With COIN trading about 30% below its peak, a strengthening stablecoin flywheel could reignite sentiment and reshape the stock’s story.

Why Stablecoins Are Coinbase’s (COIN) Best Bet

Story Highlights

Stablecoins are having a moment, and Coinbase (COIN) sits right in the blast radius of that growth. The company helped bring USDC to life with Circle (CRCL) and now participates economically as USDC scales into payments, savings, and commerce.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Interestingly, shares have cooled off, hovering about 31% below the 52-week high of $444.65, which, to me, puts expectations back into fair territory. I’m Bullish from here because the stablecoin engine is finally humming loud enough to matter in the headline numbers. And unlike trading spikes, this engine appears durable and increasingly integrated into real-world cash flows, which is why sentiment might turn positive from here, irrespective of valuation multiples.

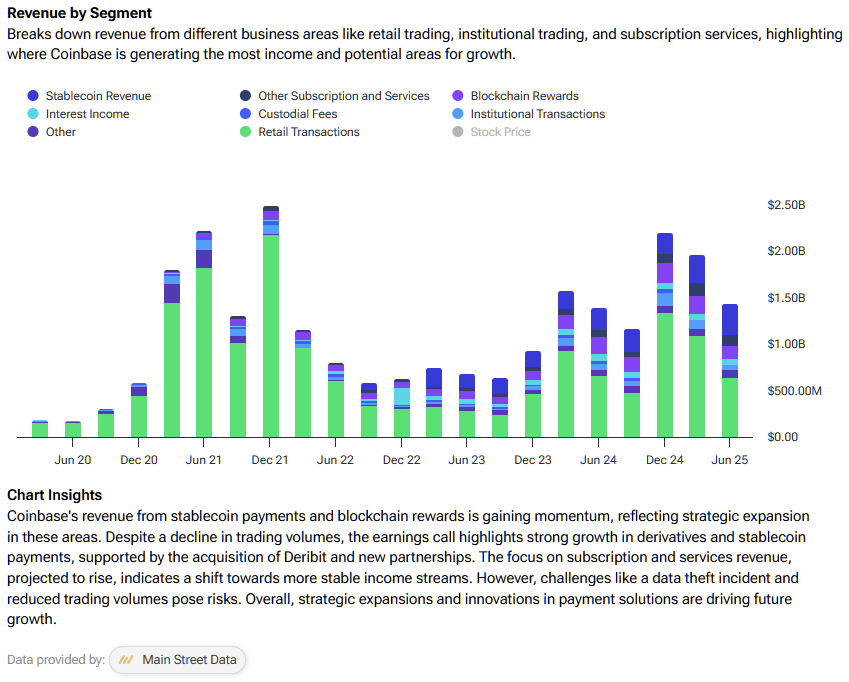

The Quiet Engine Under the Hood

Coinbase’s stablecoin economics showed up clearly in Q2, with “stablecoin revenue” hitting $332 million, up 12%, supported by rising average USDC balances, powered by $13.8 billion on Coinbase products and $47.4 billion off-platform. Management credits boosted USDC rewards for bringing fresh deposits, and it even breaks out the revenue mix, with on-platform balances plus a large contribution tied to off-platform USDC, which Coinbase participates in through its Circle agreement.

That agreement is the “how.” Since 2023, Coinbase and Circle share interest income from USDC reserves, and revenue is split based on USDC held on each platform and equally on broader distribution, which is why off-platform supply matters to COIN’s P&L. With USDC’s float swelling this year, Circle’s first post-IPO report showed reserve income surging alongside a jump in average circulation that lifts Coinbase’s take. And if you rewind one quarter, Coinbase already flagged that subscription and services growth was primarily driven by stablecoin revenue as USDC’s market cap set new highs.

Meanwhile, Coinbase is tuning the machine for durability, as it revised pricing on stablecoin trading pairs back in March, accepting lower volumes to nudge activity toward higher-quality, recurring economics rather than pure churn. That shows up in the mix, as transaction revenue softened with lower volatility, yet the stablecoin line grew and kept the services flywheel turning. If you’re asking where the resilience comes from, it’s this blend of platform balances, off-platform economics, and deliberate pricing that funnels more utility (and margin) into the stablecoin stack.

Where the Flywheel Spins Next

Coinbase is turning stablecoins into a merchant product, not just a trading pair. Coinbase Payments launched this summer with Shopify (SHOP), allowing shoppers to pay in USDC on Base and providing merchants with familiar tools like authorization/capture and refunds. Management’s Q2 letter also stated that USDC on Base went live in Shopify Payments, Coinbase Business, and the Coinbase One Card, with a business waitlist already forming. That should translate to excellent distribution at scale.

Partnerships and policy are the second gear. In April, Coinbase and PayPal (PYPL) scrapped fees for USD-PYUSD conversions to facilitate consumer and merchant adoption. That is, even when the coin isn’t USDC, Coinbase captures the on- and off-ramp and custody economics. Meanwhile, Coinbase has secured a MiCA license in Luxembourg, opening service coverage across the EU just as the bloc’s stablecoin rules begin to bite. The addressable market may broaden further, as a consortium of major European banks has just announced plans for a euro-stablecoin company, a sign of mainstream momentum that could catalyze more integrations that Coinbase can serve.

The third driver is sheer scale. USDC circulation averaged roughly $61 billion in Q2 and continued to grow into August, according to Circle’s results, which indicates a sustained supply that supports larger balances and higher payment throughput. More supply plus faster rails equals better unit economics. Stablecoin revenue drops through at high incremental margins, and every new merchant or wallet integration expands that flywheel.

