Discretionary spending has shifted from categories like entertainment, travel, apparel and dining to home goods and electronics over the past few months as the pandemic has restricted individuals to their homes. Retailers like Home Depot, Lowe’s, Wayfair, Williams-Sonoma and Bed, Bath & Beyond have experienced a spike in the demand for home merchandise and furnishings as people have been focusing on home décor and on creating a workspace due to the remote working trend.

However, there are concerns that the surge in demand for home goods might not continue for long. We will analyze how Willams-Sonoma and Bed Bath & Beyond gained from the pandemic-led demand and use the TipRanks Stock Comparison tool to see which retail stock offers a better investment opportunity.

Williams-Sonoma (WSM)

High-end home furnishings and kitchenware retailer Williams-Sonoma gauged the changing retail environment over the past few years and adopted a “digital-first” approach more rapidly than its peers. The company operates under various brand names, including its namesake Williams Sonoma, Pottery Barn and West Elm.

The company’s revenue rose 8.8% to $1.49 billion in 2Q FY 2020 (ended Aug. 2) as e-commerce revenue grew 46% Y/Y and accounted for 76% of the top line. Overall, 2Q comparable sales grew 10.5%.

Notably, comp sales growth of 29.4% for the Williams Sonoma brand reflected the shift to home cooking while Pottery Barn’s comps grew 8.1% as the brand experienced strength in outdoor furniture, work from home solutions and products that enhance family living spaces. The company’s more affordable West Elm brand generated comps growth of 7% with substantial growth in indoor and outdoor, home office, dining and storage furniture in the second quarter.

The 2Q adjusted EPS surged by an impressive 107% Y/Y to $1.80 driven by strong gross and operating margin expansion due to strong sales and a significant reduction in payroll and ad cost spending.

In its 2Q conference call, the company disclosed that its business continues to be very strong in the third quarter and quarter-to-date sales were robust across all brands.

Given the changing market conditions due to the pandemic, Williams-Sonoma is accelerating its digital growth strategy and shifting its channel mix with more emphasis on digital as store sales are contracting. Over the long-term, it aims to generate revenue growth of mid to high single digits. (See WSM stock analysis on TipRanks)

On Oct 12, WSM shares rose 6.1% as the company announced a 10% hike in its quarterly dividend per share to $0.53 (payable Nov. 27). The company has also decided to resume its share repurchase program and fully repaid the short-term borrowings under its $500 million revolver facility backed by the “on-going strength of its business and liquidity position”.

Following yesterday’s surge, Williams-Sonoma stock has advanced 44% so far in 2020 and so the average analyst price target of $104.58 does not indicate further upside.

Last month, Oppenheimer analyst Brian Nagel reiterated a Buy rating for Williams-Sonoma with a price target of $115 (9% upside potential), saying “Amid a further strengthening domestic housing market and healthy home furnishing sector, we are increasingly optimistic that operating margin will continue to expand at the company, as WSM drives the acceleration of its profitable e-commerce business.”

Overall, the Street is cautiously optimistic about Williams Sonoma with a Moderate Buy consensus based on 5 Buys, 7 Holds and 1 Sell.

Bed Bath & Beyond (BBBY)

Who would have imagined that a pandemic would bring back Bed Bath and Beyond on the growth track. Earlier this month, BBBY reported comparable sales growth for the first time since 4Q FY16. The company’s comparable sales grew 6% in 2Q FY20 (ended Aug. 29) as comps from digital channels surged 89%, partially offset by a 12% decline in comparable store sales.

Meanwhile, 2Q net sales fell 1% Y/Y to $2.7 billion reflecting the impact of the divestiture of One Kings Lane and temporary store closures triggered by the pandemic. However, the adjusted gross margin expanded 200 basis points to 35.9% due to favorable product mix and leverage of distribution and fulfillment costs on sales. Gross margin expansion and lower payroll and advertising expenses helped in driving a 47% growth in the 2Q adjusted EPS to $0.50.

