British chip designer Arm Holdings (NASDAQ:ARM) finally saw its American Depository Shares (ADS) debut with a premium on the Nasdaq stock exchange on September 14. The share price surged 25% on its first trading day, closing at $63.59, and continued the upward spiral in after-hours trading. Arm’s 95.5 million shares were listed with an initial public offering (IPO) price of $51 per ADS.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Softbank-backed (OTHEROTC:SFTBY) Arm’s shares opened at $56.10 and saw its valuation reach $65 billion in its stock market debut. The successful launch of the most awaited IPO of the year seems to have sparked positive investor sentiment. The high price of the listing also suggests that investor appetite for IPOs has revived after being dull for most of the post-pandemic period. This could also be a boon for the upcoming IPOs of grocery-delivery company Instacart and marketing-automation platform Klaviyo.

Arm Makes a Splash in IPO

Arm, a semiconductor player and one of the largest chip designers globally, also drew a lot of attention thanks to the ongoing artificial intelligence (AI) frenzy. Arm’s designs are used to power smartphone chips, automobiles, and data centers. Arm said last week that it expects the total addressable market (TAM) for chip designs to be worth $250 billion by 2025.

Softbank currently owns 90.6% of Arm and is highly bullish about the share price gradually reaching extraordinary levels. The Masayoshi Son-backed Japanese conglomerate made $4.87 billion by selling the minority stake in Arm in the initial listing.

Meanwhile, Arm sold $735 million worth of shares to its influential clients. These include Apple (NASDAQ:AAPL), Alphabet (NASDAQ:GOOG, GOOGL), Nvidia (NASDAQ:NVDA), Intel (NASDAQ:INTC), and Taiwan Semiconductor (NASDAQ:TSM) among others.

Is Arm Holdings a Good Investment?

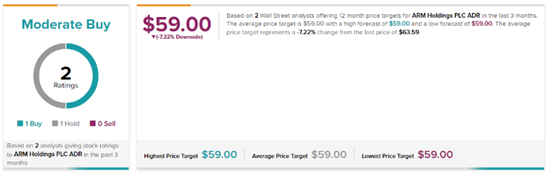

Ahead of Arm’s IPO, two analysts initiated coverage of ARM stock with differing views. New Street analyst Pierre Ferragu gave ARM a Buy rating with a price target of $59 (7.2% downside).

Ferragu is impressed with the timing of Arm’s IPO, which he notes happened during the lows of the smartphone market. In 2026, Ferragu sees Arm reach a value of $82 billion, showing promising growth prospects. He is also encouraged by Arm’s consistent financial performance and the potential growth of the semiconductor end markets in which it operates.

On the contrary, Needham analyst Charles Shi gave ARM a Hold rating and did not set a price target on the stock. Although Arm is a viable player in the semiconductor market, Shi believes the segment is going to transform into a high-performance computing and IoT (Internet of Things) based market in the future. He sees a lot of competition in the space and noted that depending largely on smartphone chips will not drive a higher valuation for Arm Holdings.

Based on these two conflicting views, Arm has a Moderate Buy consensus rating on TipRanks. The average Arm Holdings price target of $59 implies 7.2% downside potential from current levels.