I’m bullish on oil over the long run, recognizing the increasing scarcity of black gold, a slow transition to renewable fuels, and improving demand from developing nations. I’m also relatively bullish on oil in the near term, given OPEC+’s movements to reduce supply. In this context, it’s arguable that the least risk-intensive investments involve investing in Big Oil. These are the most-capitalized and profit-driven companies in the business. And two of the biggest oil stocks are Exxon Mobil (NYSE:XOM) and Shell (NYSE:SHEL) (LSE:SHEL).

I’m bullish on both companies. However, given Shell’s cheaper valuation despite its larger debt position, I believe the British company represents a more attractive opportunity for investors keen on increasing their exposure to oil.

Exxon Mobil

It’s well known that the oil and gas sector is cyclical, but thankfully, Exxon Mobil has diversified accordingly, with operations in upstream, processing, and chemicals. This diversified business provides stability and helps maintain cash flows for its much sought-after dividend.

Exxon Mobil is actively investing in future growth. It recently completed large refinery and oil production projects on time and within budget, and these projects have positioned Exxon to benefit from strong long-term demand. The oil giant has been focusing on two key areas for production expansion.

The first is the Permian basin in the U.S., known for its large reserves and low production costs. The second is Guyana, where massive offshore reserves continue to be found. Both these projects offer Exxon access to oil at production costs below $35 per barrel.

In something of a strategic change, Exxon also announced that it would be moving into the lithium market. The firm hopes to become one of the biggest players in the lithium market, with its first production slated for 2026.

The company’s aim is to produce enough of the silvery metal to power one million electric vehicle (EV) batteries by 2030. The moving into the lithium sector seemingly provides something of a hedge as major economies move away from black gold, although some analysts do question whether lithium will remain integral in batteries in the future.

Meanwhile, the company is in a healthy financial position with a net-debt position of $16.17 billion. In turn, Exxon has a total-debt-to-equity position of 22.45%. The stock currently trades at 12.9x forward earnings. This falls to 12x and 11.5x in forward years two and three. Additionally, Exxon offers a 3.3% dividend yield.

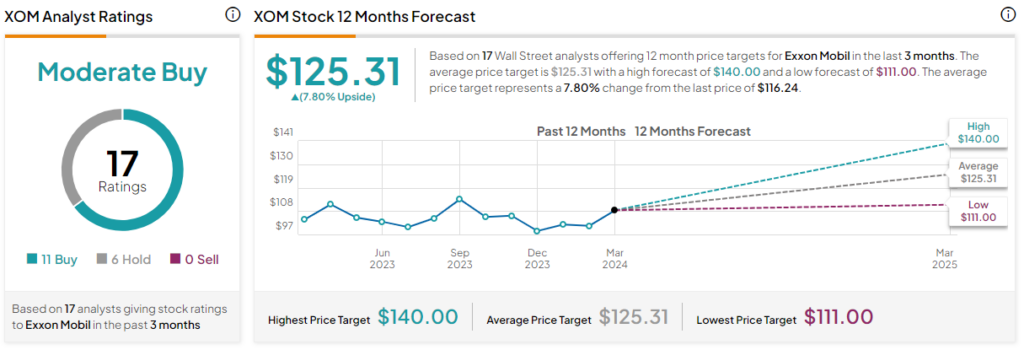

Is XOM Stock a Buy, According to Analysts?

According to analysts covering the stock over the past three months, Exxon Mobil is a Moderate Buy. It has 11 Buy ratings and six Hold ratings. The average Exxon Mobil stock price target is $125.31, indicating a 7.8% upside from the current position. The highest share price target is $140, and the lowest share price target is $111.

Shell

Like Exxon, London-based Shell has been making good progress on its new projects. This includes a Canadian LNG (liquefied natural gas) project, which may start delivering sooner than anticipated, and recent maintenance works on the Prelude facility, which could lead to higher LNG utilization rates. Moreover, Shell’s recent financial report showed an improved reserve ratio.

This is particularly important, considering that we’re in something of a purple patch for the industry. Shell’s report highlighted that it has enough oil and gas to sustain production levels for 9.8 years. While the Canada LNG project is part of this, Shell’s 6.25% equity in the North Field East project in Qatar — Exxon also has 6.25% equity in the expansion project — has contributed to expanding reserves.

The British company is also focused on cost-cutting in an effort to expand margins and resilience in the case of an oil price crash. Chief financial officer Sinead Gorman said in February that the Big Oil giant had already made $1 billion of savings and planned to save an additional $2 billion by the end of 2025. Job cuts are seemingly a large part of the equation. This rationalization also includes the simplification of the firm’s portfolio by divesting assets in Singapore and Nigeria.

Shell’s cost-cutting is part of a broader effort to reduce the valuation gap between the British giant and its North American peers. Shell is currently trading at 8.58x forward earnings, and this falls to 8.17x and 7.78x in forward years two and three.

As we can see, Shell still trades at a discount to Exxon. Some of this can be attributed to debt. Shell’s net debt stood at around $43 billion at the end of 2023, and its total-debt-to-equity ratio currently sits at 43.29% — more than Exxon. But it also offers a 4.1% dividend yield — stronger than Exxon.

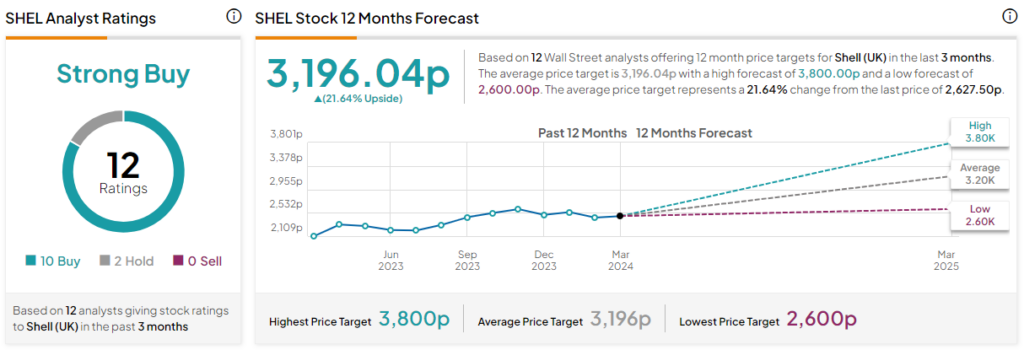

Is SHEL Stock a Buy, According to Analysts?

According to analysts covering the stock over the past three months, Shell is a Strong Buy. It has 10 Buys and two Hold ratings. The average Shell stock price target is 3,196.04p, indicating 21.6% upside from the current position. The highest share price target is 3,800p, and the lowest share price target is 2,600p.

The Takeaway

Neither stock looks like a bad buy, given the prevailing climate, tightness in oil supply partially due to OPEC+ reductions, and relatively resilient demand. However, Shell appears the better buy, given its significant valuation discount to Exxon. That’s despite the British company holding more debt than its U.S. peer.