Exxon (NYSE:XOM) could soon provide further insights into its lithium initiatives. According to a Reuters report, the oil and gas behemoth might disclose its lithium strategy as soon as Monday, November 13. This development coincides with mounting market demand to enhance production capacities, streamline logistics, and optimize costs associated with lithium, which is a crucial component in EV (Electric Vehicle) batteries.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The report emphasized Exxon’s collaboration with Tetra Technologies (NYSE:TTI) to commence lithium production in Arkansas by 2026. The company plans to extract lithium from brine water. Moreover, the initial production is anticipated to meet the demand for approximately 100,000 electric vehicle batteries.

Let’s delve deeper.

Lithium Offers Promising Opportunities

Darren Woods, the CEO of Exxon, said during the Q3 conference call that lithium has promising opportunities ahead. Further, lithium extraction from the brine water fits very well within its capabilities and on the cost of supply curve. Moreover, the process has a much lower environmental impact than the current production process for lithium.

Woods highlighted that Exxon’s identity is often limited to that of an energy company, overlooking that it is also a significant player in the global chemical industry. He added that Exxon’s expertise in managing and transforming hydrogen and carbon molecules into products extends to various sectors, including lithium.

Lithium could offer significant growth opportunities, so let’s look at what the Street recommends for XOM stock.

Is ExxonMobil a Buy or Sell?

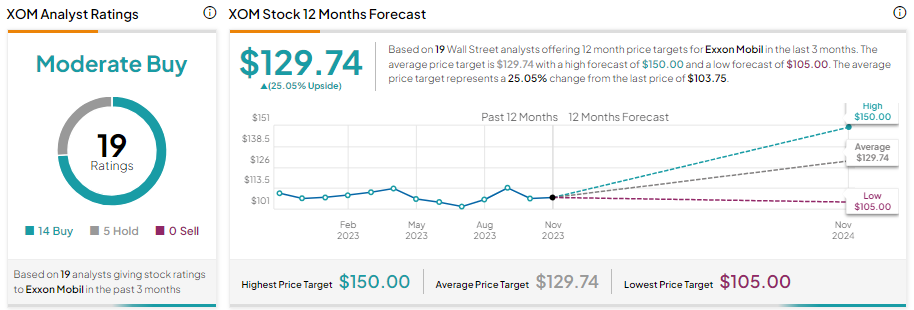

Wall Street analysts are cautiously optimistic about XOM stock, reflecting lower average realized prices and tough year-over-year comparisons in 2023.

With 14 Buy and five Holds, XOM stock has a Moderate Buy consensus rating. Further, the average XOM stock price target of $129.74 implies 25.05% upside potential from current levels.