Communications platform provider Zoom Video Communications Inc. (ZM) has delivered better-than-expected earnings for the first quarter. Shares of the company rose as much as 16% during after-hours trading on Monday before settling around 4.8% higher.

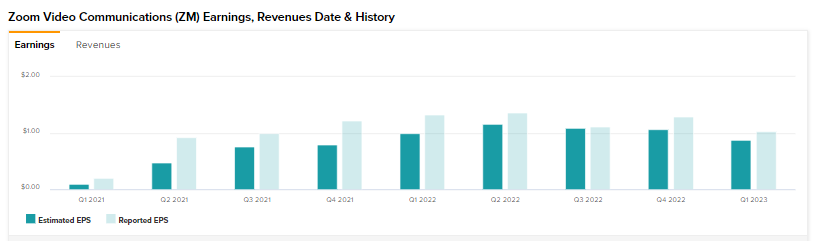

Revenue grew 12.3% year-over-year to $1.07 billion, which was in line with estimates. Earnings per share (EPS) of $1.03 came in ahead of expectations by $0.16. The number of customers with a revenue contribution of over $100,00 jumped 46% during this period.

Management Weighs In

Founder and CEO of Zoom, Eric S. Yuan, said, “In Q1, we launched Zoom Contact Center, Zoom Whiteboard, and Zoom IQ for sales, demonstrating our continued focus on enhancing the customer experience and promoting hybrid work. We believe these innovative solutions will further expand our market opportunity for future growth and expansion with customers. Additionally in Q1, we delivered revenue of over one billion dollars driven by ongoing success in Enterprise, Zoom Rooms, and Zoom Phone, which reached three million seats during the quarter.”

Furthermore, the number of Zoom’s enterprise customers has grown by 24% to 198,900.

Financial Outlook

Looking ahead to the second quarter, Zoom forecasts its revenue to be between $1.115 billion and $1.120 billion. Non-GAAP diluted EPS is expected to be between $0.90 and $0.92.

For the full fiscal year of 2023, revenue is expected to range between $4.530 billion and $4.550 billion, with accompanying non-GAAP diluted EPS of between $3.70 and $3.77.

Analyst’s Take

Barclays analyst Ryan MacWilliams has reiterated a Hold rating on the stock while decreasing the price target to $90 from $150.

On the other hand, the Street anticipates double-digit gains in Zoom. The consensus rating on Zoom is a Moderate Buy based on 10 Buys and 15 Holds and the average Zoom price target of $149.50 implies a 67.4% potential upside. That’s after a 51.5% slide in the share price so far in 2022.

Cathie Wood Keeps Adding Zoom

TipRanks data shows hedge fund confidence signal in Zoom remains very negative based on the activities of 15 funds in the recent quarter. In the last quarter, hedge funds decreased their holdings in Zoom by 1.3 million shares.

Meanwhile, Cathie Woods’ ARK Investment Management steadily added Zoom despite a decline in stock price over the past year. Wood has bought the stock six times since the beginning of 2021. ARK currently holds Zoom stock worth around $986.39 million, which makes up 4.12% of its total portfolio.

Closing Note

Despite delivering an earnings beat this quarter, concerns persist over Zoom’s slowing growth. Although the company rode the demand surge during pandemic days, revenue growth is slowing as the world emerges from complete shutdowns. How consumers receive Zoom’s new products will determine its future trajectory. Wall Street remains cautiously optimistic about the stock.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Regeneron & Sanofi Get FDA’s Green Light for Dupixent

TJX Companies Reveal Insider Stock Sale

This C-Suite Executive Sells His Stake in Kraft Heinz