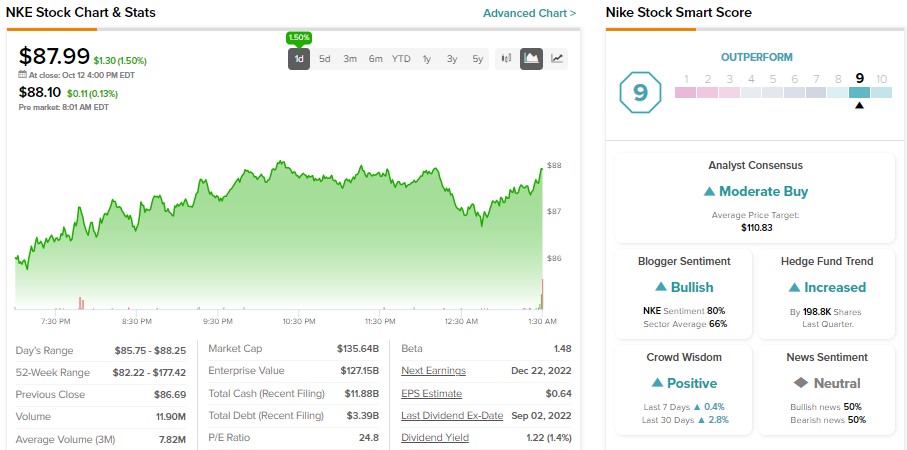

Given the margin headwinds and supply-chain issues, Nike stock has declined about 46% year-to-date. Meanwhile, it is trading closer to its 52-week low.

Williams Trading analyst Sam Poser believes that “Nike is challenged by ongoing logistic missteps, which began when shortly after the 15-week pandemic-related factory shutdowns in Vietnam and Indonesia last fall.”

Poser added that the “ongoing lack of visibility for the balance of FY23” keeps him on the sidelines. He recommends a Hold on Nike stock and has a price target of $79, implying 10.2% downside potential.

Is Nike Stock a Buy, Sell, or Hold?

While NKE stock has lost substantial value, analysts remain cautiously optimistic about its prospects. It has a Moderate Buy consensus rating based on 16 Buy and 10 Hold recommendations. Meanwhile, these analysts’ average price target of $110.83 implies 26% upside potential.

While analysts are cautiously optimistic about NKE stock, hedge funds have a positive stance. TipRanks’ data shows that hedge funds bought 198.8K Nike stock last quarter. Meanwhile, Nike stock has an Outperform Smart Score of nine out of 10 on TipRanks.