SoftBank Group (OTCMKTS:SFTBY) is targeting a valuation of between $50 and $54 billion for the initial public offering (IPO) of Arm Ltd. The valuation translates to a per-piece price of $47 to $51 for Arm’s shares. Arm is set to begin its pre-listing roadshow this week, after the Labor Day Holiday on September 4. The company aims to raise between $5 and $5.4 billion from the initial listing. Arm is looking to consider pricing its shares on September 13, with the shares slated to trade on September 14.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Softbank, a Japanese multinational investment holding company, is the majority owner of Arm Ltd., a British chip designer and one of the major players in the semiconductor industry. The current valuation is pegged relatively lower than the valuation at which Softbank bought Arm in 2016. Last week, Softbank bought another 25% stake in Arm that was held by one of its funds, Vision Fund, for $16 billion.

The Masayoshi Son-backed Softbank was earlier pitching Arm’s valuation at close to $80 billion, but the current valuation displays the weakness in the capital markets. However, even with the lower valuation, Arm is set to become the most valuable U.S. IPO on the NYSE, after Rivian’s (NASDAQ:RIVN) $70 billion debut in November 2021.

Softbank will only give away 10% of Arm in the listing and withhold the majority stake as it seeks to gain more returns on its investment. Numerous big tech companies that are also currently Arm’s customers have agreed to invest in Arm. These include Apple (NASDAQ:AAPL), Samsung, Intel (NASDAQ:INTC), and Nvidia (NASDAQ:NVDA). The Commitment from these tech companies will also boost investor confidence in Arm’s IPO.

Is SFTBY a Good Buy?

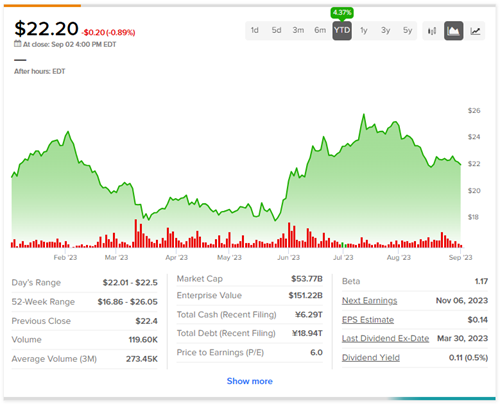

The upcoming IPO could make Softbank a worthwhile investment. Notably, Jefferies analyst Atul Goyal is the only analyst to have given a rating to SFTBY stock within the past three months. Goyal has a Buy rating on SoftBank shares with a price forecast of $23.83, implying 7.3% upside potential from current levels.

Year-to-date, Softbank stock is up by 4.4%.