With multiple suitors lining up, shares of omni-channel retailer Macy’s (NYSE:M) have gained nearly 40% over the past month. Earlier this month, an investor group led by Arkhouse Management and Brigade Capital made a $5.8 billion bid for Macy’s. The investor group has already built up a sizable stake in the company and has proposed to acquire the remaining shares they do not own at $21 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Macy’s owns some of the most well-known names, such as Bloomingdale’s and Bluemercury. However, the retailer is facing sagging same-store sales and is struggling to hold onto its market share. It has been looking at small-format outlets to drive performance. Still, Arkhouse’s eyes might be on Macy’s real estate portfolio and its bid could potentially shoot up after due diligence.

Reportedly, private equity major Sycamore Partners is also eyeing a possible bid for Macy’s and has secured debt for the move. Amid this M & A action, Macy’s market capitalization has already crossed the $5.5 billion mark.

Is Macy’s a Good Stock to Buy Now?

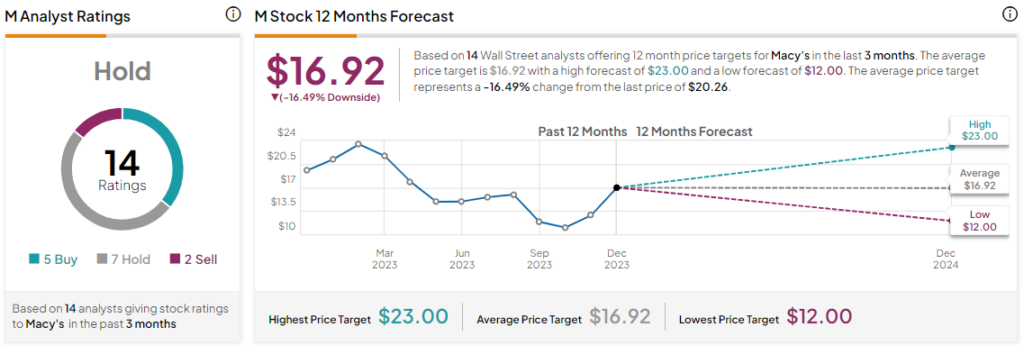

Morgan Stanley’s Alexandra Straton has maintained a Hold rating on Macy’s but raised the price target to $21 from $15. The analyst pegs the retailer’s real estate portfolio at $6 billion to $7 billion in a base scenario but feels a deal “Could prove difficult to execute.” Overall, the Street has a Hold consensus rating on Macy’s, and the average M price target of $16.92 implies a potential downside of 16.5% in the stock.

Read full Disclosure