Adobe (ADBE), the longtime leader in creative software, recently sank to its 52-week low near $327 — underscoring the growing skepticism surrounding its investment outlook. While much of that doubt stems from fears that artificial intelligence could erode Adobe’s long-standing dominance in the creative space, the latest hit came with the debut of Sora 2, OpenAI’s new text-to-video model integrated into ChatGPT Plus and Pro, announced at the end of September.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The model’s rapid adoption and overwhelmingly positive feedback highlight the massive technological leap this new version has made in automated video generation. For Adobe, the consequence is clear: this new ease of access could directly impact industries like content creation, video, visual effects, and marketing—areas where Adobe has traditionally been dominant.

As I noted in my recent coverage of the company, Adobe’s latest earnings results fell out of favor not due to weak fundamentals, but because of a slight slowdown in subscription growth—enough for bears to argue that Adobe is losing ground and narrowing its leadership gap in creative software against new entrants.

That said, while these headwinds are largely driven by sentiment and speculation rather than hard data, they still deserve consideration when valuing Adobe’s long-term thesis. In my view, however, the current valuation already prices in these risks quite broadly for a company that, despite the market’s reluctance to recognize it, continues to deliver exceptionally strong profitability and cash flows.

As difficult as it may be to go against the tide in such a harsh momentum environment, over the long term, I believe Adobe still deserves a Buy rating—even if it maintains its current growth pace. In the short to medium term, though, the stock may remain under pressure until a clear catalyst emerges to signal a turning point.

Sora 2 and the New Era of AI-Generated Content

In recent years, artificial intelligence has increasingly become an integral part of everyday life—especially since late 2022, when we saw a major leap in large language model (LLM)-based chatbots. Models like ChatGPT, Gemini, Claude, and others have attracted millions of users at an unprecedented pace. As these tools continue to become more powerful—capable of performing increasingly complex and wide-ranging tasks—it’s estimated that more than half of the adult population in the U.S. already uses LLMs in some form.

Among today’s leading LLMs, OpenAI’s ChatGPT is to AI what Adobe is to creative software: the undisputed leader. ChatGPT is estimated to hold around 60% of the U.S. chatbot market share and currently has roughly 800 million weekly users, equivalent to about 10% of the world’s adult population.

While ChatGPT excels in text-based responses, it arguably had lagged behind in image and video capabilities—until recently. Sora, OpenAI’s text-to-video model integrated with ChatGPT, has existed since February 2024, but only Sora 2 truly took off, with major improvements and a dedicated app.

Social media platforms like Instagram Reels and TikTok are now teeming with videos made using Sora — covering everything from cinematic shorts to satirical takes on celebrities and politicians. The quality of these clips has rapidly improved, surpassing expectations for what AI-generated content can achieve. Perhaps most strikingly, access to Sora comes bundled with a ChatGPT Plus or Pro subscription, starting at just $20 per month.

Adobe Faces Its Biggest Creative Disruption Yet

Understandably, many market participants view the early success of the new version of Sora as a significant threat to Adobe. After all, it potentially lowers the barrier to entry for video and animation creation—making processes that once required complex tools and workflows dramatically simpler. And to make matters worse for incumbents, the quality of AI-generated video keeps improving at an incredible pace.

This innovation lands squarely in Adobe’s backyard, competing with products like Premiere Pro, After Effects, and others that handle video editing and visual effects—tools that, while powerful, are far more complex to operate. In contrast, Sora offers faster prototyping, shorter turnaround times, and—most importantly—almost no technical skill required. But perhaps most concerning for Adobe is that Sora touches the core of its competitive moat: workflows.

Adobe’s strength has never relied on a single product. Its edge lies in an integrated ecosystem for skilled producers and animators—a network of interconnected tools, cloud storage, shared libraries, and creative assets that professionals have built their entire workflows around. For fine-grained creative control, Adobe remains best-in-class.

However, while Sora is early in its adoption curve, there are early signs that it’s evolving toward workflow readiness. For instance, Microsoft (MSFT) has highlighted the integration of Sora as a “video playground” within Azure AI Foundry, positioning the consumer app as a potential gateway for developer and enterprise-level workflows. This suggests that businesses may soon start integrating Sora directly into their pipelines via API access, bringing it closer than ever to professional use cases.

Sticking With What Works Until Proven Otherwise

One cannot deny that the emergence of Sora—and other players in the AI creative space, such as Canva and Figma (FIG)—is intensifying competition with Adobe, putting increasing pressure on its growth trends. Naturally, today’s competitive landscape feels far more threatening for Adobe than it did five years ago. Yet, back then, Adobe traded at an EV/Sales multiple of 16.2x, while today it trades at only around 6x.

