Shares of infrastructure semiconductor solutions provider Marvell Technology, Inc. (MRVL) have declined 39.5% so far in 2022. While the company is scheduled to disclose first-quarter numbers on May 26, a number of insider transactions have taken place in the last two months.

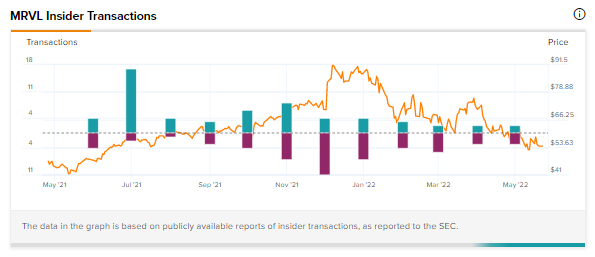

Insiders’ Moves

TipRanks data indicates that during April and May, insiders made four Buy transactions and six Sell transactions. Matthew Murphy, the CEO, President, and Director of the company, sold shares worth $1.93 million. Ford Tamer, a Director at Marvell and a TipRanks four-star insider, offloaded shares worth $3.44 million. Additionally, Mitchell Gaynor, EVP CALO, who carried out the most recent share sale six days ago, dumped shares worth $2.13 million.

The magnitude of Buy transactions pales in comparison. Nguyen Loi, EVP, Optical & CC Grp, bought shares worth $528,122. Similarly, Nariman Yousefi, EVP, Auto Coherent DSP & Switch, bought shares worth $560,790 almost a month ago. The TipRanks database also highlights that all of these transactions were uninformative in nature. During this period, Marvell shares have slid from about $76.16 on March 29 to the present $54 level.

Upcoming Q1 Results

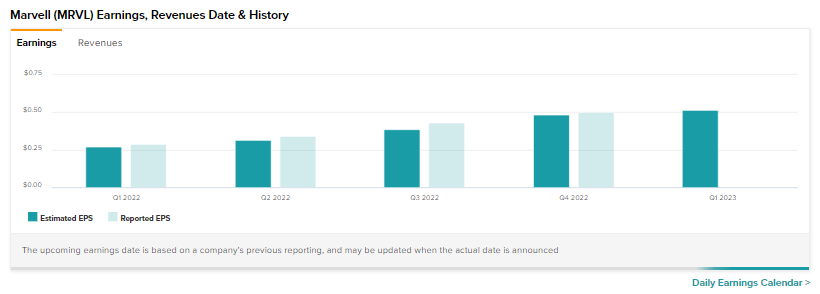

Marvell outperformed expectations in the fourth quarter on both the top line and bottom line. Robust sales growth and margin expansion helped the company post a 68.3% jump in revenue and a 72.4% jump in the bottom line during this period.

On May 26, the Street expects the company to post an EPS of $0.51. In the year-ago period, shares of the company had gained about 5% after it had delivered EPS of $0.29 versus expectations of $0.27.

Analyst’s Take

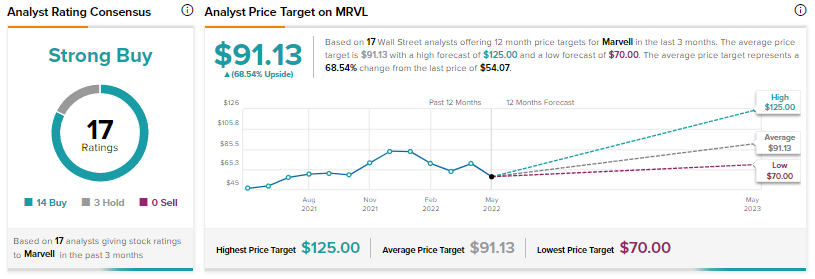

Ahead of earnings, the Street remains positive about Marvell with a Strong Buy based on 14 Buys and three Holds.

Oppenheimer’s Rick Schafer has reiterated a Buy rating on the stock while decreasing the price target to $90 from $110. Nonetheless, the average Marvell price target of $91.13 still implies a potential upside of 68.5% for the stock.

Closing Note

Marvell’s storage and networking solutions continue to see robust demand. While its Inphi acquisition last year helped boost the top line, in 2022, it acquired tanzanite to boost its cloud expertise. Since the recent insider moves were uninformative transactions, how shares perform on May 26 remains to be seen.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Macro Headwinds Hurt Kohl’s Q1 Performance

Why Did Shares of Children’s Place Gain 10% Despite Q1 Miss?

Foot Locker Gains 6% Despite Mixed Q1 Results