Macy’s (NYSE:M) has received a $5.8 billion buyout bid from an investor group led by Arkhouse Management and Brigade Capital Management. This development comes amid the department store chain’s ongoing struggle to maintain its market position, primarily in the face of intensified competition and macroeconomic headwinds.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to a Wall Street Journal report, the investor group already has a prominent position in Macy’s through Arkhouse-managed funds. Further, on December 1, Arkhouse Management and Brigade Capital Management submitted a proposal to acquire the remaining shares of Macy’s that they currently do not own, offering $21 per share. This proposed price represents a premium of nearly 21% compared to Macy’s closing price of $17.39 on Friday, December 8.

While the retailer’s stance on the proposal remains uncertain, let’s look at its recent financial performance.

Macy’s Revenue Is Trending Lower

Macy’s top line continues to trend lower in 2023. Its total revenue declined by over 8% in the first nine months of Fiscal 2023. The company’s management blamed macroeconomic conditions, which took a toll on consumer spending in discretionary categories and pressured its sales.

Looking ahead, Macy’s top line is projected to decrease. The company expects its full-year comparable sales to decline by 6-7%. Moreover, its EPS is likely to witness a substantial fall. Macy’s expects its adjusted EPS to be in the range of $2.88 to $3.13, compared to $4.48 in 2022.

However, Macy’s is pursuing strategies to stimulate growth, and its management remains upbeat about the company’s prospects. The retailer is introducing small-format stores, expanding product offerings on the digital marketplace, attracting and retaining luxury clientele via differentiated offerings, and adding more private brands to enhance customer loyalty. With this backdrop, let’s look at what the Street recommends for Macy’s stock.

What is the Macy’s Forecast?

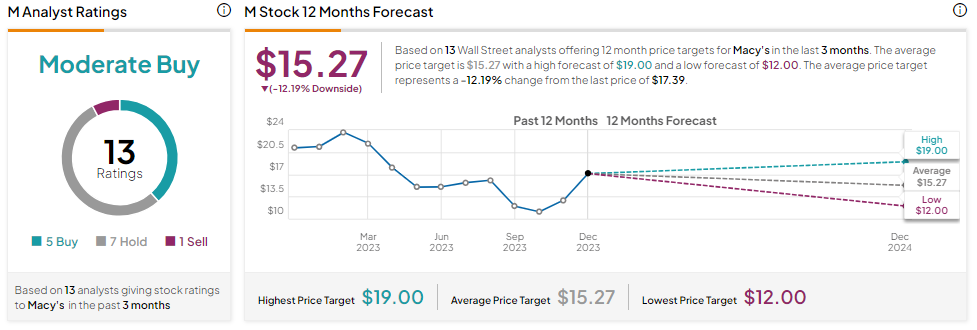

Macy’s stock has underperformed the broader market year-to-date. However, analysts’ average price target suggests further downside potential from current levels.

Macy’s stock has a Moderate Buy consensus rating on TipRanks, reflecting five Buy, seven Hold, and one Sell recommendations. Further, the average M stock price target of $15.27 indicates 12.12% downside potential from current levels.