What’s remarkable is that despite this multiple contracting by nearly 10 points over the period, the company’s fundamentals have remained exceptionally strong. Revenue, operating income, and free cash flow have all grown at a five-year CAGR of 13.3%, 16.3%, and 16.2%, respectively.

Of course, current valuations reflect future growth expectations, not past achievements. Still, looking ahead, consensus forecasts for the next three years call for EPS growth between 12% and 13%, and revenue growth between 9% and 10%. If those projections hold true, it would indeed mark a modest slowdown from the low double-digit growth seen in recent years.

Even so, trading at just 6x EV/Sales, this compression feels too severe for such a limited decline in both top and bottom-line performance.

What is the Price Target for ADBE?

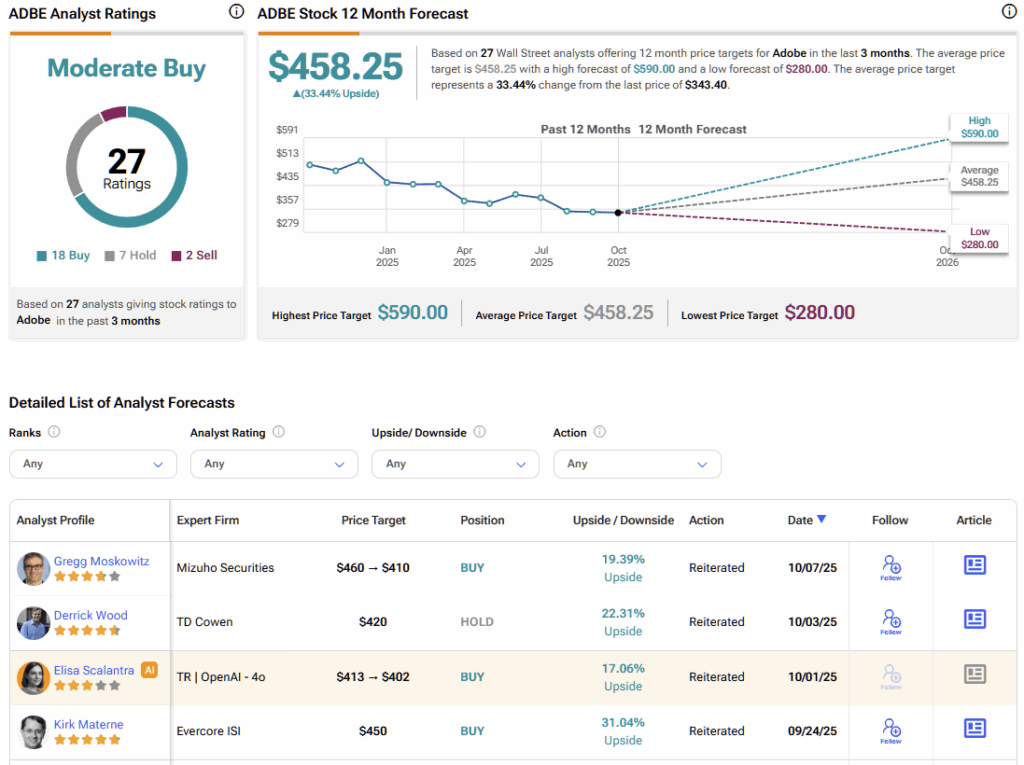

Wall Street’s consensus on ADBE remains broadly bullish, though there’s still room for debate. Over the past three months, 27 analysts have issued ratings: 18 Buy, seven Hold, and just two Sell. On the other hand, there’s a clear sense of valuation disconnect, as ADBE’s average stock price target of $458.25 implies an upside potential of roughly 33% over the next 12 months.

The Long Game Still Belongs to Adobe

The emergence of such a powerful and easy-to-use creative tool like OpenAI’s Sora is undoubtedly a new challenge for Adobe. However, the magnitude of its impact remains questionable given the versatility and optionality of Adobe’s workflow ecosystem.

Since I would frame Adobe’s positioning as running a marathon rather than a sprint, I believe that, over the long term, the market will once again recognize the robust and predictable top- and bottom-line growth the company has delivered for so many years. While part of its moat may indeed erode—and those concerns are likely already reflected in its valuation—as long as this doesn’t materialize in the financial metrics as real threats, it’s hard to justify Adobe’s valuation having compressed by nearly threefold since five years ago.

Having said that, as long as the AI narrative remains at peak hype, in the short to medium term, I believe only tangible product catalysts—such as tools matching or surpassing Sora’s potential and ease of use—can ease investor concerns around Adobe’s “eroding moat.” Probabilistically speaking, the likelihood of ADBE developing its own AI-powered video creation solution (both for professionals and mobile-centric consumers) is pretty high.

While I acknowledge that the kind of premium the stock once commanded, pre-AI boom, might no longer be justified, I also believe that today’s valuation is excessively discounted. In my view, ADBE remains a Buy.