SoFi Technologies, Inc. (NASDAQ: SOFI) lowered its revenue guidance for full-year 2022 after the President of the United States, Joe Biden, postponed the suspension date of federal student loan payment from May 1, 2022, to August 31, 2022.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Shares of the company declined 6.4% in Wednesday’s extended trade and a further 5.6% at the time of writing. Perhaps, management expectations of a further extension resulted in such a pessimistic reaction for the stock.

SoFi now projects adjusted net revenue of $1.47 billion in 2022, down from prior guidance of $1.57 billion. Adjusted EBITDA is expected to be $100 million, compared to the previous guidance of $180 million.

The company said that its student loan refinancing business has been affected quite deeply due to COVID-19, as it has been operating at 50% levels over the past two years.

The CEO of SoFi, Anthony Noto, said, “SoFi has done an outstanding job achieving record financial results, member and product growth and consistent profitability, despite the negative impact of the extended student loan payment moratorium. We will work diligently to continue that trend in 2022.”

Wall Street’s Take

Following the news, Mizuho Securities analyst Dan Dolev maintained a Buy rating on SoFi but lowered the price target to $14 from $17. The new price target implies 60% upside potential from current levels.

Dolev said, “Many investors believe the guide-down includes additional weak spots; however, our analysis shows the drag on the P&L is only due to extending the moratorium. We see no incremental weakness.”

Consensus among analysts is a Moderate Buy based on seven Buys and six Holds. SoFi’s average price target stands at $16.50 and implies upside potential of 88.6% to current levels.

Website Traffic

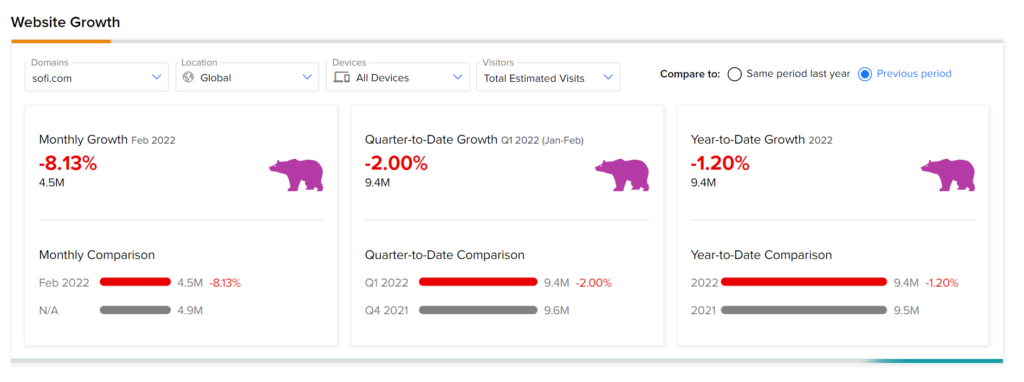

TipRanks’ Website Traffic tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into SOFI’s performance.

According to the tool, the SoFi website recorded an 8.1% monthly decline in global visits in February, compared to the previous year. Further, the footfall on its website has declined 1.2% year-to-date against the same period last year.

Takeaway

A drop in website traffic for an online personal finance company could mean only one thing – a drop in sales. Thus, given the management’s revised revenue guidance, along with insights from our Website Traffic Tool, it can be expected that the company’s performance in the upcoming quarterly results might not be impressive.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Why Novavax Stock is Near 52-Week Lows

Riot Blockchain Stock Declines Despite Higher Bitcoin Production

Confluent, Microsoft Deepen Their Cloud Connect