Despite its better-than-expected results for the first quarter ended March 31, 2022, some top-level executives of Zillow Group, Inc. (NASDAQ: Z), an American tech realty marketplace firm, were recently seen selling their stakes in the company.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Topping the list is Chief Financial Officer Parker Allen, who, on May 20, made an informative sell of 6,755 Zillow shares for $278,306. Allen now holds shares worth $6.32 million in the company.

On May 19, Chief People Officer Spaulding Dan hived off 5,171 shares for $212,795. Post the sell-off, Dan’s valuation of the company’s shares stands at $932,450.

Meanwhile, the Chief Operating Officer of Zillow Group, Jeremy Wacksman, sold 2,198 shares for $41.14 a share. The COO now holds $1.96 million worth of the company’s shares.

Similarly, on May 19, the Chief Technology Officer of the company, David Beitel, sold 1,280 shares for $41.37 per share. Post his stake sale, Beitel holds $3.67 million worth of Zillow Group’s shares.

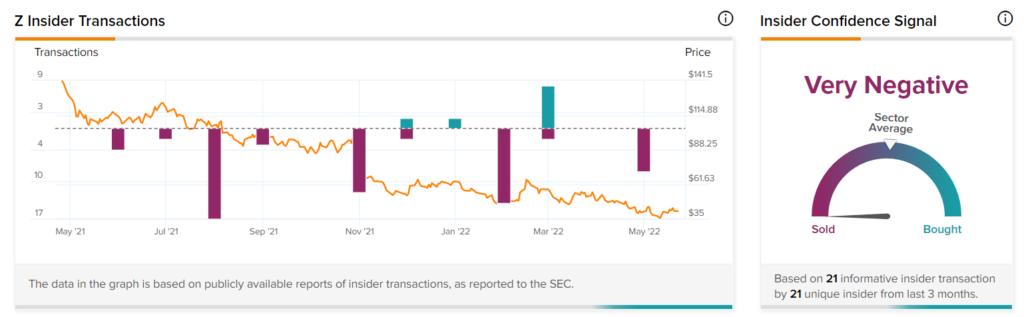

TipRanks’ Insider Trading Activity tool shows that the confidence in Z stock is currently Very Negative based on informative transactions by 21 insiders over the past three months. Further, corporate insiders have sold shares worth $1.3 million over this period.

Q1 Results

Revenues for the first quarter came in at $4.26 billion, up 250% year-over-year, topping the consensus estimate of $3.39 billion.

Zillow’s earnings for the quarter stood at $0.55 per share, up 25% from the same quarter last year. The figure also surpassed the consensus estimate of $0.24 per share.

Meanwhile, its average monthly active users declined 5% year-over-year to 211 million.

Stock Rating

Recently, Morgan Stanley analyst Brian Nowak reiterated a Hold rating on the stock with a price target of $54, which implies upside potential of 31.8% from current levels.

Overall, the Street is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on two Buys and three Holds. Zillow Group’s average price target of $50.50 implies that the stock has upside potential of 23.3% from current levels. Shares have gained 63.7% over the past year.

Conclusion

Near-term concerns in the form of a volatile economic environment, fewer new for-sale listings, tight inventory, and a slowdown in refinancing activity may be the prime factors why Zillow’s top executives are selling their stakes in the company.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

This C-Suite Executive Sells His Stake in Kraft Heinz

Foot Locker Gains 6% Despite Mixed Q1 Results

Macro Headwinds Hurt Kohl’s Q1 Performance