The company stated that on a preliminary basis, it experienced positive comparable sales growth in September with similar store and digital sales trends as in fiscal 2Q.

Over the years, BBBY has lagged its peers in expanding its online business. Last year, activist investors pushed for management shake-up following years of underperformance. In November 2019, Mark J. Tritton, who previously served as Target’s Executive Vice President and Chief Merchandising Officer, assumed the role of BBBY’s President and CEO.

Within two months of his joining, the new CEO removed six senior members, including chief merchandising officer and chief marketing officer. Under the leadership of Tritton, the company has been enhancing its omnichannel capabilities, improving its merchandise assortment and optimizing its cost structure and asset base. (See BBBY stock analysis on TipRanks)

In 2Q, BBBY gained about 2 million new online customers supported by the company’s buy online pickup in store and curbside pickup facilities. In September, it announced the nationwide rollout of same-day delivery.

The company aims to deliver an annualized improvement of $250 million to $350 million in its EBITDA, excluding one-time costs. BBBY recently cut 2,800 jobs and is also selling non-core assets, including the recent sale of PersonalizationMall.com for $245 million. It is also closing 200 underperforming stores.

Following the 2Q results, Goldman Sachs analyst Kate McShane increased her price target for BBBY stock to $17 from $8 but reiterated a Sell rating. The analyst stated, “While in our view, BBBY is benefitting from a ‘golden era’ of home goods demand, we are also beginning to see clear evidence of an improving business following a decade of mismanagement, underinvestment and reluctance to skate where the puck was going (i.e. Omni).”

However, given the year-to-date rise in the shares, the analyst said that she is “reluctant to chase today.” Also, the analyst feels that near-terms trends could be short-lived.

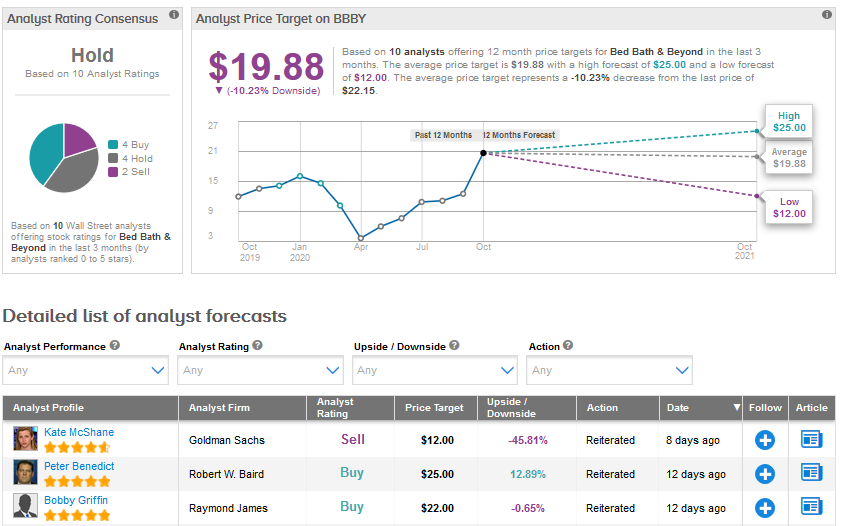

BBBY shares have risen 28% year-to-date, mainly reflecting the surge following 2Q results. The average analyst price target of $19.88 indicates a potential downside of about 10.2% over the coming months. The Street is sidelined on the stock with a Hold consensus based on 4 Buys, 4 Holds, and 2 Sells.

Conclusion

Williams-Sonoma stock has fared better than BBBY so far in 2020. The company’s fundamentals look stronger than BBBY, which is still in the midst of a turnaround. Moreover, Williams-Sonoma has a dividend yield of 1.92% and has announced a dividend hike while BBBY suspended its dividends earlier this year due to the pandemic.

Based on the Street consensus and dividends, Williams-Sonoma stock appears to be a better pick than Bed Bath & Beyond for long-term growth.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment