OpenAI’s (PC:OPAIQ) new video app Sora hit one million downloads in less than five days after launching in late September, according to project head Bill Peebles, who shared the news on X. Interestingly, he noted that Sora reached this milestone even faster than ChatGPT, which is the Microsoft (MSFT)-backed AI firm’s popular chatbot with 800 million weekly active users. Even though it’s only available on iOS and requires an invite code, it still reached the #1 spot on Apple’s (AAPL) App Store. Peebles said the team is working hard to keep up with Sora’s rapid growth, which lets people type a prompt in order to generate short videos.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

At the same time, Sora has faced criticism, especially about copyright issues. Indeed, users have created or seen videos using characters from shows like SpongeBob SquarePants, Rick and Morty, and South Park. As a result, the Motion Picture Association (MPA) said that these kinds of videos are spreading quickly and violate creators’ rights. MPA CEO Charles Rivkin called on OpenAI to take action right away after saying that copyright law clearly applies in these cases and protects the work of filmmakers and studios.

In response, OpenAI CEO Sam Altman stated that the company will soon give rights holders better tools to manage how characters are used on the app. However, during a developer event, Altman admitted that some users have said that Sora feels too limited. Nevertheless, he asked users to be patient as OpenAI works out the best way forward. “Please give us some grace,” he said, adding that the app is still evolving and things will change quickly as OpenAI improves its rules and features.

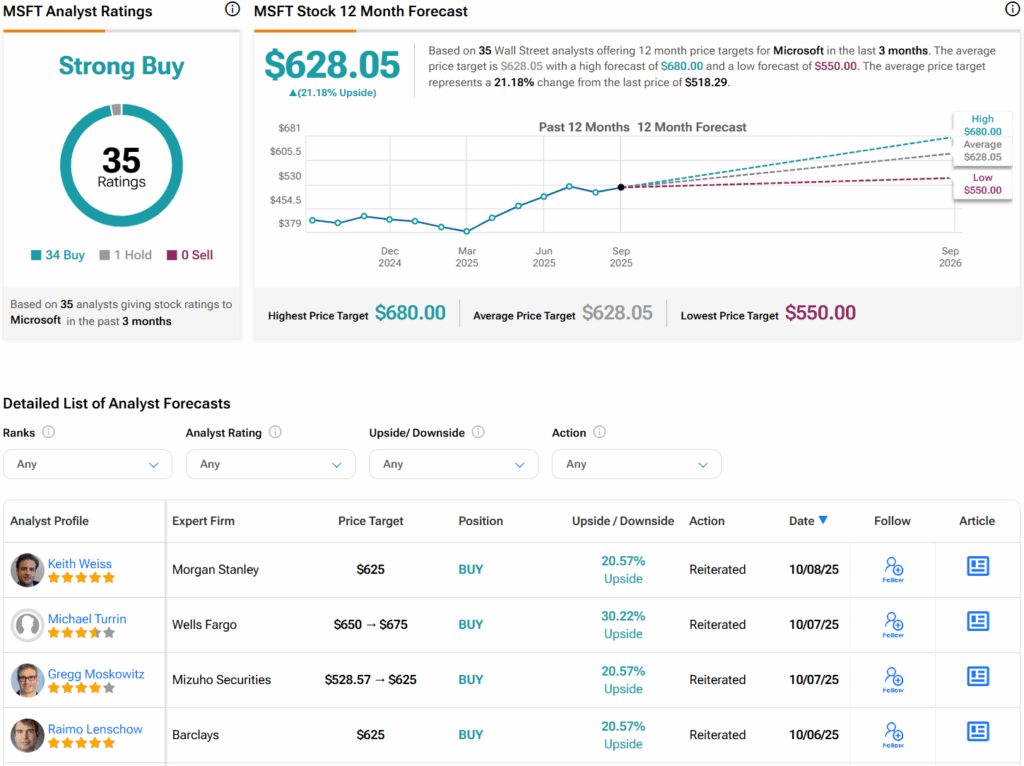

Is MSFT Stock a Buy?

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSFT stock based on 34 Buys and one Hold assigned in the last three months. Furthermore, the average MSFT price target of $628.05 per share implies 21.2% upside potential.