Amazon (AMZN) has tapped the bond market to raise about $12.8 billion. The e-commerce and cloud computing giant sold multiple bonds maturing between 2024 and 2062, and has hired investment banks Goldman Sachs (GS), JPMorgan Chase (JPM), and Morgan Stanley (MS) to help with the bond sale.

Amazon plans to use the bond proceeds for general corporate purposes, which it says may include working capital, acquisitions, and share repurchases. In March, the company launched a $10 billion share repurchase program without a fixed expiration date. Amazon also plans a 20-for-1 stock split.

Wall Street’s Take

Consensus among analysts is a Strong Buy based on 34 Buys and one Sell. The average Amazon price forecast stands at $4,143.76 and implies upside potential of 37% to current levels. Shares have declined 11% year-to-date.

Stock Investors

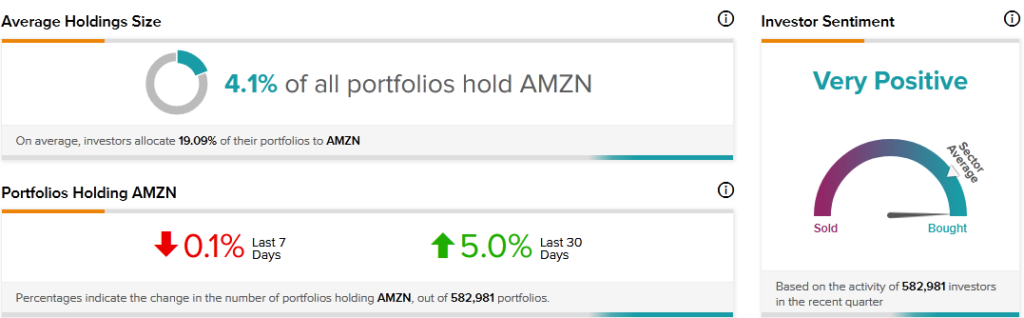

TipRanks’ Stock Investors tool shows that investor sentiment is currently Very Positive on Amazon, with 5% of portfolios tracked by TipRanks increasing their exposure to AMZN stock over the past 30 days.

Key Takeaway for Investors

Amazon’s bond sale looks well-timed. Borrowing now may be cheaper than doing it in the future, considering that interest rates are expected to rise as the Fed tries to combat inflation.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Apple Stock Expected to Rise on After Shifting Manufacturing to India

Mercedes-Benz Updates Carbon Neutral Plan

Shopify Woos Investors With Stock Split