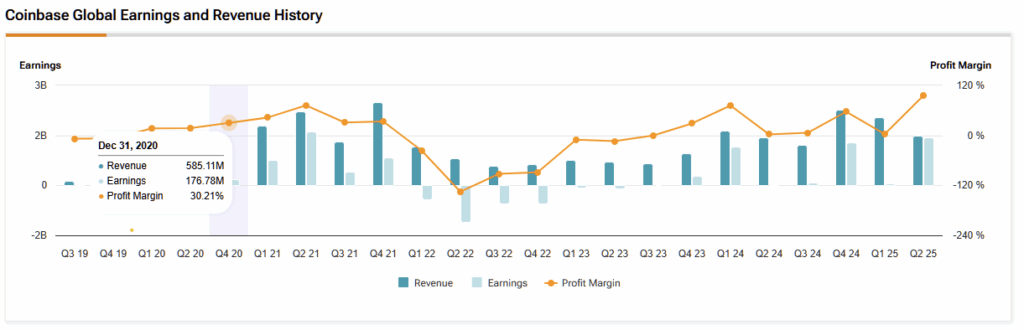

Earnings Power, and Why Estimates Look Noisy

The problem with valuing Coinbase is that consensus EPS appears choppy because the GAAP line fluctuates with crypto prices, fair-value marks (including Coinbase’s investment in Circle), and one-time events. For example, Q2 included $1.5 billion in gains on strategic investments and $308 million tied to a data-theft incident. Transaction revenue also whips around with volatility and pricing decisions. None of that negates the more stable, fee-light economics coming from stablecoins.

Regardless, this year’s estimate of $7.89 per share implies a 17% YoY decline, which is followed by 2026’s estimate of $8.04, up just 2%, and then another drop of 6% to 2028. Therefore, in my view, you shouldn’t take these figures too seriously and the accompanying valuation multiples (e.g., the 39x P/E on this year’s expected EPS). Instead, focus on the underlying developments and adoption of the crypto economy and stablecoins.

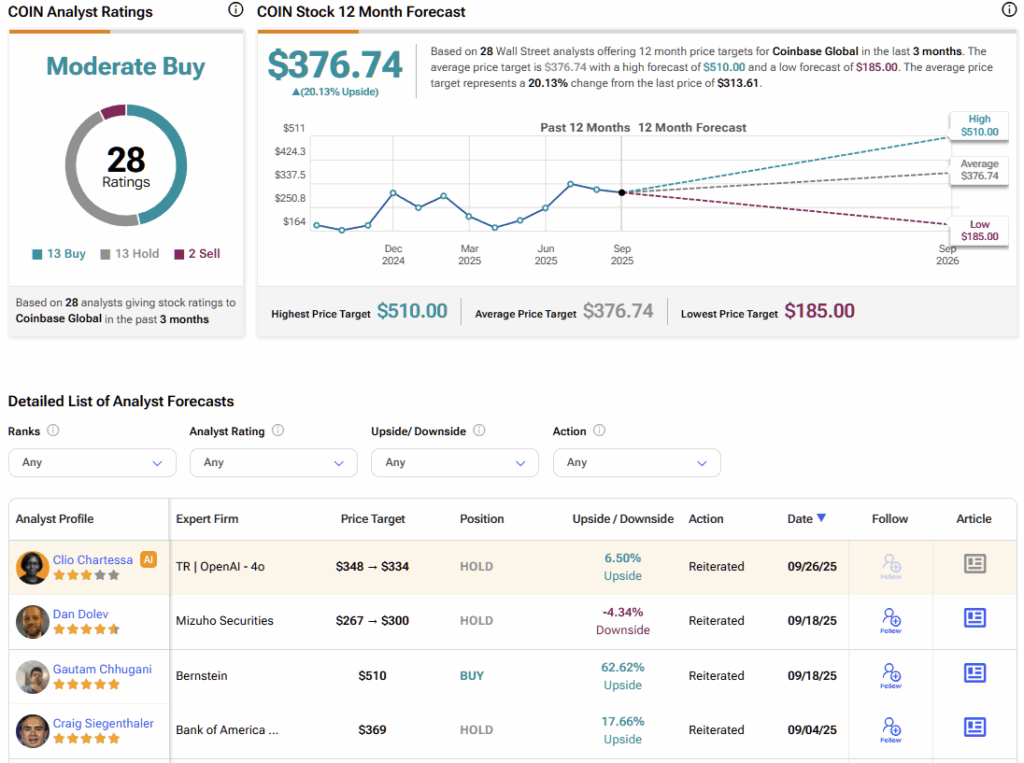

Is COIN a Buy, Hold, or Sell?

There are 28 analysts offering price targets on COIN stock via TipRanks, comprising 13 Buy, 13 Hold, and just two Sell ratings. COIN’s average stock price target currently stands at $376.74, implying more than 20% upside over the next twelve months.

Stablecoins Emerge as Coinbase’s Next Growth Engine

Stablecoins have shifted from back-end infrastructure to a core revenue driver for Coinbase. The company’s Q2 results highlighted hundreds of millions in stablecoin revenue, expanding even as trading activity slowed. Initiatives like Coinbase Payments and the PayPal partnership are broadening the funnel for on-chain commerce.

Given this backdrop, traditional consensus estimates matter less than market sentiment, which is increasingly tied to adoption trends and crypto price momentum. With shares still trading about one-third below recent highs, a reversal in that trend looks plausible as underlying adoption continues to build.

1