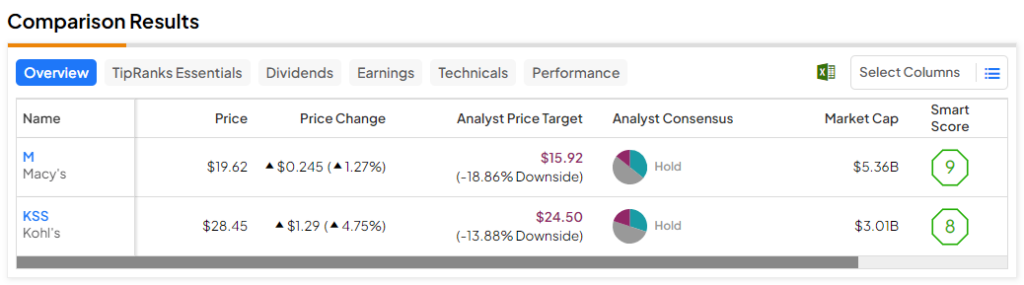

In this piece, I evaluated two department store retailers, Macy’s (NYSE:M) and Kohl’s (NYSE:KSS), to determine which is the better stock to buy. A closer look suggests a neutral view for Macy’s and a bearish view for Kohl’s.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Macy’s is a holding company of department stores that includes Bloomingdale’s and the beauty retail chain Bluemercury in addition to Macy’s stores. Meanwhile, Kohl’s is a department store retail chain with over 1,100 locations spanning every U.S. state except Hawaii.

Shares of Macy’s are roughly flat year-to-date following an enormous 76% rally over the last three months, with nearly all of that gain coming since November 9. On the other hand, Kohl’s stock is up 21% year-to-date after a 22% gain over the last three months.

While Kohl’s three-month rally is almost like a muted version of Macy’s rally over the same timeframe, Macy’s has something going for it that Kohl’s doesn’t. Rumors of a possible buyout have attached a rough price target to Macy’s, although there is far more to consider with both companies to determine which stock is better.

Macy’s (NYSE:M)

On the one hand, Macy’s has managed to beat top- and bottom-line earnings results throughout much of this year, but on the other, its same-store sales are dropping. However, the big story is the reported buyout offer, which has slapped a rough estimate of $21 per share on Macy’s, making a neutral view seem appropriate at current levels.

In fact, the rumors about a potential takeover have driven Macy’s shares through the roof, carrying their price so high that it’s simply too risky to buy any now. Unnamed sources told CNBC and The Wall Street Journal that Arkhouse Management and Brigade Capital offered to buy Macy’s for $5.8 billion, a deal that values the department-store retailer at $21 a share.

Given Arkhouse’s focus on real estate, it’s believed that the deal is all about the real estate Macy’s owns. In fact, the sources even suggested the firms might bid even higher based on due diligence. Unfortunately, the retailer reported a 7% year-over-year decline in same-store sales for the most recent quarter. It also guided for a decline of up to 7% in same-store sales for the holiday shopping quarter, although that was an improvement from the previous expectation of up to a 7.5% drop.

Like most brick-and-mortar retailers, Macy’s is struggling against online competition, so after the recent three-month tear, it’s challenging to get to a more constructive view of the retailer.

Macy’s does pay a solid dividend of 3.4% with a low payout ratio of 22.41% of its net income, which suggests it may be able to continue paying its dividend in the near term. Thus, it could be worth holding while awaiting a potential buyout, but only in the event of a sizable pullback between now and then. At current levels, Macy’s just looks too risky.

What is the Price Target for M stock?

Macy’s has a Hold consensus rating based on five Buys, seven Holds, and two Sell ratings assigned over the last three months. At $15.92, the average Macy’s stock price target implies downside potential of 18.53%.

Kohl’s (NYSE:KSS)

As a brick-and-mortar retailer, Kohl’s faces many of the same struggles as Macy’s in the fight against online retailers. However, in some ways, it’s even worse off, considering that it’s struggling to break even on an annual basis. Due to the lack of positive catalysts and its ongoing struggles, a bearish view seems appropriate for Kohl’s after the recent run-up in its shares.

In 2023, Kohl’s has made some progress on profitability, managing to smash earnings estimates in all three of the reported quarters thus far. Meanwhile, in 2022, the retailer even posted a surprise loss in the fourth quarter and widely missed estimates in the first quarter.

However, while Kohl’s has performed better on the top line, beating revenue estimates in most quarters over the last two years, its track record of steadily declining sales year-over-year continues. In the most recent quarter, same-store sales fell by 5.5% year-over-year, more than the expected 3.8% drop. In short, these sales and earnings trends don’t bode well for Kohl’s.

It might be tempting to buy some shares for the retailer’s dividend. However, it’s important to understand why Kohl’s is not an attractive dividend stock despite its high 7% yield. Believe it or not, the retailer actually has a negative payout ratio (-152.67%) because it continues to pay out dividends even though it’s unprofitable on an annual basis.

This ratio represents the percentage of net income that Kohl’s is payout out in dividends. As a result, a negative payout ratio is a major warning sign because, in the worst-case scenario, it could suggest poor money management. At the very least, a negative payout ratio suggests the company’s dividend is at risk of going away, meaning it wouldn’t be a good idea to hold Kohl’s stock just for the dividend.

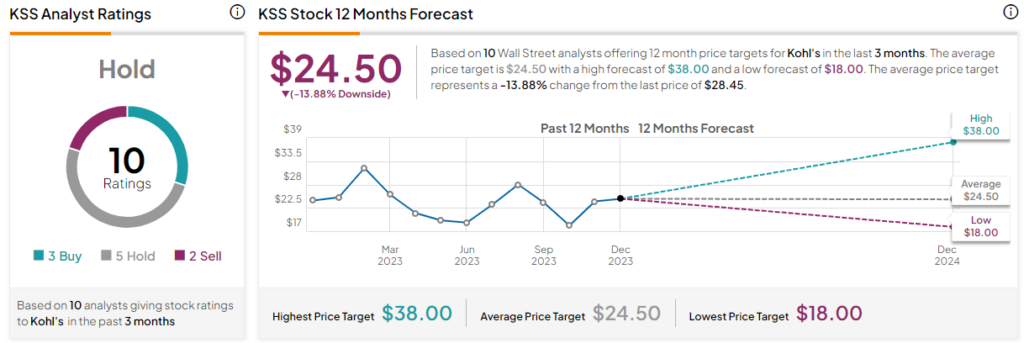

What is the Price Target for KSS Stock?

Kohl’s has a Hold consensus rating based on three Buys, five Holds, and two Sell ratings assigned over the last three months. At $24.50, the average Kohl’s stock price target implies downside potential of 13.9%.

Conclusion: Neutral on M, Bearish on KSS

Unfortunately, falling same-store sales trends are red flags for both Macy’s and Kohl’s. However, Macy’s is the winner of this pairing with a neutral view because of the buyout rumors. It could be worth holding for its dividend, but it may be best to wait and see if the shares pull back a bit, especially given the roughly $21/share cap on Macy’s stock, pending clarification on whether the buyout rumors are true.