The valuation of the much-awaited initial public offering (IPO) of Instacart has been revised lower, reflecting a weak investor appetite for new listings. As per the updated IPO-related SEC filing, Instacart aims to raise up to $616 million in capital at a valuation of up to $7.7 billion. The grocery delivery app is offering 22 million shares at an IPO price between $26 and $28. The targeted valuation is way below the $39 billion level the company saw in its last funding round in 2021.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The 22 million shares being offered include 14.1 million of newly issued shares and 7.9 million shares from stockholders who are selling.

The company’s pre-IPO roadshow begins on Monday, September 11, with the initial listing scheduled in the coming week.

Instacart runs an online grocery delivery portal that delivers groceries from stores to the customer’s doorstep. The pandemic-driven online ordering craze boosted Instacart’s sales and hiked up its valuation. The company is expected to disclose its valuation range during the roadshow. Elevated interest from the roadshow could also lead to a relatively higher final valuation before the listing.

In the first six months of 2023, Instacart earned revenues of $1.5 billion, up 31% year-over-year. Meanwhile, the company made a net profit of $242 million, improving drastically from the $74 million in net loss reported in the prior-year period.

Capital Markets Suffer from Lower Deals

Capital markets have experienced sluggish deal activities in the current challenging macro backdrop. Importantly, the elevated interest rate environment is keeping investors at bay. Remarkably, Instacart was worth roughly $39 billion in 2021 when it started raising funds from private investors. In March 2022, the company cut its valuation to $24 billion as global stocks started dipping with recessionary fears in mind. The steep reduction in Instacart’s valuation is a stark reminder of diminishing investor confidence. The second half of 2023 could see better days for IPO activity as nations begin relaxing their monetary policies towards year-end.

Even so, IPO activity is picking up after a slump over the past one and a half years. In addition to Instacart, Softbank (SFTBY)-backed chip designer firm Arm Holdings and marketing-automation company Klaviyo are aiming to collectively raise billions of dollars via stock offerings this month. Arm is listing with a modestly higher valuation of $50 billion, which is also revised down from the initial value of $80 billion.

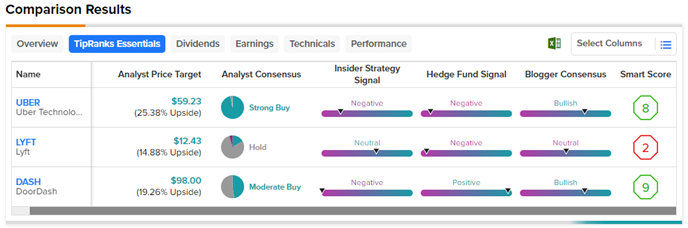

Instacart will trade under the ticker symbol “CART” on the Nasdaq Stock Exchange. Once public, Instacart will compete with listed players in the home delivery space. These include Uber (NYSE:UBER), Lyft (NASDAQ:LYFT), and DoorDash (NYSE:DASH). Here is a look at how these listed players fare currently, with the help of the TipRanks Stock Comparison tool.